Fincash » Professional Tax » Professional Tax Registration Certificate

Table of Contents

- Understanding Professional Tax

- What is PTRC Registration?

- Who is Liable for Paying the Professional Tax?

- PTRC Registration Documents

- Tax Returns and Professional Tax Registration

- PTRC Application e-filing

- How do I Pay my PTRC Online?

- The Penalty Clause

- Steps to PTRC Certificate Download

- Conclusion

- Frequently Asked Questions (FAQs)

A Detailed Guide to Professional Tax Registration Certificate (PTRC)

According to the notification, professional taxpayers will have to jointly pay the professional tax Registration Certificate (PTRC) on each state's authority's official website of the Goods and Services Tax Department. If you look at your pay stubs, you will see a minor Deduction along with the House Rent Allowance (HRA), transportation, and basic salary breakdowns.

The professional tax is the name given to this deduction. Each state imposes this tax in a manner that is often unique; therefore, there are certain states where no deduction is allowed. You will find more details about PTRC, professional tax, and other related aspects in this article.

Understanding Professional Tax

Most Indian state governments levy a monthly professional tax on your Income from a wage, trade, profession, or calling. State governments can establish income tax slabs and the associated professional tax amounts under Clause (2) of Article 276 of the Constitution of India, 1949.

What is PTRC Registration?

The company serving as the employer must have a Professional Tax Registration Certificate (PTRC). The employer must withhold professional tax from the employee's remuneration when the employee's compensation exceeds Rs. 7500 per month. Organisations with directors must obtain a professional tax number. In the case of a full-time director or a managing director, the director is considered an employee of the corporation, and the company must deduct at least Rs. 200 per month from each director's income and pay that tax at the proper intervals. The directors are not required to obtain a separate Professional Tax Enrollment number.

Who is Liable for Paying the Professional Tax?

For the government, professional tax payments are a source of income. If you are salaried, you can pay your professional tax online according to the announced pre-determined professional tax slab schedule. Traders, attorneys, architects, physicians, company secretaries, chartered accountants, and other professionals must pay a professional tax to the state's Commercial Tax Department. Employees of private companies must also make a professional tax payment or e-payment. Typically, this deduction is calculated based on the monthly professional tax slab set by the government. The employer employs a professional tax online payment method to send the collected professional tax payment amounts to the state exchequer.

Talk to our investment specialist

PTRC Registration Documents

Here is a list of professional tax registration documents in Maharashtra and other states of the country:

- Address proof of establishment

- Address proof of directors, proprietor or partners

- PAN of directors, proprietors or partners

- Pictures of directors, proprietors or partners

- Salary details of all employees

- Financial statement of the establishment

- Certificate of Incorporation

Tax Returns and Professional Tax Registration

Professional tax registration is required:

- Within 30 days of beginning the practice in the case of professionals

- Within 30 days of hiring workers in a business

The amount of the salary or wages paid must be subtracted from the professional tax. Within 30 days of hiring workers for the business, the assessee must apply for the Registration Certificate to their home state's tax office. If the assessee works at more than one place, a separate application should be made to each body concerning each location under the purview.

The payment must be made within 15 days of the next month if the employer has more than 20 employees. However, if an employer has fewer than 20 workers, they must make quarterly payments.

PTRC Application e-filing

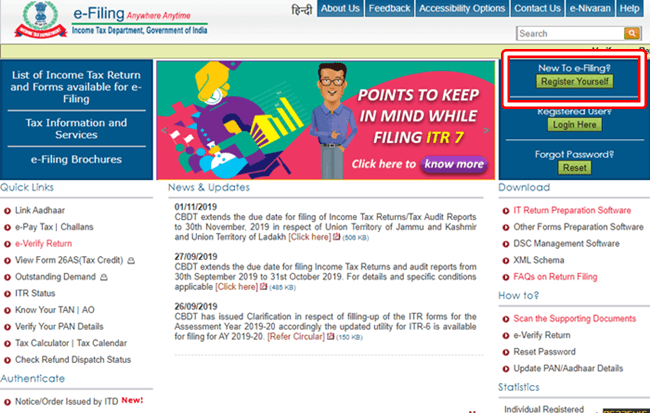

A PTRC application must be submitted within 30 days of the date the state professional tax is due. You must timely submit an online application, or else fines will be applied by an authorised agency. Depending on where you work or run your business, you can pay your professional Taxes online by visiting the state's website for sales taxes or professional taxes. The state government has made new electronic payment technologies available to pay professional tax. The new procedure allows the professional taxpayer to make a single online payment for the PTRC and PTEC by using the official website of the States Goods and Services Tax Department.

