Table of Contents

6 Major Benefits of Credit Cards you Must Know!

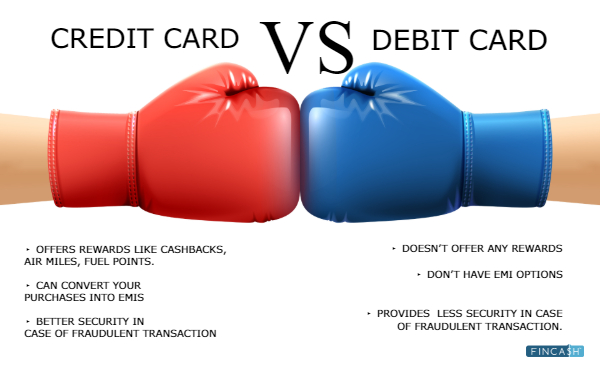

Plastic cards are increasing rapidly day by day. Today, a lot of people are choosing credit cards over debit cards for the fair amount of benefits they offer.

This article aims to list the top benefits of credit cards and the various features involved.

Benefits of Credit Cards

Here are six top benefits of credit cards to look at-

1. Convenient mode of payment

Carrying loads of cash while traveling can be troublesome. Now that cards are accepted everywhere, it has become a simple and secure alternative to use money. Credit cards can even be linked to e-wallets on your mobile phones so that you don't need to carry one in your pocket.

2. Purchasing power

With a credit card, you can purchase more than what you usually can. It has a certain Credit Limit up to which you can spend the money. This gives you the ability to make big purchases like electronics, two-wheeler, health insurance, holiday booking, etc and not worry about falling short on cash.

3. Credit score

A credit card helps you build a good Credit Score. Credit Bureaus like CIBIL Score, CRIF High Mark, Experian and Equifax provides scores depending on how well you have dealt with the repayments. When you use a card for a transaction, you owe the amount to the company. This helps your score to grow.

A Good Credit score means you will be able to get easy loans and credit cards approvals in the future. You won’t have this benefit if you use a Debit Card, cash or cheques.

4. Reward points

Credit card companies offer various reward points on the transactions through respective card. These reward points can be used to get gifts, vouchers, flight bookings, etc. Different banks have different reward plans to offer, eg- HDFC reward points have for food & dining, SBI reward points have travel & holiday, ICICI reward points have for hi-tech gadgets, etc.

5. Interest-free credit

Credit cards offer interest-free periods on your purchases. This means if you pay off the amount before the due date, then you don’t have to pay any interest on your spends. In case, if you Fail to repay the amount before the due date, then an interest rate of 10-15% is charged.

6. Tracking purchases

Every transaction you make using a credit card, gets recorded on your monthly credit card statement. This can be used to keep track of your expenses and create a budget for yourself to spend.

Get Best Cards Online

Features of a Credit Card

Following are some of the key features of credit cards:

Supplementary cards

A supplementary credit card or an Add-on card is issued under a primary credit card. This add-on card can be applied to your family members like parents, spouse, and children above 18+. Ideally, most creditors provide the same credit limit as assigned to the primary credit card. And, some may even not charge for add-on credit cards.

Equated Monthly Installments (EMIS)

The purchases you make using a credit card can be converted into EMIs which can then be paid on a monthly Basis. This helps you make big purchases like buying furniture, gadgets, home appliances, etc.

Widely accepted

This is one of the most important benefits of credit cards. VISA credit cards and Master credit cards are accepted worldwide. So, you don’t have to worry about money when traveling abroad.

Utility bill payments

You can make all your utility bill payments through credit card. An automated system can be followed where you just need to give instructions to the credit provider. This way you need not worry about paying your bills on time.

Accepted online

Credit cards can be used for net banking and mobile applications as a mode of payment for online purchases.

What Happens when you Upgrade Credit Card?

Following are some of the additional benefits you can get once you upgrade your credit card:

Increase your credit limit

After upgrading, you can increase your credit limit. This can help you increase your credit score along with other benefits.

Fast approval of the loan

A good Credit Report showing timely payments will help you get quick loan approval.

Conclusion

Looking at various benefits of credit cards may seem tempting right? However, these are meant only if you have good discipline towards managing money. Ideally, you should not spend more than what you earn!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.