Table of Contents

- What is the Dividend Yield?

- Fluctuating Value of Dividend Yield

- Dividend Yield: What You Need to Know?

- Dividend Yield Formula

- Example of Calculating Dividend Yield Ratio

- Factors that Led to Higher Dividend

- Benefits of Dividend Yield

- Drawbacks of Dividend Yields

- What Does a Good Dividend Yield Look Like?

- Is it Possible for a Dividend Yield to be too High?

- Dividend Payout Ratio vs Dividend Yield

- Conclusion

What is Dividend Yield?

Dividends are a significant source of Income for some equity owners. While everyone appreciates investment income, retirees, who typically rely on the extra cash flow to live, require a consistent income stream.

If you're planning to invest in shares as part of your financial strategy, the dividend yield might give you a picture of how much money you'll make. This information is useful for planning and can assist you in making smart judgments about where to invest your money.

Are you wondering what the dividend yield is and how its value fluctuates? Are you also confused about its benefits and limitations and the value it holds for you? Go through this article to learn everything in detail about Dividend yield and what is it about.

What is the Dividend Yield?

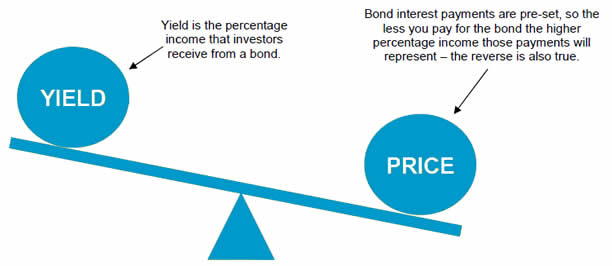

The dividend yield refers to a financial ratio (dividend/price) that illustrates how much a firm pays out in dividends each year concerning its stock price. It is given as a percentage. The price/dividend ratio is the counterpart of the dividend yield.

Fluctuating Value of Dividend Yield

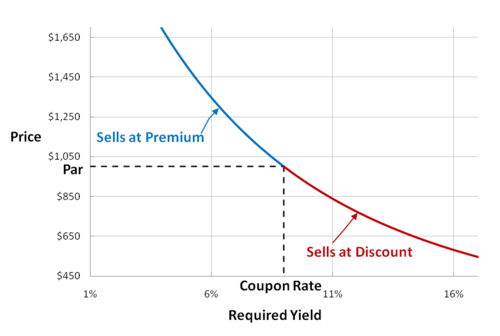

A stock's dividend yield estimates the dividend-only return of an investment. The dividend yield goes up when the stock price goes down and vice versa. Since the dividend yields fluctuate concerning the price of the stock, they can appear higher for stocks that are rapidly losing value.

Dividend Yield: What You Need to Know?

New companies which are still expanding swiftly but are tiny may pay a smaller average dividend than established companies in the same sector.

In other circumstances, dividend yield might not always reveal much about the type of dividend paid by the company. For example, the average dividend yield is extremely high among Real Estate Investment Trusts (REITs).

On the other hand, ordinary dividend yields differ from qualified dividend yields in that the former is treated as regular income while the latter is taxed as Capital gains. Business Development Companies (BDCs) and Master Limited Partnerships (MLPs), like REITs, are known for their high dividend yields.

Here, the "pass-through" mechanism refers to the fact that the corporation does not have to pay income Taxes on revenues distributed as dividends. In contrast, dividend payments must be treated as ordinary income and taxed accordingly.

These companies' dividends (MLPs and BDCs) are not eligible for Capital Gains tax treatment. While the increased tax burden on dividends from conventional corporations reduces the effective return gained by the investor, MLPs, BDCs, and REITs nevertheless pay larger-than-average dividends after taxes.

Talk to our investment specialist

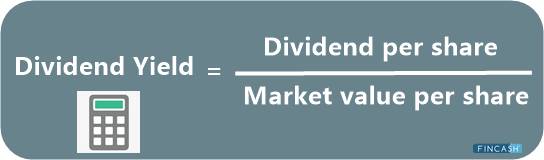

Dividend Yield Formula

Dividends are typically paid once every quarter. However, the frequency of payouts might vary. While some corporations pay monthly dividends, others pay an annual dividend. The dividend payment is a crucial statistic to consider if you're Investing your money to receive future income.

The dividend yield ratio can be calculated by taking the dividend per share and dividing it by the Market value of each share. Also, companies are more likely to announce dividends as gross dividends distributed.

In that scenario, it must be divided by the number of shares of common stock outstanding in that year. The market value of the share after the tenure in question is used.