In reality, if you pay your professional tax every month, e-filing becomes a need. You must file returns and make payments every month if your annual tax burden exceeds Rs. 50,000. Your professional tax must be paid by the last day of the next month. You can only file your taxes once in March, at the end of the Fiscal Year, if your total Obligation is less than Rs. 50,000.

How do I Pay my PTRC Online?

The few steps listed below will help you pay your professional tax online:

- After accessing the state website, select the e-payment option

- To access the portal, enter your Tax Information Network (TIN) Number

- A form will show after you successfully log in. By Default, it will contain all your data and your TIN

- The kind of electronic payment, the month of the payment, the sum, and the address under which you are registered are asked next. Once the information has been submitted, it cannot be changed, so be careful to input it precisely

- If the system does not support periodicity (the Facility to select a custom period), select a monthly or annual payment schedule based on your previous year's Tax Liability

- Use Form ID for paying professional taxes on behalf of your staff members. If you don't believe this relates to you, you can select 'Other', and then from the drop-down option, pick the appropriate option

- Once you finished filling out the form, click the 'submit' button. The Government Request Number (GRN) will be created instantly. To complete the purchase and pay your professional taxes, click 'Pay'

- The Receipt that will show up following a successful transaction should be saved

The Penalty Clause

It's crucial to pay your professional taxes online on time. Penalties for non-compliance are 10% of the online tax payment that is owed. The typical penalty for getting the registration number late is Rs. 5 per day from the missed date. If you submit professional tax returns after the due date, you will be charged a penalty of Rs. 1,000 or Rs. 2,000, depending on how much time has passed since the due date.

Steps to PTRC Certificate Download

After a successful transaction, the system will lead you to the Goods and Services Tax Department web page. For PTRC, separate "Cyber Receipts" will be produced. You can save the electronic receipt for use in upcoming correspondence. And then, you can download the receipt later if it is not immediately generated or if they cannot do so. Here's how to do it:

- Go to the state website to download for the e-payment. After logging in, choose the e-services, VAT, and Allied Acts payments options

- Click 'Act' after choosing the Pending Transaction History option

- By choosing the 'Submit' option, all payments made for this previously will be shown

- The 'Get Condition' button will show in front of the Status column if the challan is in the pending or blank status

- You can get their current status by choosing 'Get Status'. After that, this button will be replaced with the 'View Challan' button, which will enable you to create a digital receipt

- To prove that you have paid your professional tax, save the paper that displays after a successful transaction

Conclusion

Any state in India can charge a professional tax up to a maximum of Rs. 2500. According to the Income Tax Act, the entire professional tax paid during the year is Deductible. This tax provides the state governments with income that aids in the implementation of plans for the welfare and development of the area. Employers with salaried staff withhold professional tax from their pay, which is deposited with the state government. Others should pay it to the government directly or through the regional organisations designated to Handle it.

Frequently Asked Questions (FAQs)

1. Is paying professional tax obligatory for a person receiving a salary?

A: Yes. It is required for the employed or earning sector of the society to pay professional tax.

2. Who requires a Certificate of Registration (RC)?

A: A certificate of registration is required for all employers who pay professional tax to the state government on behalf of the employees.

3. What different professions of taxpayers are there?

A: Based on the following factors, there are two sorts of professional taxpayers:

Employers with more than one employee are required to obtain the PTRC. Such an employee must receive a wage from the employer that exceeds the established threshold for PT to be assessed

Any person who is engaged in a profession, calling, or trade who is included under one of the classes indicated in Schedule I (second column) must get a PTEC or Profession Tax Enrolment Certificate

4. Is PT enrolment and Registration for enterprises required?

A: Yes. All businesses must receive an enrolment certificate and a registration certificate within 30 days of opening, except for those who are exempt.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.