Table of Contents

Defining Walras's Law

Walras's Law, an economic theory, posits that when excess supply is in one Market, there must be a corresponding excess demand in another market to restore equilibrium. According to Walras's Law, for an individual market to be in equilibrium, all other markets must also be in equilibrium.

This differs from Keynesian Economics, which allows for imbalances in one market without requiring an offsetting imbalance in another market.

History of Walras's Law

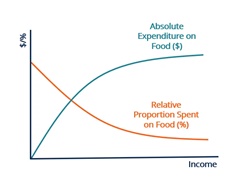

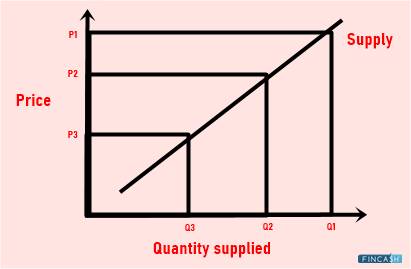

Walras's law derives its name from the distinguished Economist Léon Walras (1834 - 1910), who is credited with formulating the concept as part of his General Equilibrium Theory and establishing the Lausanne School of Economics. Walras's ground-breaking ideas can be found in his influential book "Elements of Pure Economics," published in 1874. Alongside William Jevons and Carl Menger, Walras is extensively recognized as one of the founding fathers of neoclassical economics. At the core of Walras's law lies the belief that market forces, often called the "invisible hand," act to bring about equilibrium. When there is excess demand in a market, prices are expected to rise as the invisible hand works to rectify the imbalance. Conversely, when there is excess supply, prices are driven down, ultimately benefitting consumers and restoring equilibrium.

In the framework of Walras's law, producers respond to changes in interest rates rationally. If interest rates increase, they curtail production, while a decrease in rates prompts them to invest further in Manufacturing facilities. These theoretical dynamics put forth by Walras are contingent upon the assumption that consumers are driven by self-interest and that firms aim to maximize their profits. Overall, Walras's law, together with his broader contributions to economic theory, has had a lasting impact on our understanding of Market Dynamics and the principles that govern them.

Talk to our investment specialist

What are the Limitations of Walras's Law?

In practical terms, there have been instances where Walras's theory has not aligned with empirical observations. Even if all other markets are in equilibrium, the presence of excess supply or demand in a specific market indicates that it is not in equilibrium. Walras's law takes a holistic view of markets, considering them as a collective rather than individually. Economists who have examined and expanded upon Walras's law have put forth the hypothesis that the difficulty of quantifying units of "utility," a subjective concept, poses a challenge in formulating the law in mathematical equations—a goal Walras himself aimed to achieve. Critics of Walras's law argue that measuring utility for each individual, let alone aggregating it across a population to form a utility function, is not a practical endeavour. They contend that if this measurement cannot be accomplished, the law would not hold, as utility strongly influences demand.

Walras's Law and General Equilibrium

Walras's Law provides a critical insight into the conditions necessary for a general equilibrium to prevail in an Economy. By asserting that the sum of all excess demands must be zero, it highlights the notion that any disequilibrium in one market will necessarily spill over into other markets. In other words, a shortage or surplus in one market cannot persist indefinitely without affecting the equilibrium in other markets.

Implications for Economic Analysis

Walras's Law has profound implications for economic analysis and understanding market dynamics. It emphasizes that achieving a state of general equilibrium requires simultaneous adjustment in all markets, as interdependencies exist among different goods and services. It challenges the notion that markets can independently reach equilibrium in isolation from one another. Moreover, Walras's Law serves as a valuable tool for economists to analyse the stability of economic systems. It provides a framework to assess the existence and uniqueness of equilibrium solutions and to understand the role of price adjustments in restoring equilibrium.

Conclusion

Walras's Law stands as a crucial pillar in general equilibrium economics, contributing to our understanding of market dynamics and the conditions necessary for Economic Equilibrium. By highlighting the interconnectedness of markets and the need for simultaneous adjustments, this fundamental principle provides valuable insights into the functioning of market economies.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.