Example of Calculating Dividend Yield Ratio

Assume a corporation has declared a Cash Dividend of Rs. 10,00,000 to be paid this year. There are 10,000 shares of common stock in circulation. As a result, each share will get the following dividend:

Total cash dividend/ Outstanding Common Stock = 10,00,000/10,000 = 100 dividends per share

As a result, the per-share dividend would be Rs. 100. Divide the current market price by the current market value of the stock to get the dividend yield ratio. If the stock's current market value is Rs. 1,000, the following is the result:

Dividend per share/ market value per share = 100/1,000 = 0.1 or 10%

Factors that Led to Higher Dividend

There are two main reasons for a company's dividend per share payout to rise-

- The first is a rise in the company's net profits, which are used to pay dividends. There is more room to pay higher dividends to shareholders if the company is functioning well and cash flows are improving. A dividend increase is a favourable indicator of firm performance in this context

- The second reason a business's dividend may be raised is due to a change in its growth strategy, which causes the company to spend less of its cash flow and Earnings on growth and expansion, leaving a higher portion of profits available to be distributed to equity investors in the form of dividends

Benefits of Dividend Yield

Here are some key benefits of dividend yield:

When properly applied, the dividend yield is a valuable metric, and effort is taken to determine if the company behind the payout can keep paying it

When deciding which dividend stocks to buy, income investors, or those intending to use their investment Portfolio as an income source today, will use dividend yield as a starting point. After all, if you are living off your portfolio, you need it to provide a certain amount of revenue. If you're in this scenario, you might focus on stocks that provide a higher yield right now, as long as the company is doing well and its Balance Sheet and earnings are solid enough to protect the distribution

Dividend yield can also be a useful measure in determining a stock's value. If the dividend yield differs significantly from its historical level or similar companies, it can assist in determining whether a stock is selling at a better — or worse — price. Again, the yield is only the beginning; understanding a company's activities and cash flows is critical for keeping the dividend yield in a proper perspective

Drawbacks of Dividend Yields

Even though the larger dividend yields are appealing, they may come at the expense of the company's future growth. It is considered to believe that every penny a firm pays in dividends to its shareholders is a penny it is not reinvesting for the development and for earning added capital gains.

Even if they are not getting the dividends, shareholders can earn larger returns if the value of their stock rises due to company growth while they keep it. Investors shouldn't analyse a stock solely based on its dividend yield.

Data on dividends could be outdated or based on inaccurate information. As their price falls, many companies have a high yield. If a company's stock falls far enough, the dividend may be reduced or eliminated.

When examining a company that appears distressed and has a higher-than-average dividend yield, investors should proceed with caution. A significant downturn can dramatically increase the quotient of the calculation because the stock's price is the denominator of the dividend yield equation.

What Does a Good Dividend Yield Look Like?

Before trying to determine a desirable dividend yield Range, it's vital to remember that a stock's dividend yield may fluctuate due to corporate financial decisions and macroeconomic variables (i.e., changing Inflation expectations, productivity growth rates and interest rates).

Dividends paid by well-established corporations are generally higher than those paid by early-stage enterprises. Growth-oriented start-ups tend to have more steady, predictable revenues and fewer investment prospects than mature organisations, which we frequently see in the technological and healthcare sectors.

Consequently, established companies are more likely to pay out dividends to their owners. Based on Industry, dividend yields on the highest-yielding equities now range from 3.0% to 7.5%. The average dividend yield across all industries is 1.6%.

Is it Possible for a Dividend Yield to be too High?

Dividends are only one Factor in determining a stock's value. The potential for stock value appreciation is often a much more important indicator of value.

Consider both the dividend yield and the growth prospects of stock before purchasing. Also, keep in mind that a high dividend yield isn't always a desirable thing. Take note of the following high-dividend-yielding scenarios:

- Dividend payouts that are too high can limit a company's growth potential and value. At the end of the day, every dollar paid to stockholders is a dollar that the company is not reinvesting in itself

- A high dividend yield is sometimes the outcome of a fast stock price decrease rather than a large dividend. The resulting dividend yield appears nice on paper, but it's deceiving and may distract you from the real issue - a falling stock price

- A higher dividend yield might be a scheme to entice investors. This is a method used by shady companies to entice you in, but their dividend payouts are not sustainable. Many times, the businesses themselves are not long-term viable

Dividend Payout Ratio vs Dividend Yield

The Dividend Payout Ratio (DPR) expresses dividend payments as a percentage of a company's net earnings, whereas the dividend yield expresses dividend payments as a stock price percentage.

The Dividend Per Share (DPS) ratio is divided by the Earnings Per Share (EPS) ratio to get to the DPR. The Earnings Per Share (EPS) ratio is calculated by dividing the company's annual net earnings by the number of common stock shares held by stockholders. The formula can be found below.

DPR = Annual DPS/ Annual EPS

Conclusion

A high dividend yield can be a useful metric when assessing equities for investment objectives. However, this does not always imply a strong business. Look beyond the amount at a single point in time and consider the sector and the company's dividend yield over time. You should be aware that there exists some regularity, and it isn't a one-off occurrence.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.