Table of Contents

IDBI Bank Savings Account

IDBI Bank Savings Account

Industrial Development Bank of India (IDBI) was established in 1964 as an act to provide credit to the booming industrial sector in India. It was a subsidiary of the Reserve Bank of India (RBI) before being transferred to the Government of India. On January 21, 2019, the RBI recategorised the bank as a private sector bank after 51% of its stake was bought by LIC.

IDBI Bank Savings Account offers benefits to people of various financial backgrounds and age groups. The customer can choose whatever suits them the best as per their financial requirements.

Types of IDBI Bank Savings Account

IDBI Super Savings Account

The Super Savings account helps you to transfer funds faster. It provides you with a complete banking convenience to access your money with the ease. With this account, you can not only save your money, but also make it grow by attractive interest rates. The monthly average balance (MAB) that you need you to maintain is- Rs. 5000 (metro and urban), Rs. 2,500 (semi-urban) and Rs. 500(rural).

IDBI Super Savings Plus Account

This IDBI savings account aims to offers you enhanced benefits and advantages for a superior banking experience. You can withdrawal Rs.40,000 per day via ATM/POS and can make 15 NEFT transactions free every month. You will also get a complimentary lounge programme on the RuPay platinum Debit Card with build-in insurance cover.

Super Shakti Women’s Account

As the name goes, IDBI bank has designed a special savings account for women that offers a Zero Balance Savings Account. Also, this account is free for her child below the age of 18 years. It offers a specially designed women’s international ATM-cum-debit card, which allows higher ATM cash withdrawal limit of Rs. 40,000 per day. You need to maintain a monthly average balance (MAB)of Rs. 5000 (metro and urban), Rs. 2,500 (semi-urban) and Rs 500 (rural).

Talk to our investment specialist

IDBI Bank Senior Citizen Account

IDBI Bank offers an account to senior citizens that can facilitate banking transactions with hosts of facilities. Senior citizens from the age group of 60 can open this account. Senior citizen account by IDBI not only allows you to save money, but also make it grow by availing the auto Sweep Out/Sweep In Facility. You can avail higher ATM cash withdrawal limits of Rs. 50,000 per day and also, get 10 free transactions at other Bank ATM.

IDBI Bank Being Me Account

"Being Me" is a unique savings account dedicated for the Youth. It is a specially designed product for today’s youth to establish a bond with the Youth and make them aware about financial discipline. The account gives preferential rate on educational loan, training on financial planning, discounted charges for opening of share Trading Account with ICMS, etc.

IDBI Bank Power Kids Account

It is a piggy bank for the Kids that will not only help in saving money, but also provide an interest on the same. The Power Kids account will allow them to take out money when required, and guide them to operate their account in a better and convenient way. At every interval, the bank will advise kids about better investment options. You just need to maintain a monthly average balance (MAB) of Rs. 500. The withdrawal limit is up to Rs. 2000 at ATM/POS.

IDBI Bank Small Account (Relaxed KYC)

This IDBI savings account is meant for everyone. It is completely elementary in its approach with Zero Balance account for inclusive banking. You will get a free Debit cum ATM card, SMS & email alerts for any transaction and a free consolidated monthly account statement via e-mail.

IDBI Bank Sabka Basic Savings Account (Complete KYC)

Sabka Basic account doesn't require a minimum balance, therefore the bank intends to extend its services to a vast section people for Financial Inclusion. With this account, you will get a free International Debit cum ATM card, SMS & email alerts for any transaction you make form your account and consolidated monthly account statements via e-mail.

Pension Saving Account

This IDBI savings account is specially designed keeping the requirements of users in mind. The account gives you the special privileges, easier and quicker transactions and value-added services with a host of exclusive offers for hassle-free banking. It allows you to transfer funds faster from anywhere, anytime. You can avail five free ATM transactions at other bank’s ATMs in non-metro locations.

Steps to Open an IDBI Bank Savings Account

Offline- In a Bank Branch

Visit the IDBI bank branch near you and request the bank executive for an account opening form. While filing the form ensure all the details filled correctly. The details in the application form should match the KYC documents that you submit for proof. The bank will verify the duly filled form and the supporting documents submitted.

Instant Online Savings

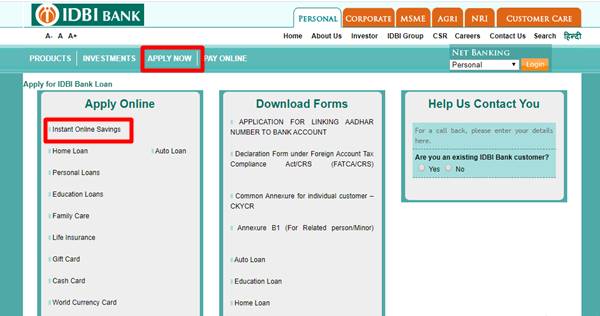

- Log in the official website of IDBI bank

- On the home page, click Apply Online, in the first row, you will find Instant Online Savings, click on it

- The page will take you to two options- (a) Click Here to Help Us Contact You and (b) Click Here to directly fill the form. In the 'a' option, you need to provide your contact details and the bank representative will get in touch with you soon. The 'b' option will take you to an online form that you need to fill and submit.

- Upon approval of the documents, the account will be activated in a short span of time.

The account holder will receive a welcome kit consisting of free passbook, cheque book and a debit card.

Eligibility Criteria to Open a Savings Account in IDBI Bank

Customers should meet the following criteria to open a savings account with the bank-

- The person should be a citizen of India.

- The individual should be 18 years of age or above except in case of a minor savings account.

- Individuals need to submit valid identity and address proof to the bank that is Government approved.

- Once the bank approves the submitted documents, the applicant will have to make an initial deposit depending upon the type of the savings account.

IDBI Bank Savings Account Customer Care

Customers can contact 24x7 phone banking numbers: 1800-209-4324 and 1800-22-1070

Debit Card Blocking Toll Free number:

1800-22-6999Debit Card blocking through SMS: In case you remember your Card number

SMS BLOCK < Customer ID > < Card Number > to 5676777Eg: SMS BLOCK 12345678 4587771234567890 to 5676777

In case you do not remember your Card number

SMS BLOCK < Customer ID > to 5676777

Eg: SMS BLOCK 12345678 to 5676777

Non-Toll Free number: +91-22-67719100

Contact number for outside India customers: +91-22-67719100

Registered Office Address

IDBI Bank Ltd. IDBI Tower, WTC Complex, Cuffe Parade, Colaba, Mumbai 400005.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.