Table of Contents

All You Need To Know About Prepaid Debit Card

Prepaid cards work well for many people as it is a very secure way of using money. It is also known as pay-as-you-go card because you just need load money and spend it as per your needs. Moreover, for many people, it is a new way to budget money. Here’s how Prepaid Debit Card works!

What is a Prepaid Card?

A prepaid card is an alternative Bank card that allows you to spend the exact amount you have loaded on your card. This is similar to having a prepaid SIM card where you can use the SIM for the exact amount you have loaded for making calls, messaging, etc. Like debit cards, prepaid cards can be used on the merchant’s portal for further transactions with a payment network like Visa or MasterCard.

Prepaid Debit Card in India

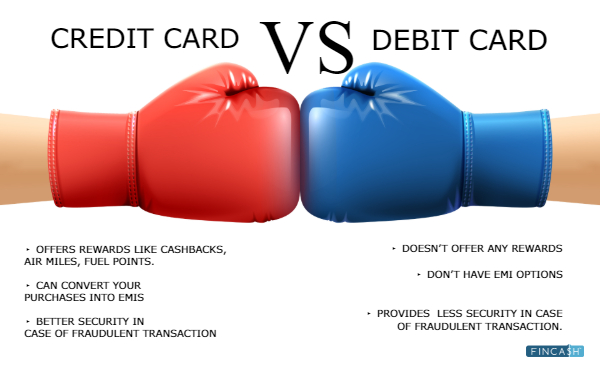

Prepaid cards are very different from debit cards as they are not linked to any bank account, therefore, you will not be able to avail overdraft facilities. But, just like debit and credit cards, prepaid works at any merchant that accepts payment networks such as Visa and MasterCard.

Unlike credit cards, prepaid cards are easy to get because there’s no credit risk. Also, you don’t have to worry about debt, interest rates, etc.

Prepaid cards can be useful for teenagers, fixed Income groups and relatives visiting from other countries. Also, if you are a compulsive spender then prepaid cards can be a good option. As you can’t spend more than what you put!

Virtual Prepaid Card

Virtual prepaid cards give the best online shopping experience by making it safer and more secure. As these cards are specially designed for online purchases, you can’t use them at retail for POS purchases.

Virtual prepaid offers security to businesses and individuals world over. Just like physical cards, virtual too has a 16-digit card number with a CVV number.

Best Prepaid Debit Cards in India

There are many banks that offer prepaid cards, the most popular ones are ICICI Bank, HDFC Bank, Axis Bank, SBI Bank, Bank of Baroda, etc. These banks offer hassle-free services to their customers.

Get Best Debit Cards Online

1. SBI Prepaid Card

SBI Bank is a leading bank that offers you following prepaid debit cards-

- State Bank Gift Card- Gifting convenience

- State Bank EZ Pay Card- Periodic payments made easy

- State Bank Foreign travel card- Convenient & safe foreign travel

- State Bank Achiever Card- Instant gratification

- SBI NMRC City 1 Card- SBI NMRC city 1 card

Pick the one that gives you an enhanced experience during online shopping and at the merchant's portal.

2. ICICI Prepaid Card

ICICI bank offers you many prepaid debit cards as mentioned below. All the cards have a Visa payment gateway and can be used online and at POS terminals.

- Expressions Gift Card

- PayDirect Card

- Pockets, the Digital Bank

- Multi Wallet Card

- Gift Card

- Meal Card

- Reimbursement Card

3. HDFC Prepaid Card

HDFC prepaid cards are basically divided into different categories depending upon the purpose like food, medical, corporate and gift payments. Some of the HDFC Prepaid cards are-

- Millenia Prepaid Cards

- GiftPlus Card

- MoneyPlus Card

- Reward Card

4. Axis Bank Prepaid Card

Axis bank offers you prepaid cards in three different categories-

- Meal Card

- Gift Card

- Smart Pay Card.

The purpose of each category is to offer special features.

5. Yes Bank

Yes Bank offers four prepaid cards for your use to meet your needs and requirements

- Yes Bank Jewellery Gift Card

- Yes Bank Multi-Currency Travel Card

- Yes Gift Card

- Incredible India Card

Prepaid Business Debit Card

If you find that liquid cash is tough to manage or handover than a prepaid business Debit Card can be a better option. With this, a business can set its spending limit and keep a clear track.

In addition, you can also monitor your employees’ spending if they have access to your business finance. For instance, an employee is travelling abroad, handing over a prepaid business card can not only make your tracking easy, but you can also set a limit on how much an employee can spend.

With additional security options available, using a business prepaid card online is easy. It protects your assets and improves corporate practices. You can also swipe your business prepaid debit card at most online sites, stores, and suppliers.

Conclusion

As we know, a prepaid debit card is an easy, simple and hassle-free way of doing transactions. Set monthly budget, load money, and use! This not only sets a budget for you, but also controls your spending.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.