Table of Contents

What is Negative Growth?

A reduction in corporate sales or profitability is referred to as negative growth. It can also refer to a downturn in a country's Economy, as measured by a drop in its Gross Domestic Product (GDP) in any given quarter of the year.

In most cases, negative growth is expressed as a negative percentage rate.

Negative Growth of an Economy

To understand negative growth, it is highly essential to comprehend the measures of positive growth. Economists use GDP to measure growth through a variety of indicators to describe the state and performance of the economy. These drivers are private consumption, government spending, gross investment, and net exports. It is a symbol of prosperity and expansion when an economy is growing, which can be evaluated by money supply, economic production, and productivity.

On the contrary, wages fall tremendously in an economy with negative growth rates, and the overall money supply shrinks. Economists see negative growth as a precursor to a Recession or depression.

Negative Growth in Industrial Life Cycle

The Industry life cycle is a theoretical framework for assessing an industry's maturity. It is divided into four stages:

Stage One of the Business

The start-up stage is when industry participants experience fast growth. As all sector players are exposed to significant risk, identifying the Market leaders can be challenging. In general, disruptive technology characterises the start-up stage, which has the potential for large-scale growth.

Talk to our investment specialist

The Consolidation Stage

It is a phase of consistent positive growth, during which industry participants begin to emerge. It is defined by a small number of enterprises owning a significant portion of the market. In general, industries in consolidation develop faster than the economy.

Maturity Stage

The maturity stage is when all industry competitors offer identical value propositions, and competition is mainly based on price. A negative increase in profit margins for industry players is decreased.

Relative Decline Stage

When an industry grows slower than the economy, it is in relative decline. It is usual to observe a limited or negative increase in market share and profitability at this time.

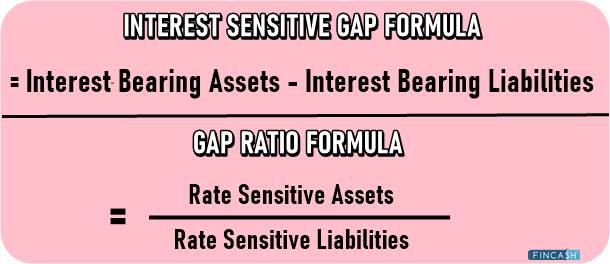

Negative Growth Industries

In a business, horizontal analysis can find negative growth to look for Year-Over-Year declines. Horizontal analysis compares financial outcomes across multiple fiscal periods to indicate a pattern. Negative growth can be accurately identified either on a nominal or proportionate Basis.

When comparing an account balance year-over-year, it is possible to detect negative nominal growth. It's an excellent indicator to see if a company is reducing size. If a corporation's Property, Plant, and Equipment (PP&E) are decreasing each year, it's likely that the company is selling or disposing of its Capital assets. In the end, it could result in a reduction in the predicted future cash flows provided by the company's productive assets.

The financial statements can be rendered uniform in size by dividing Balance Sheet accounts by total assets or Income sheet accounts by total revenues.

Horizontal analysis of financial accounts of common size allows for the identification of patterns throughout the time. If the common size cost of goods sold accounts rise at a negative rate year-over-year, it means that the company's revenues have grown faster than its cost of goods sold; thus, improving gross profitability.

Negative Growth Example

The Great Recession of 2008 was a period of negative Economic Growth lasting more than two years.

In 2008, the Great Recession began and lasted until 2010. In 2008, GDP growth was -0.1% , while in 2009, it was -2.5%. With a rate of 2.6% in 2010, the GDP growth rate returned to positive territory. Although low growth alarms investors and consumers, it is only one of several variables contributing to a recession.

Negative Growth Rate in India

India's economy grew at its slowest pace in over four decades in 2020-21, with a negative growth rate of 7.3% and a meagre 1.6% in the fourth quarter of the Fiscal Year.

Conclusion

Analysts use growth as one of the major methods to describe a company's performance. Positive growth indicates that the company is improving and is expected to report increased Earnings, resulting in a rise in the stock price. Negative growth is the polar opposite of positive growth, and it reflects the performance of a corporation experiencing a drop in sales and profitability.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.