Table of Contents

How to Check your CIBIL Score?

Formed in the year 2000, TransUnion CIBIL (Credit Information Bureau India Limited) is India’s oldest and well-known Credit Information Company. On the Basis of the credit information of an individual, CIBIL generates Credit Score and Credit Report. Lenders take a look at this report to decide if they want to lend the money to the applicant. Ideally, lenders consider applicants with a good repayment history.

What is CIBIL Score?

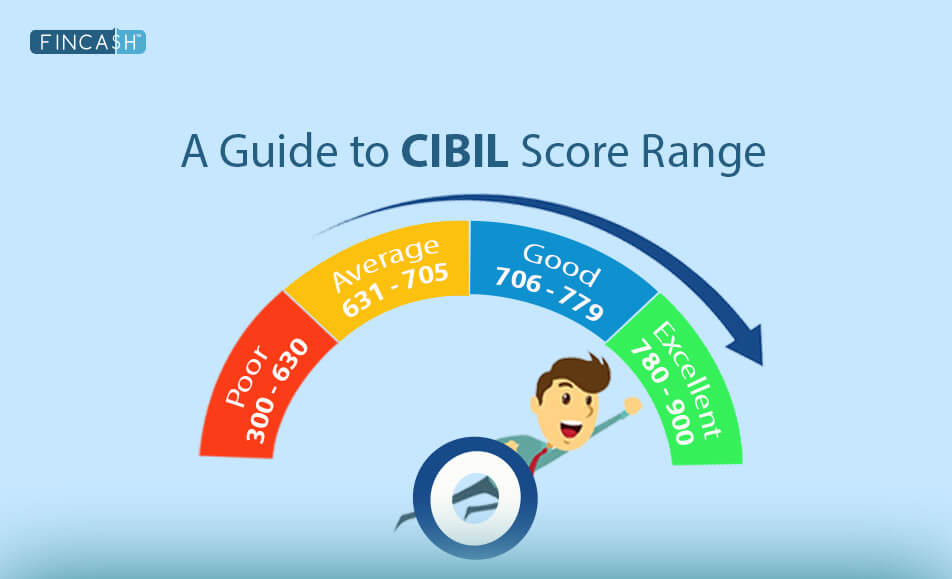

A CIBIL Score is a three-digit number that represents your creditworthiness. It ranges from 300 to 900 and is derived by measuring your payment history, and other credit details as maintained by the CIBIL. Generally, any score above 700 is considered excellent. And, that is what you should aim for.

A high CIBIL score tells how responsible and disciplined you are as a borrower. Lenders always look forward to lending money to such customers.

With a 700+ CIBIL score, you can easily qualify for loans and credit cards. You will also be eligible for the best credit card deals and loan terms. You may even have the power to negotiate low-interest rates on loans.

How to Check CIBIL Score?

Below are a few simple steps to get your CIBIL report:

Step 1- Go to the CIBIL website.

Step 2- At the home page, you’ll have to provide necessary information such as name, number, email address and PAN details.

Step 3- Fill all the questions correctly about your credit cards and loans based on which your CIBIL score will be calculated. Following a complete credit report will be generated.

There would be a few main steps to be performed to check your CIBIL score-

Step 4- If you need more than one report a year then you will be suggested various paid subscriptions.

Step 5- In case, you want to go for a paid subscription, you would need to authenticate yourself. You’ll receive an email on your registered account. Click on the link and enter the one – time password provided in the email.

Step 6- You might need to change the password again. Once you log in, all your personal details will be auto-populated. Enter your contact number and click submit.

Step 7- After submission, you’ll get your CIBIL score along with the credit report.

Ensure you don’t just check your scores. Review & monitor all the information in your report. If you come across any errors, get it rectified.

Check credit score

How is the CIBIL score calculated?

There are four factors that impact your CIBIL score:

Payment history

Making late payments or defaulting on your loan EMIs or credit card dues has a negative impact on your CIBIL credit score. To eliminate any risk, ensure you make all your payments on or before the due date.

Credit mix

Ideally, a diverse credit line can have a good impact to your score. You can keep a balance between secured loans and unsecured loans.

High credit utilisation

Every credit card comes with a credit utilisation limit. If you exceed the limit usage, then lenders consider you as credit hungry and may not lend you money in the future. Ideally, you should maintain 30-40% of the Credit Limit in every credit card.

Multiple enquiries

Too many loan inquiries at the same time can hamper your score. It also might indicate that you already have too much debt burdens. So, apply for a loan or a credit card only when it is required.

How to Maintain a Good CIBIL Score?

Here’re some of the tips to maintain a good CIBIL score:

- Pay your credit card dues and loan EMIs on time

- Don’t apply for multiple credit cards and loans at the same time

- Review your credit reports regularly. If you come across any incorrect information, get them corrected

- Keep your credit utilisation ratio up to 30-40% across all credit cards

- Build a strong and long credit history

Conclusion

Along with CIBIL, CRIF High Mark, Experian and Equifax are other RBI-registered Credit Bureaus in India. You are entitled to a free credit check every. So make the best use of it and start monitoring your report.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Housing loan