Table of Contents

Unbundled Life Insurance Policy

An unbundled Life Insurance policy, also known as universal life insurance, refers to a kind of financial protection plan designed to offer cash to the beneficiaries after the policyholder’s death. The policy comprises an investment and savings component, which the policyholder can use during his lifetime.

The provisions of an unbundled life insurance policy meaning don’t come with an expiration date, which means the policyholder can alter the amount and time period of the premiums associated with the death benefits received when the policy is in force.

Understanding Unbundled Life Insurance Policy

An unbundled life insurance policy contains a cash value component wherein one can save and invest a portion of every premium payment on behalf of the policyholder. There is an option for a savings component in unbundled life insurance policies. This savings component generally comes with a stated interest-earning rate.

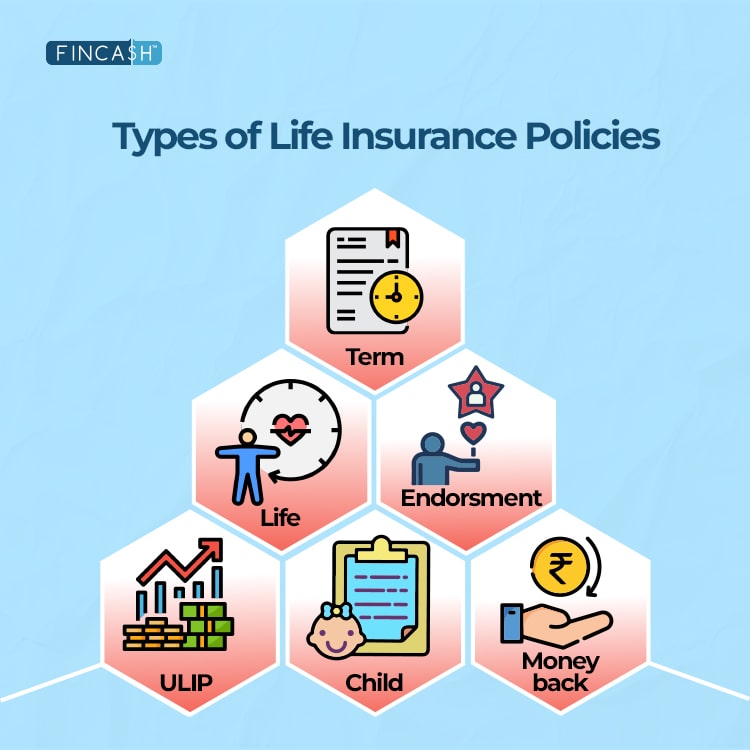

Besides, most unbundled life insurance policies comprise a policy loan option, in which the loan amount borrowed is typically based on the cash value. Also, an unbundled or universal life insurance policy is one of the various Permanent Life Insurance types.

In an unbundled life insurance policy, the premium is paid monthly and can be used for two things. One portion of every premium payment can be invested and saved on the policyholder's behalf. And the remaining portion of the premium amount goes to death benefits received along with other administrative expenses.

You can change the premium amounts and the death benefit you want your beneficiaries to get during the lifetime of the unbundled life insurance policy. The best thing about this policy type is that it clearly states the administrative fees, also known as underwriting and other sales expense fees.

Some of the benefits of an unbundled life insurance policy include -

- Flexibility of altering the policy’s terms as per your needs.

- You can adjust the premium amount, and the death benefits your beneficiaries will receive.

- You can track where exactly your premium payments are being utilized.

Talk to our investment specialist

Different Elements of an Unbundled Life Insurance Policy

Every unbundled/universal life insurance policy has its own provisions and coverage terms, and it may vary by type and provider. However, you can expect some of the following basic elements.

Flexible Premiums

It is one of the most significant features of a universal life insurance policy. You can enjoy good flexibility and easy adjustability of premium payments both in terms of the cash value element and the death benefit. The premium amounts to be paid depend on the policyholder’s risks and the coverage amount.

Cash Value

You can get an option for a savings component in an unbundled life insurance policy. The savings component generally comes with a specified interest-earning rate. You can contribute to the cash value at your desired time or by making some additional payments other than your premium amount. For an added payment flexibility, the premium payments also usually come from the cash value directly.

Surrender Options

The surrender option enables policyholders to withdraw their cash value and terminate the policy. The policyholder can usually withdraw the cash value directly. However, the cash value will generally be subject to surrender charges, which may vary based on the year of termination.

Loan Option

A majority of the unbundled life insurance policies offer a policy loan option, the borrowing amount of which generally depends on the cash value. In this option, the policyholder can obtain tax-free payouts. However, s/he will be subject to regular payments at a certain rate of interest.

This kind of loan is usually considered a kind of collateralized loan as the policy and the cash value offered can serve as Collateral for defaults and missed payments. Moreover, the interest rates of an unbundled life insurance policy loan option are usually lower than the traditional loan facilities.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.