Table of Contents

What is Tangible Personal Property?

Tangible personal property refers to the type of property that can be touched and is movable. This is unlike Real Property that can be touched, but is not movable. Real property includes building, Land, etc., while tangible personal property includes furniture, clothing, vehicles, etc.

If something has to be considered as tangible personal property, it has to be touchable. This type of property is depreciated over a 5 to 7 year period and the diagram depicts a straight-line depreciation.

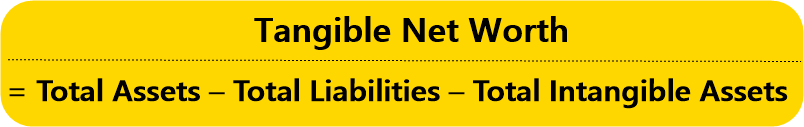

The opposite of tangible personal property is intangible personal property which refers to items that cannot be touched or felt. It includes copyrights, patents, trademark, agreement, etc.

Tangible personal property attracts Taxes. Even if you have rented or leased out such property, you will have to file tax returns for this purpose. A number of countries across the globe require that the owner of the property list out the fair Market share of each tangible personal property owned.

Tangible Personal Property and Business

1. Business Taxes

If you purchase a tangible personal property, remember that it is a Deductible expense. In some situations, you can list this purchase as a business expense in the first year of buying the item. However, usually, the cost of the item has to be spread out over the usefulness time period. This process is known as depreciation for tangible property and amortization for intangible property.

2. Business Loans

Tangible personal property in business can be used as Collateral to take a business loan. This means the lender of the loan can take the property if the borrower defaults in the payment.

One of the ways to illustrate a profitable business loan is when a company purchases a car for business. This is not a personal loan, therefore, the expenditure is deducted as a business expense.

However, since tangible personal property can be moved, creditors often find it difficult to consider it as loan security. And since it's personal, depreciation takes place over time. For example, if a business takes a loan to purchase land, the lender can capture the land if the business defaults in payment. However, if the loan is taken to purchase a few laptops, the lender may not be able to recover the amount since the laptops can be moved. Moreover, the price will undergo depreciation.

Talk to our investment specialist

Accounts and Tangible Personal Property

No matter how many items you own, make sure to keep a good record of business property. Every time you purchase an item, make sure to record it along with the cost of depreciation. It is for your own use and also if for any deductions applicable.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.