Table of Contents

What is a Good CIBIL Score?

If you’re planning to apply for a loan or a credit card, then your Credit Score matters a lot. Your score shows how responsible you are as a borrower. Lenders always prefer customers with a good CIBIL Score as they are confident of lending credits to them.

TransUnion CIBIL Ltd, commonly known as CIBIL is the oldest Credit Bureaus in India that provide credit information. CIBIL credit bureau is licensed by the RBI and governed by the Credit Information Companies (Regulation) Act of 2005. It assesses your creditworthiness based on your repayment habits, credit history, on-going credit lines, dues pending, etc.

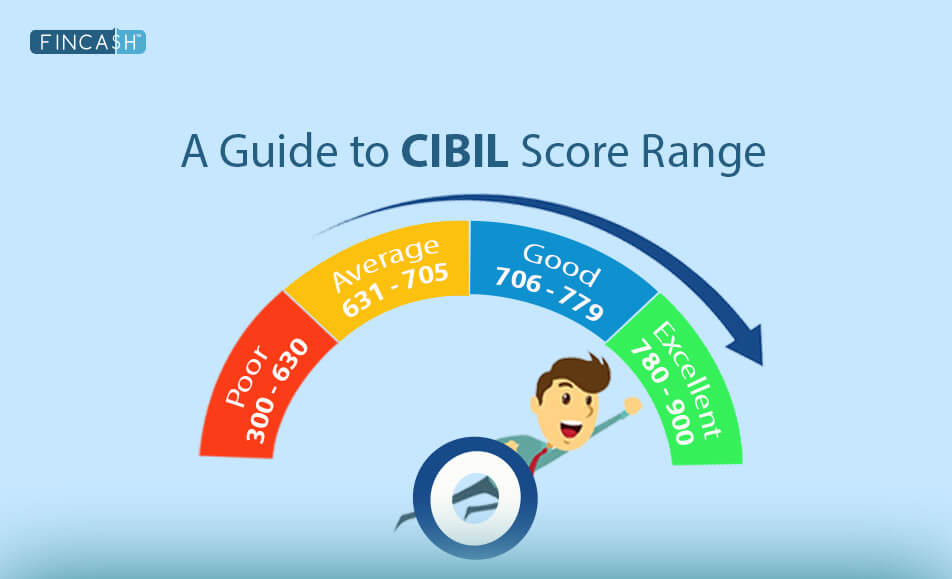

CIBIL Score Range

CIBIL credit scores are measured on a scale between 300 and 900. The minimum score you would need to maintain is 750. With this score, you would be eligible for loans, credit cards, etc.

Let’s see what are the different CIBIL score ranges indicate-

| CIBIL Score Ranges | Category |

|---|---|

| 750 to 900 | Excellent |

| 700 to 749 | Good |

| 650 to 699 | Fair |

| 550 to 649 | Poor |

Check credit score

NA/NH

If you have not used a credit card or have taken a loan yet, you will have no credit history. Therefore, your CIBIL score will be NA/NH, which means 'No history' or 'Not applicable'. To build a credit history, you might have to consider taking credit in terms of a credit card or any loan.

550 to 649

These CIBIL scores indicate that a borrower has a payment Default on credit cards or loans. Some lenders may offer a loan by asking for a guarantor to reduce the risk. If a borrower fails to clear the debt, then lenders can depend on the guarantor for loan repayment.

650 to 699

These fall under average credit scores. This shows that the borrower has neither been too good nor too bad with the loan repayments. However, to lower the risk of loan rejection, a borrower can improve the scores. With such scores, you may not still get favorable loan terms or credit card features.

700 to 749

These are good CIBIL scores. A borrower with such scores has a good chance of getting quick loans and credit card approvals. However, despite a good score, it is not as risk-free as the highest score bracket of 750+. To get the best benefits, you have to improve your score.

750 to 900

Anything above 750 is an excellent score. With such scores, you can easily get a loan or credit card approvals. You may even have the power to negotiate loan terms and lower interest rates. Moreover, you’ll be eligible for best credit card offers like air miles, cashbacks, rewards, etc., by various creditors. You can ideally choose the one that suits you the best.

Why do you Need to Maintain a Good CIBIL Score?

Easy loan and credit card approvals

A Good Credit score can make lending easier for you. Loans, credit cards, and other credit lines can be easily approved for someone with a 750+ CIBIL score. Lenders are confident about lending funds to such borrowers.

Negotiating power

Individuals with a good CIBIL score not only get easy loan approvals, but might also have the power to negotiate loan terms. You can also negotiate with the lenders to reduce the interest rates. This can save you a lot of money and help in swifter repayment.

Best credit card options

With a good CIBIL score, you’ll have a lot of credit card options from various creditors. You will also be eligible for benefits like air miles, rewards, cash backs, etc. You can compare the features offered by different creditors and choose the one that suits you the best.

High credit limit

With a good CIBIL score, you can apply for higher credit limits. Usually, the credit card comes with a certain limit. If you exceed this limit, your score may go down. But, with a strong score, you have the option to apply for a higher Credit Limit. With this advantage, you can use your card for most of your monthly spends without letting your score affected.

With a low credit score, you may get approved for a loan or credit card, but the rates may be higher, and the limit may be lower.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

You Might Also Like