Fincash » Mutual Funds India » Mutual Fund Portfolio Overlap

Table of Contents

What is Mutual Fund Portfolio Overlap?

Some might Call it a recent ‘fad’ in the investment sector, while some call it a rising investment opportunity. Either way, Mutual Funds have captured the investors’ choice greatly. They are highly liquid investments and offer the chance to diversify investment portfolios. All of this comes with professional management of funds.

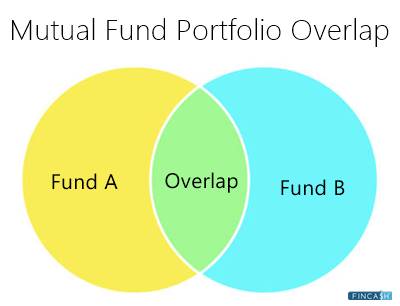

But being a newer investment avenue, mutual fund investments face many problems. A common and frequent one is the overlapping investments in different mutual funds. In the financial dictionary, it is called 'mutual fund Portfolio overlap.' Let us try to understand this term.

What is a mutual fund portfolio?

Before jumping on to the complications caused by an overlap in the mutual fund portfolio, let’s look at what a portfolio is. A mutual fund portfolio shows all the investments you have made in various mutual fund schemes. For the people who don’t know what a mutual fund is — a mutual fund is a fund wherein an investor pools their money, and a fund manager invests this amount in various securities, such as shares, Debentures, marketable securities, etc.

What is mutual fund portfolio overlap?

People often invest in more than one mutual fund to diversify their investments. So, they take up varying schemes companies, banks, and financial institutions offer. But more often than not, these companies, banks, and financial institutions invest the investor’s money similarly. There is a likelihood that two different mutual fund schemes may invest your specified amount in the shares of the same company. Now in effect, these so-called different policies are the same and will produce similar returns. This way, the purpose of diversifying investments is not fulfilled, and an overlap takes place.

Talk to our investment specialist

Mutual fund portfolio overlap example

Let’s say you invest in two mutual funds, such as Fund 1 and Fund 2, offered by two different companies.

Now you wish to find where these mutual fund companies have invested your fund amount. You get to know that in Fund 1, your money has been invested in the shares of, say, TCS, Reliance, and Infosys. Fund 2 has been invested in Wipro, SBI, and TCS. Here, you will see an overlap of investment in the shares of TCS in both funds. You will not want any similarity between the two schemes you opted for, as the sole reason behind choosing varying schemes was to diversify your portfolio.

Why mutual fund portfolio overlap is a problem?

People wish to invest in various schemes of several companies to diversify their investments. But what is the need for diversification? One of the simple reasons behind it is to diversify the risks associated with investments. The investment sector is uncertain, and nobody can guarantee returns on any particular investment. This is because the business world is dynamic. Thus, there is considerable risk in each investment avenue. The extent of this risk may vary across different asset classes. Therefore, to balance out the risks, investors diversify their portfolios. This is based on the notion that if one investment fails or suffers a loss, another investment will nullify the effect of that loss. So, whenever there is an overlap in a mutual fund portfolio, it increases the risk.

To what extent is a portfolio overlap reasonable?

A perfect portfolio is one where there is no overlapping at all. But since perfection is an illusion, investment portfolios— just like everything else— cannot be perfect. Investment portfolios, in general, and mutual fund portfolios, in particular, will always have something in common. But, the percentage of overlap can be managed.

But how do you know how much overlap is fine, and when do you need to be considerate? Here is what you need to know:

- An overlap of 10-30% is quite common. When you invest in Mutual Funds, even in different companies, you are bound to have a minimum percentage of overlap. This is because the approach and the strategy of mutual fund investments are the same everywhere

- But if your overlap is around 40-50%, the diversification percentage is very low. This means half of your investment is similar

Now, this would not mean that you have wasted your money on these funds. Even if you have invested in similar kinds of funds, you will get some returns. Only the chances of getting higher returns due to diversification will be less.

How to deal with portfolio overlap?

As they say, 'Precaution is better than cure.' Dealing with a mutual fund portfolio overlap is not that difficult if you take preventive steps from the beginning. Here are some of them:

1. Compare the schemes before buying

Comparing different schemes before buying will help you to a great extent. Every mutual fund company provides details of the schemes they offer. Even if you do not have financial knowledge, you can easily compare various schemes using online tools.

2. Do not buy different schemes from the same company

If you buy two different schemes from the same fund manager, chances are high that you will end up with a huge overlap in your portfolio. This is because the company’s core strategy will be the same, irrespective of the scheme you opt for. So, if you wish to invest in more than one mutual fund, try to find companies that have contrasting strategies for investment. It can be put simply in other words: effective investment does not only mean diversification of risk, but in effect, it means diversification of investment avenues.

3. Avoid similar types of funds

Mutual funds can be broadly classified into large-cap, medium-cap, and Small cap funds. If you invest in two large-cap mutual funds, even in different companies, there is a high probability that the portfolios might overlap. This is because all large-cap mutual funds tend to comprise securities of a similar nature, likewise for medium and small-cap funds. Thus, try to avoid Investing in the same funds as much as you can.

4. Identify your goals for investment

Identifying the purpose of your investment will help a great deal in deciding the kind of mutual fund (large, medium, and small-cap) you should invest in. This classification will make it easier for you to decide what fund to invest in. This will, in turn, help in portfolio diversification instead of an overlap.

Conclusion

Investing money today is just like sowing a seed. It takes time, but once it grows into a tree, it gives shade in the scorching sun. The value of prudent investing cannot be undermined. And for this, it is important to understand the obstacles you might face in your investment journey. A problem like a portfolio overlap is very common and, at the same time, manageable if the right steps are taken. So, make sure you have basic financial awareness to become a ‘prudent investor.’

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.