Table of Contents

Asset Allocation : Strategic, Tactical and Models

We've heard of the term "asset allocation" very often, what is asset allocation? Why is it important? What are the benefits?What is strategic asset allocation? What is Tactical Asset Allocation? How are asset allocation models developed? We seek to answer some of these questions here. Volatility or risk in an investor’s Portfolio is known to give sleepless nights both to investors as well as financial advisors, hence portfolio construction(or rather asset allocation) is at the heart of financial planning.

Asset Allocation: Why?

Asset allocation or portfolio construction has always been important. Consider the following case where somebody invests money in a factory for ice -cream. The business yields good returns in the summer season (assuming people want something cold in lieu of the heat!), however, the yield drops considerably in the rainy season when it’s rainy, windy and cold. The business has what we can classify as “season risk”. However, suppose the investor was also invested in a business that manufactures umbrella’s, in summer the sales of umbrellas would be only marginal if any...however during the rainy season the demand for umbrellas would go up substantially. So let’s consider the following scenarios by business:

| Business Type | Return in Summer | Return in Rainy Season |

|---|---|---|

| Ice-cream | Yes | No |

| Umbrella's | No | Yes |

| 50% in ice-cream & 50% in umbrella | Yes | Yes |

Hence by Investing in business’s that performed well in different season’s (hence uncorrelated!) the investor can actually get a return which is not subject to the vagaries of weather (season’s). The return here is steadier than investing in a single business. So what’s the key out here…..investing in an uncorrelated asset makes the return less volatile and steady.

Asset Allocation: Which Assets and How to Mix?

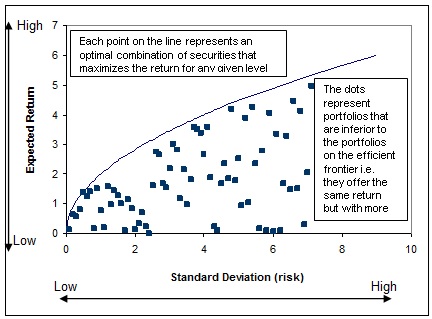

Applying the above concept learnt here, if we apply this to an investment portfolio(of stocks, Mutual Funds etc), we need to create a mix of uncorrelated assets to get the desired return which is steady. However what happens is that when using a mix of assets each portfolio has a given level of risk, i.e. the deviation of return that can be expected, since historically though asset classes may have an overall return that is positive, there would have been periods of negative returns also or more specifically there would be a Standard Deviation of returns expected from the Average Return that the Asset Class would have delivered historically. Hence we endeavour to create a portfolio of different levels of risk (or standard deviation), but given historical data, there would be only one portfolio (with different weights in different assets) giving the highest return for the given level of risk…this is called “the efficient frontier”. Please refer to the chart below for a graphical representation. As explained above, the efficient frontier is the line which has a mix of assets for the given level of risk giving the highest return; other portfolios will give lesser returns.

Strategic Asset Allocation & Tactical Asset Allocation: How to Decide?

Asset allocation is the strategy used in choosing between the various kinds of possible investments, in other words, the strategy used in choosing in what asset classes such as stocks and Bonds etc one wants to invest. A large part of financial planning consists of finding an asset allocation that is appropriate for a given person in terms of their appetite for and ability to shoulder the risk.

When we are advising an investor on asset allocation, the idea is to get the investor into a number of assets which are not correlated. As per the risk appetite of the investor, we can choose different portfolios with different risk levels. For e.g. consider the following using 4 broad asset classes such as cash, bonds, equities, and alternatives:

| Conservative | Moderate | Aggressive | |

|---|---|---|---|

| Returns Range p.a. (90% Conf) | -2 to 17 | -8 to 28 | -13 to 38 |

| Average Return/Std. Dev. p.a. | 7/6 | 9/11 | 11/6 |

| Cash | 40 | 15 | 0 |

| Bonds | 40 | 45 | 40 |

| Equities | 10 | 30 | 50 |

| Alternative | 10 | 10 | 10 |

*All figures are in percentages

From portfolios which are classified as conservative to aggressive, the risk (or standard deviation) of the portfolios increases, we get the optimal portfolios for a specific risk. One clear observation is that as risk increases the allocation of risky assets (equity etc) increases, essentially saying that to get a higher return there is a higher standard deviation that the portfolio may be subject to.

One must also understand the importance of having an asset mix (or asset allocation) rather than just holding one asset class; this reduces the overall volatility of the portfolio and ensures that the returns are steady. Strategic asset allocation is very important when the investor looks at creating a portfolio with a long-term horizon, these are portfolios which are of a five to ten-year time horizon. Also, when investors want to overlay the current Market views and tweak the strategic portfolios with a slight variation then the resultant portfolios are called the "Tactical Asset Allocation Portfolios" for e.g. if the view is that equity markets are going to perform very well in the future, then the allocation to equities may go up slightly( say by 5%), also the addition in one asset class is Offset by the lowering of allocation in another asset class when the view in the that may be negative.

Talk to our investment specialist

Asset Allocation by Life Cycle and Age

An important aspect is to determine the risk profile or risk appetite of the investor. With most investors their risk taking ability changes with age since with age our financial standing changes. Hence, the asset allocation of an individual also changes with age. It is advisable to sit with your financial advisor and ensure that the asset allocation is reviewed in blocks of at least three or five years.

Asset Allocation Models: The Importance

It is important to realise the importance of having different asset classes in a portfolio, it is necessary to have sufficiently uncorrelated assets in a portfolio so that when an asset class doesn’t earn, the others to give the investor a positive return on the portfolio. However, many have a question in mind…why not just hold one asset class that is performing well, ensure you enter the market at the right level (market timing!) and also try and get that multi-bagger (superior security selection!).

Investors normally spend a considerable amount of time in market timing and security selection. It's surprising to know the actual effect of such actions to returns is, in fact, a mere 9-10 percent. In fact, a study by Nobel prize winner Gary Brinson (along with Hood and Beebower) in 1986 of 91 large US pension funds indicated investment policy* dominates investment strategy (market timing and security selection), such that investment policy contributes to an average 93.6 percent of the variation in the total plan return. (A similar exercise conducted by Brinson in 1991, yielded a result of around 92 percent). It was then concluded that the contribution of investment policy (asset allocation) is the overwhelmingly dominant contributor to Total Return and overwhelms the contribution to return of factors such as market timing and security selection

| Factors | Return Variation |

|---|---|

| Investment policy* | 93.6% |

| Policy and timing | 95.3% |

| Policy and security selection | 97.8% |

Brinson Study (1986) *Investment policy means the specification of the plan sponsor's objectives, constraints, and requirements, including identification of the normal asset allocation mix.

The essence of the above study (though there have been various disputes) is that asset allocation explains more than 90% of the returns! Asset allocation is, in fact, king! Though one might get into market timing and superior security selection, the right asset allocation is the most important aspect of a portfolio.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.