7 Best Fuel Credit Card For Frequent Travelers 2025

Commuting in your own vehicle is a comforting. But with the rise in fuel prices and maintenance costs, using personal vehicle on a daily Basis may be a concern for many people. In order to save on fuel and other travel expenses, a fuel credit card can always be a great option for frequent travelers.

It basically offers various benefits like fuel surcharge waiver, turbo points, rewards, etc. With fuel credit card, you will be able to travel efficiently and make expensive road trips at cheaper costs.

Top Fuel Credit Cards

Here are some of the best credit cards for fuel-

| Credit Card Name | Annual Fee |

|---|---|

| IndianOil Citi Titanium Credit Card | Rs. 1000 |

| IndusInd Bank Signature Legend Credit Card | Nil |

| ICICI Bank HPCL Coral Credit Card | Nil |

| RBL Bank Platinum Delight Credit Card | Rs. 1000 |

| BPCL SBI Card | Rs. 499 |

| IndianOil HDFC Bank Credit Card | Rs. 500 |

| HSBC Premier MasterCard | Nil |

IndianOil Citi Titanium Credit Card

- Get up to 15% discount at all the participating restaurants

- Earn 4 Turbo Points on spending Rs. 150 spent at any Indian Oil retail outlet

- Earn 2 Turbo Points on Rs. 150 spent at grocery and supermarkets

- Earn 1 Turbo Point on Rs. 150 spent on shopping and dining

- Redeem the earned reward points across Indian Oil Retail Outlets and purchase fuel for free

Get Best Cards Online

BPCL SBI Card

- Win 2,000 reward points worth Rs.500 as a welcome gift

- Get 4.25% value back and 13X reward points on every Rs.100 you spend for fuel

- Earn 5X reward points every time you spend Rs.100 on groceries, departmental stores, movies, dining and utility bill

IndianOil HDFC Bank Credit Card

- Earn 5% as fuel points at IndianOil outlets

- Receive one fuel point for every Rs.150 spent on other purchases

- Enjoy 1% waiver on all additional payments for fuel

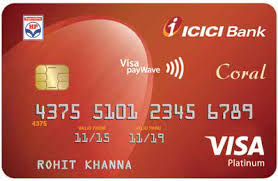

ICICI Bank HPCL Coral Credit Card

- Earn 2 points on every Rs. 100 spent on your retail purchases

- Get a 2.5% cashback and 1% fuel surcharge on fuel purchases at HPCL gas stations

- Enjoy Rs. 100 discount for any two movie tickets on BookMyShow

- Minimum 15% discount on dining at over 800 restaurants

IndusInd Bank Signature Legend Credit Card

- Enjoy 3 fully paid one-way domestic tickets

- Get Jet Airways promotion codes

- Get a 100% discount on base fare and airline fuel charges

- Earn 1 reward point for every Rs. 100 spent during weekdays and 2 rewards on weekends

RBL Bank Platinum Delight Credit Card

- Earn 2 points for every Rs.100 spent on weekdays

- Earn 4 points for every Rs.100 spent during weekends

- Earn up to 1000 bonus reward points every month for using your credit card for five or more times in a month

- Get a discount on groceries, movies, hotel, etc.

HSBC Premier MasterCard

- Avail reward points for brands like Tumi Bose, Apple, Jimmy Choo, etc

- Get 2 reward points every time you spend Rs. 100

- Get free access to more than 850 airport lounges internationally

- Complimentary access and discounts at selected golf courses in India

- Get 1% fuel surcharge waiver at any fuel pumps

- Get cashback and rewards on international spending

Key Tips to Choose Best Fuel Credit Cards

Here are some of the key features you should compare before applying for a fuel credit card-

1. Annual fee of the credit card

Different fuel credit cards have different annual fees. Choose a card such that you would be comfortable paying.

2. Fuel surcharge waiver

A fuel surcharge waiver is the amount of fee levied on fuel expenses for using the credit card. Ensure that the credit card you choose has a complete waiver on fuel surcharge.

3. Acceptance at fuel stations

Before finalizing your credit card make sure it is accepted at a majority of gas stations across India.

4. Rewards and points

A good fuel Credit card offers the best rewards and points to redeem for your expenses. Check for the Redemption rates and offers that you can avail.

Conclusion

A fuel credit card helps serve its purpose by cutting down costs on your fuel expenses. For someone who owns a vehicle and travels daily a fuel card is a game-changer. With so many benefits and discounts offered, it certainly is one of the easiest and convenient ways to reduce travel costs and save money.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.