Table of Contents

Major Benefits of Jan Dhan Yojana Scheme (PMJDY)

Pradhan Mantri Jan Dhan Yojana (PMJDY) was launched by Prime Minister Narendra Modi on 28th August 2014. This program was initiated to expand and make financial services affordable to Indian citizens.

About Pradhan Mantri Jan Dhan Yojana (PMJDY)

The programme is run under the Department of Financial Services, Ministry of Finance. Over 318 million Bank accounts were opened by 27th June 2018 and by 3rd July 2019, the overall balance under the scheme had crossed Rs. 1 lakh crore.

According to a report, the government focused on ‘Unbanked adults’. This means the government tried encouraging every citizen, even those without a bank account to opt for one. It was also found that over 50% of the total users of this scheme were women.

The main objective of this programme is to make financial services like basic savings bank accounts, remittance, credit, insurance and pensions available to every individual of India.

Who can Open PMJDY Account?

Since Pradhan Mantri Jan Dhan Yojana is aimed at reaching everyone, the age limit for any individual who wishes to enrol under the scheme is a minimum of 18 years and a maximum of 65 years. It covers people of all working-age groups.

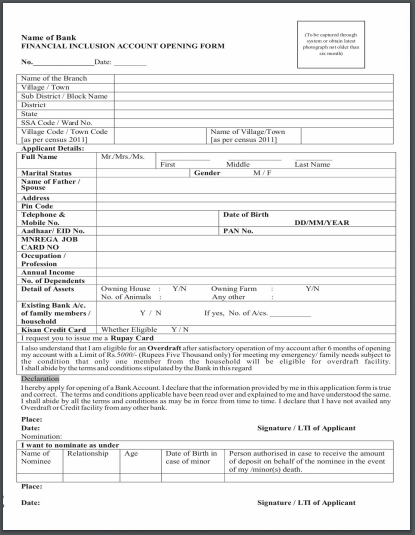

The account opening form is available in both Hindi and English and is available on the official website of PMJDY.

Talk to our investment specialist

Documents Required for PMJDY

If you wish to create an account under the Pradhan Mantri Jan Dhan Yojana, you require the following documents:

- Passport

- Driving License

- PAN Card

- Aadhar Card

- Voter’s Identity Card

- You will require a job card issued by the National Rural Employment Guarantee Act (NREGA). Make sure the state government officer signs your card

- Any documents needed by the central government after consultation with the regulator must be submitted

- Any Identity Card issued by any government or public holdings should be submitted. However, the photo present on the ID card should be that of the applicant

5 Best Benefits of Jan Dhan Yojana Scheme

Various benefits have been listed under this programme-

1. Interest on deposits

This scheme provides interest on deposits that are made towards the Savings Account opened under PMJDY.

2. Zero balance account

You don’t need any money to open an account under this scheme. You can always begin the account with Zero balance and then maintain a minimum account balance. However, if the user wishes to make a transaction via cheques, a minimum account balance is required.

3. Provision of overdraft facility

A provision of an overdraft Facility is made if the user maintains a good minimum account balance for 6 months consistently. One account from a household will get the benefit of an overdraft facility of Rs. 5000. This facility is usually provided to a woman in the house.

4. Accidental insurance cover of Rs. 1 lakh

The scheme provides an accidental insurance cover of Rs. 1 Lakh under the RuPay scheme. A case of an accident will be considered PMJDY eligible if the transaction is made within 90 days.

5. Mobile banking facility

Account holders can access their account anywhere via mobile banking facilities. They can carry out transaction, check balance and transferring funds with ease.

Where can you Open PMJDY Account?

The scheme is made available across various public and private sector banks in the country. You can also register online for the programme through the websites of the approved banks mentioned below.

Here’s a list of public and private sector banks where you can access the Pradhan Mantri Jan Dhan programme.

Public Sector Banks

- State Bank of India (SBI)

- Union Bank of India

- Allahabad Bank

- Dena Bank

- Syndicate Bank

- Punjab and Sind Bank

- Vijaya Bank

- Central Bank of India

- Punjab National Bank (PNB)

- Indian Bank

- IDBI Bank

- Corporation Bank

- Canara Bank

- Bank of India (BoI)

- Bank of Maharashtra

- Andhra Bank

- Bank of Baroda (BoB)

- Oriental Bank of Commerce (OBC)

Private Sector Banks

- Dhanalaxmi Bank Ltd

- YES Bank Ltd

- Kotak Mahindra Bank Ltd

- Karnataka Bank Ltd

- Induslnd Bank Ltd

- Federal Bank Ltd

- HDFC Bank Ltd

- Axis Bank Ltd

- ICICI Bank Ltd

Frequently Asked Questions (FAQs)

Here are answers to some the most frequently asked questions regarding Pradhan Mantri Jan Dhan Yojana.

1. Can I open an account under Pradhan Mantri Jan Dhan programme online?

A: Yes, you can. Visit the approved banks’ official websites and follow the process to create your account. You can also create an account under the programme through PMJDY’s official website.

2. Can I open a joint account under PMJDY?

A: Yes, you can open a joint account under the programme.

3. How much Life Insurance Cover is offered under PMJDY?

A: A life insurance cover of Rs. 30,000 is offered under the programme.

4. Is there any processing fee against a loan I’ve taken under the PMJDY?

A: No, there is no processing fee in this matter.

5. Will I be able to open a bank account under PMJDY if I don’t possess a valid residential proof?

A: Yes, you can open an account in this matter. However, you have to provide your identity proof.

6. How much money should I have to open an account under the PMJDY?

A: You can open the account with a zero account balance.

7. I don’t have one or more of the required documents at the time of opening the account. What do I do?

A: You can still open your account without the required documents. However, after 12 months you will have to provide the required documents.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.