Table of Contents

What is a Credit Score?

Are you planning to apply for a loan? Or a credit card? Want to make sure they are approved easily? Then you must have a strong Credit Score.

Your credit score is one of the important parameters a lender will consider before approving a loan or credit card.

Credit Score Ranges

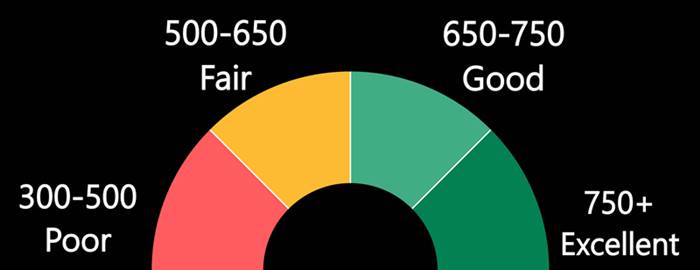

A credit score is a three-digit number that represents your creditworthiness. Like how likely you are able to pay back your credit card dues and loan EMIs based on your credit history. There are four RBI-registered Credit Bureaus in India- CIBIL, CRIF High Mark, Equifax and Experian, and each of them has their own scoring model. The score typically ranges between 300 and 900. A higher score represents that you’re a responsible borrower, and thus you may have higher chances of favorable credit terms and quick loan approval.

Here’s a general look at Credit Score Ranges:

| Poor | Fair | Good | Excellent |

|---|---|---|---|

| 300-500 | 500-650 | 650-750 | 750+ |

Credit scores are used by potential lenders and credit card companies, banks, etc., as one of the factors while deciding whether to offer you a loan or credit card.

Check credit score

Why is Credit Score Important?

If you’re looking for reasons to maintain Good Credit, here are some great benefits to having a 750+ credit score.

Easy loan approval

A borrower with a good credit score may have a higher preference in getting quick loan approval. This is because such borrowers have good credit history, which builds lender's confidence in lending money. Therefore, a good score can increase the chances of quick loan approval.

Negotiating power

With a good score, you have the power to negotiate your loan term. You can also negotiate for a lower interest rate on a new loan. However, if you have a low credit score, you won’t have this power, you also may not have many offers on credit cards.

Add-on features on credit card

With a strong credit score, you may qualify for the best credit cards, which include cash backs, rewards and benefits like air miles, etc.

Higher credit limit on credit card

Your borrowing capacity is based on your credit score and Income. If you’ve a good score, creditors consider you a responsible borrower and may increase your Credit Limit. Even if you get a credit card with a bad score, your limit may be limited.

Conclusion

With a strong credit score, you can save a lot of money. It works as power when you apply for a new loan or credit card. Instead of paying heavy interest rates on loan EMIs or credit card dues with a bad score, start building an excellent score for great credit benefits ahead.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.