Table of Contents

VISA Credit Card- Best VISA Credit Cards to Apply 2025 - 2026

VISA is an international corporation providing financial services to people. It has its headquarters in the United States of America. It offers cashless payment services on credit cards, debit cards, prepaid cards, gift cards, etc. Today, VISA credit card is currently the most globally accepted credit card services.

What is a VISA Credit Card?

VISA credit card was the first consumer credit card program available for consumers and merchants in the United States. They offered the first credit card service in 1958. Today VISA has its operations worldwide in over 200 countries.

It offers users with a lot of attractive benefits and offers like cashback, rewards, discounts, gift vouchers, etc. Many top banks including ICICI Bank, State Bank of India, HSBC Bank, Citi Bank, HDFC Bank, etc., issue VISA cards for seamless transactions.

What is VISA Network?

VISA is an international corporation that provides financial services. It offers a medium of payment for credit cards, debit cards, prepaid cards, and gift cards so as to carry out cashless transactions everywhere around the world.

VISA doesn’t issue cards nor does it offer any financial possession to people. It simply provides a network that connects consumers, merchants and banks for fund transfer.

Get Best Cards Online

Benefits of VISA Credit Card

A VISA credit card is one of the most accepted card services globally. A high acceptance network is one of the key reasons why people prefer VISA over other types of credit cards.

It offers the most advanced security system for its credit card users in the form of an EMV chip that is embedded in the card. An EMV chip basically offers superior protection for carrying out high-value transactions.

A VISA card offers zero per cent liability in case of frauds and theft. Suppose an unauthorized transaction is made using your credit card, then you won’t have to pay the equivalent amount to the company.

Variants of VISA Credit Cards

The VISA credit cards come in five different variants to choose from-

1. VISA Gold Credit Card

These cards offer discounts on dining, retail shopping, cashback and gift vouchers on various purchases. You will also receive travel and medical assistance. While travelling abroad, you can be worry-free as Visa Gold credit cards are accepted worldwide, including 1.9 million ATMs.

2. VISA Platinum Credit Card

There are more than 100 deals and offers available for Platinum card users. This Visa card is accepted globally, and it offers 24/7 customer care support for the cardholders. Enjoy offers on dining, online shopping and more. Additionally, get access to golf tournaments. Visa Platinum Credit card offers you many attractive lifestyle privileges.

3. VISA Classic Credit Card

With access to over 1.9 million ATMs in more than 200 countries worldwide, the card gives hassle-free service to its users from across the world. Be it travelling, shopping or dining, VISA Classic cards can be used almost anywhere. The best part of these credit cards is that they can be replaced immediately in case of emergencies.

4. VISA Signature Credit Card

Enjoy cashback and rewards on food, travel, retail, lifestyle, etc. With the signature card you can get complimentary airport lounge access annually.

5. VISA Infinite Credit Card

The VISA Infinite credit card gives you complimentary access to golf clubs and golf tournaments. You can also enjoy free annual airport lounge visits. You’ll receive discounts on online purchases as well as on dining at selected restaurants and hotels.

VISA Credit Card Issuing Banks

Some of the banks Offering VISA credit cards-

- American Express

- State Bank of India

- HSBC bank

- Citi Bank

- HDFC Bank

- IDBI Bank

- IndusInd Bank

- ICICI Bank

- Union Bank of India

- Standard Chartered Bank

- Yes Bank

- Kotak Mahindra Bank

- RBL Bank

Best VISA Credit Cards

Almost all banks in India offer Visa credit cards.

To explore the best ones, here are the 6 top VISA credit cards to consider.

| Card Name | Annual Fee |

|---|---|

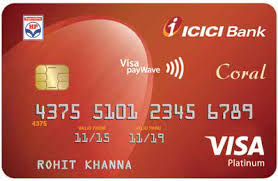

| ICICI Bank Coral Contactless Credit Card | Rs. 500 |

| Axis Bank Reserve Credit Card | Rs. 30,000 |

| ICICI Bank Platinum Chip Credit Card | Nil |

| Citi PremierMiles Credit Card | Rs. 3000 |

| Simply Click SBI Card | Rs. 499 |

| HDFC Regalia Credit Card | Rs. 2500 |

ICICI Bank Coral Contactless Credit Card

- Enjoy a discount of 15% on dining bills

- Get up to 2.5% cashback on a minimum spend of Rs.4,000 at HPCL

- Complimentary visits to airport lounges

- Buy one movie ticket and get one free from BookMyShow

- Up to 10,000 additional reward points awarded every anniversary year

Axis Bank Reserve Credit Card

- Complimentary dining access on selected restaurants

- Earn Gift vouchers of worth Rs. 10,000

- 1% fuel charge waiver at fuel stations across India

- 50% cashback on all movies booked on Bookmyshow

- Golf access across India

Citi PremierMiles Credit Card

- Earn 10,000 miles on spending Rs. 1,000 or more for the first time within a period of 60 days

- Get 3000 miles bonus on card renewal

- Earn 10 miles for spending Rs 100 on airline transactions

- Get 100 miles points on spending every Rs. 45

ICICI Bank Platinum Chip Credit Card

- It has a built-in contactless technology for quick and secure payments

- It offers payback points, redeemable on exciting gifts and vouchers

- Fuel surcharge waiver

- Minimum 15% savings on dining at selected restaurants

Simply Click SBI Card

- Amazon.in gift card worth Rs. 500 on joining

- 5X reward points on online spends

- Get 10X reward points on all your online payments

- Win e-vouchers worth Rs.2000 if you spend Rs.1 Lakh and Rs.2 Lakhs each on online payments

HDFC Regalia Credit Card

- Get complimentary lounge access at over 1000 airports

- 24x7 travel assistance service

- You’ll receive 4 reward points for every Rs.150

How to Apply for a VISA Credit Card?

You can apply for a VISA card online as well as offline

Online

- Go to the respective bank’s official website

- Choose the credit card option and choose the type of card you wish to apply

- Enter your name, phone number and email id

- Click on the Apply Online option An OTP (One Time Password) is sent to your registered mobile phone

- Use this OTP to receive a card request form

- Enter your personal details

- Select Apply, and proceed further

Offline

You can apply offline by simply visiting the nearest respective bank and meeting the credit card representative. The representative will help you complete the application and choose the appropriate card. Most banks would check your eligibility based on certain parameters like- Income, Credit Score, etc., depending on which you'll be given the credit card and Credit Limit.

What are the Documents required?

Following are the documents required to get a VISA credit card-

- An identity proof issued by the government of India like Voter ID, driving license, aadhaar card, passport, ration card, etc.

- Proof of income

- Address proof

- PAN Card

- Passport size photograph

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.