Table of Contents

Should Mutual Fund Investors Worry About 2019 Elections?

Many Mutual Fund investors are worried about the impact of the general election in 2019. Investors concern about the increase in the Market Volatility is putting them into a dilemma whether they should make changes in their investment strategy for the coming elections.

The general elections are scheduled to be held around April-May 2019 for the Lok Sabha.

People who invest in markets most often tend to get nervous and skeptical as the country moves towards the election date. Apart from the elections, there are chances of several micro and macro economic factors to influence the market movement.

BSE Sensex of Past General Elections

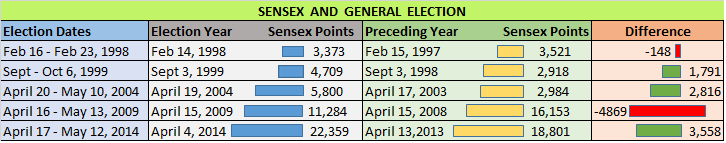

To see the market trends of previous elections, let’s have a look at the BSE Sensex data for the past five general elections held in 1998, 1999, 2004, 2009 and 2014.

The market lost the most in a year before the General Election of 2009 falling 4,869 points due to the effect of the global financial crisis on the Economy.

The index generated negative returns 1998 and 2008 with only two out of these five occasions. During 2008, it was due to global financial crises, while in 1998, markets were negatively impacted due to an unstable political scenario.

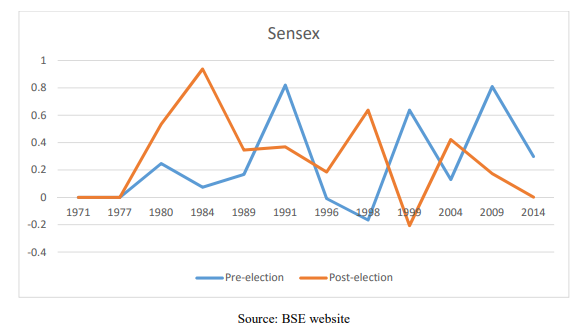

If we look at the historical data, it shows that the stock markets go up after the election results are declared. After the elections, the markets have usually been seen moving up mainly because of two main reasons- the uncertainty over who will win is over, and other is that people expect stability for next five years.

What to do?

Ideally, it can be said that elections might hit the market temporarily or curb the growth in the short term, but in the long-term, investors need not worry.

Investors must follow a disciplined approach to their investments and stick to their Asset Allocation. They should avoid changing assets pre-elections. Many investors think of changing their allocations from equities to debt, but rather investors should stick to their allocations. Investors should not be worried about the market.

Talk to our investment specialist

Also, when the market is highly volatile, investors should not invest via a lump sum mode.

Bear markets are intense, erratic, disruptive, and unsettling, but generally they are very short-lived in comparison to bull markets. But, such bear markets provide the foundation for the next bull market.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.