Fincash » Financial Goals » Yoga Principles to Apply in your Financial Life

Table of Contents

Yoga Principles to Apply in your Financial Life

Yoga, the ancient wisdom of our country India, is becoming a part of the daily life routine of numerous people across the globe. Yoga is a way of life because it helps people from all spheres of life achieve a healthy body and mind, along with emotional clarity and stability.

Asana and pranayam help to sharpen the focus, control the mind, build concentration, and lessen the stress that comes with day-to-day life. Due to its immense power, yoga is now widely accepted as part of a healthy lifestyle for the working class. This form of exercise makes you more aware and conscious. Many studies show that mindfulness helps pay more attention to details and stay focused by eliminating the clutter in heads.

But how does yoga help with managing money anyway? On the surface, there doesn't seem to be any link between the two. But if you look deep into it, you can find a lot of connections. When you compare essential parts of yoga and investment planning, you'll realise they're linked. Yoga not only makes you a better person inside and out, but also helps you make fruitful decisions.

Let's find out how you can apply yoga principles to maintain your finances.

Know How to Start Investing the Yoga Way

The following ideas will help you think about your money in a new way, maybe with a little more Zen.

1. Goal Setting

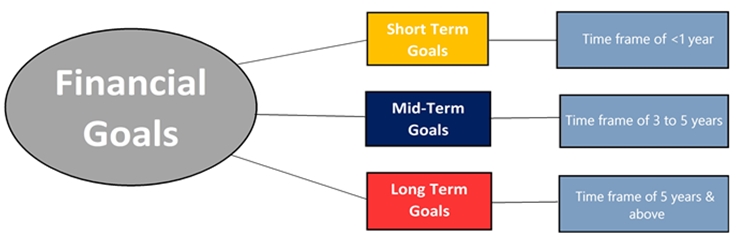

Every yoga practice has a goal, be it to get fit, be more flexible, or maintain calmness. In the same way, most investments are made with a goal in mind, such as retirement, saving for college, buying a house, planning for children, and more.

Investments generate much better results when Financial goals are set because they are constantly checked to ensure that you are meeting your goals or at least are on the way to accomplishing them.

To set a goal, ask yourself -

- Do you want to travel the whole world?

- Do you want to have a home for yourself in the next three years?

- Are you thinking about starting a new business?

- Do you want to buy your dream car?

Likewise, make a list of your goals, set a certain budget, the time frame to accomplish the goal and start planning your investment. You can take the help of a financial planner to make a good Portfolio which will help you stay financially healthy in the long run.

You can use the Goal Calculator below to start planning your investment amount, tenure, etc.

Know Your Monthly SIP Amount

2. Right Balance is the Key

Indeed, maintaining balance is critical in both yoga and finance. You know that you are becoming an expert if you can master the headstand and all other yoga asanas, which will preserve your body's ideal equilibrium.

Similarly, you must maintain a balanced portfolio with the right asset diversification. A portfolio with just equities can have a high-risk ratio, therefore, you need to diversify the risk and reward ratio by Investing in other assets like Debt fund, Gold, ETF, etc. So when one fund is performing low, other funds balance the risk and generate regular returns.

Finding balance is the key to reaching your financial investment goals, just as yoga teaches you to be mindful in all aspects of life. Hence, keep in mind that being mindful is one of the essential principles of successful investing.

Talk to our investment specialist

3. Don't Panic

One of the crucial factors in yoga is not to push the body beyond its limits. In the same way, it's hard to watch a losing investment, but if the long-term outlook is good, you should stick with it. If it doesn't, don't be afraid to cut your losses.

Although it's easy to fall into these traps, everyone knows that investing quickly at the Market's peak and selling in a panic at the bottom is a bad Financial plan. If the value of your investment is falling, resist the urge to sell in a panic. Do your research to find out why the price dropped. Are there short- or long-term factors involved? Think about the pros and cons, and keep an open mind.

The practise of yoga tends to make your body and mind more flexible, which enhances adaptability. Similarly, flexibility is needed once you have invested in the right asset or combination.

4. Don't Forget to Breathe

Yoga is among the most popular and effective ways to learn to be patient. The time it takes to master a pose or hold your breath teaches you to be patient without thinking about it. In the same way, practising patience in finance means not being fretful about returns after you've put your money to work and chosen the right mix of assets. Your money needs time to grow and build wealth.

What goes up has to come down, and the market cycle includes fluctuations and crashes. It's important to stay calm and take deep breaths when things look bad. The breath is at the beginning and end of yoga.

The idea is that if the breath gets shaky, the mind will too, and if the breath stays steady, the mind will become clear. Before learning asanas, you have to learn how to control your breath.The same goes in your investment journey as well. You must remain calm before taking any decision. In case you find yourself in an uncomfortable situation, keep in mind that no Bear Market, Recession, depression or global financial crisis will last forever. With some effort and utmost patience, you will easily come out of it.

5. Practice Self Discipline

You can't get the benefits of yoga without self-discipline, which is called Tapas. Mind, body, and soul must work together to perform the asanas well. A yogi doesn't think that their body or spirit will change overnight. So why would you think you'd get it right on your first investment try?

People who invest regularly can become financially independent much faster and plan for the future more easily. If you invest without a plan, you won't be able to reach your goals. So, you can start with smaller amounts and choose an area that interests you in learning how to invest. Some of the things you can do to stay updated include:

- Keep an eye on the news

- Read financial reports

- Be aware of worldwide politics

- Sign up for relevant newsletters

- Learn from other investors as much as possible

If you stay interested, you'll get better at investing over time and be able to make better, more informed decisions.

6. Strong Basics

Everyone has to go through hard times to learn, and people who learn from the mistakes of others are wise. If you have a strong foundation, you are less likely to get hurt or fall into a trap.

Knowing when to enter or leave an investment is the same as knowing when to get into and out of a yoga pose or when to hold the pose. In the long run, it will help you if you research everything about the asset you want to buy and don't just follow the herd mentality. In the same way, doing yoga poses with proper knowledge of the pros and cons of each pose will keep you from getting hurt and help your body grow more assertive at the same time.

7. Go with the Flow

While practising the asanas, there is always a chance of pain or strain if you overstretch the muscles. So, in order to avoid that, do your asanas with ease and be relaxed. In the same way, if you don't make calculated decisions or take risks before evaluating everything, you may Land in trouble. The more you get involved in yoga, the better you’ll know about stretching flexibility. The same applies to finance as well. If you are a new bee, ensure you start your investment journey with a little amount at your own pace without going beyond your capacity.

Once you spend a few years studying the market and build certain experience in investment, you can invest in risky funds and maintain a diverse portfolio.

8. Big 'No' to Greed

The fifth Yama of Patanjali's Yoga Sutra speaks about Aparigraha, which means not wanting to own things or being greedy, or destroying nature to get what you want.

If the investments are paying off well, people tend to get greedy and want more returns. This might lead to putting all the eggs in one basket, which isn't good for your portfolio's long-term growth. So, regarding investments, you should apply the principles of Aparigraha and control yourself before you develop the tendency of greediness. Make plans based on your financial goals and divide your assets.

Conclusion

Just like yoga helps to stay fit in the long run, investing rightfully leads to long-term wealth creation. In either case, one thing that is always a necessity is experimenting and sticking to what fits better to the specified needs. Furthermore, it is also essential to practice regularly and not give up in between, as only continuity is what leads to more effective outcomes.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.