What is a Negative Gap?

A Bank's interest-sensitive obligations surpass its interest-sensitive assets, resulting in a negative gap. It's frequently linked to the positive gap when a bank's assets surpass its liabilities.

A fundamental method for calculating a negative gap is the interest rate gap or the difference between interest-bearing assets and interest-bearing debts. It assesses a company's interest rate risk exposure.

Understanding Negative Gap

The negative gap is connected to gap analysis, which can assist in evaluating a financial institution's interest-rate risk in relation to repricing or when an interest-sensitive investment matures.

The amount of a company's gap reflects how much interest rate fluctuations will affect net interest Income. The difference between an entity's revenue and costs is net interest income derived from its assets, such as personal and Commercial Loans, mortgages, and securities.

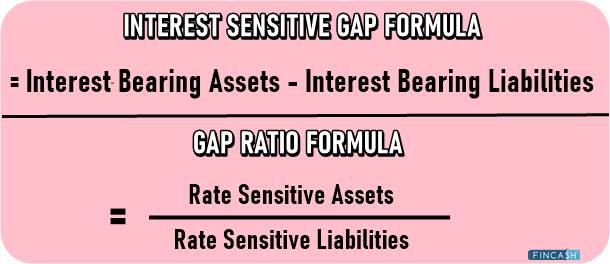

Interest-Sensitive Gap Formula

Jotted down below is the interest-sensitive gap formula for your reference:

Interest Sensitive Gap = Interest Bearing Assets - Interest-Bearing Liabilities

Concept of Gap Ratio

The rate-sensitive assets-to-liabilities ratio is known as the gap ratio. When interest rates vary, the value of assets and obligations changes dramatically. In other words, the gap ratio is a calculation that compares a company's short-term investments to its short-term expenses.

Gap Ratio Formula

Here is the gap ratio formula to calculate well:

Gap Ratio = Rate-Sensitive Assets / Rate-Sensitive Liabilities

Gap Interest

Gap interest is the interest charged when the period between the actual date of the loan disbursement and the first instalment's date is more than a month.

What is Gap Interest in Personal Loan?

Gap interest in personal loans defines the interest chargeable when an instalment is due. For instance, if a loan is given on July 24th and the payback date is the first of every month, the first EMI will be debited on September 1st. If the person fails to pay back the dues, gap interest is charged.

Difference Between Negative Gap and Positive Gap

Just as it is clear by now that when a bank's interest rate sensitive debts exceed its interest rate sensitive assets, the negative gap occurs. However, on the other hand, a positive gap occurs when a bank's interest rate-sensitive assets exceed its interest rate-sensitive liabilities. A positive gap indicates that if interest rates rise, a bank's Earnings or revenues will almost certainly grow as well.

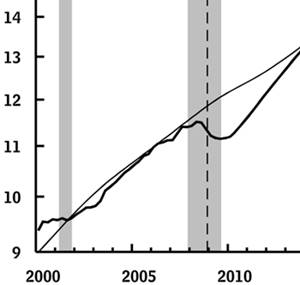

Negative Gap and Interest Rate

Interest rates have a crucial impact on the negative gap. If the interest rate falls, the obligations will be repriced at a reduced rate, resulting in a higher income. However, if the interest rate rises, the obligations will be repriced at higher rates, resulting in lesser revenue and more Capital outflow from banks.

Financial institutions constantly monitor and even forecast the movement of the average interest rate in order to rearrange assets and liabilities in a way that is believed to yield the greatest potential value to the institution.

Negative Gap and Asset Liability Management

Gap analysis is a technique for assessing liquidity risk in asset-liability management. The interest rate differential can be used to calculate investment profitability. The two most significant aspects of asset-liability management are the timing of cash flows and the availability of assets to pay liabilities. However, because options have more unpredictable cash flows, gap analysis cannot Handle them. Asset-liability management also takes into account whether assets are accessible to meet obligations and if assets or revenues can be converted to cash. This strategy can be used for a wide Range of asset types on the Balance Sheet.

The Bottom Line

A negative gap is neither beneficial nor harmful. After all, a bank's assets may be able to cover the interest it needs to pay on its liabilities. A negative gap, in a way, might suggest that a bank is exposed to interest-rate risk, and its extent can indicate how much a bank's net income might vary if interest rates move.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.