Table of Contents

Realized Gain Definition

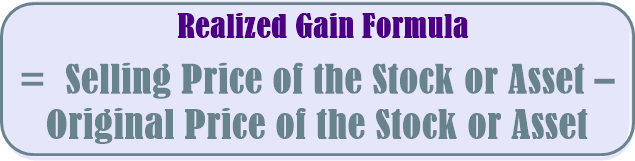

As per the Realized Gain meaning, it is known to be the result of selling some asset at a higher price in comparison to the real purchase price. While the asset might be carried on the Balance Sheet at some level far above the existing costs, the gains during the asset still in hold are regarded as unrealized. This is because the asset gets valued only at the Fair Market Value.

If you incur loss upon selling the asset, then there happens to be a Realized Loss on the other hand.

Working of the Realized Gain

Both realized as well as unrealized gains tend to vary significantly. By unrealized gain, it indicates some gain reported on the financial statement of the company. It is expected to appreciate the value of the given asset on the respective books of the company. In most cases, unrealized gains are not taxed. They add to the real reported Book Value of the asset during the time of purchasing. Moreover, these can happen across all kinds of assets as well as investments that are held by the given organization.

The assets get included on the balance sheet of the company. However, these might be reported with or also without the presence of unrealized gains. The asset’s unrealized gains can help in determining the respective selling price as the given gains get added to the book valuation of the asset.

The value of the asset, held on the books of the company, commonly is known to include the total value of unrealized gain for which the asset has received & appreciated the price that was originally booked. However, in some cases, unrealized gains might get off-balance sheet Accruals revealing the asset to be at the book value until some sale occurs.

Talk to our investment specialist

Elimination from the Balance Sheet

The asset’s sale is known to occur when the organization would choose eliminating the same from the balance sheet. Asset sales are known to happen for a wide number of reasons. Moreover, these get reported on the respective financial statements of the organization during the time interval in which the sale of the asset is taking place.

Asset sales get regularly monitored for ensuring that the asset gets sold at the length price of the arm or the fair Market value. The given regulation helps in ensuring that organizations are valuing the sale in a proper manner in the given marketplace while taking into consideration whether the given asset gets sold to some unrelated or related party.

Upon the sale of the asset, some realized profit gets achieved. As such, the organization is able to predictably observe the overall increase in the current assets along with a potential gain from the given sale.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.