Table of Contents

What is Intrinsic Value of Share?

The intrinsic value of a share; or any security; is the current value of expected future cash flows, discounted at the accurate discount rate. Dissimilar to relative valuation forms that get insight into comparable companies, the intrinsic valuation assesses only the inherent value of a specific business on its own.

Most of the times, newbie investors get tangled between jargon words and don’t get to make anything out of it. Same goes for the intrinsic value of a share. To help you out, this post defines this concept and decreases the confusion.

What is Intrinsic Value?

To put the intrinsic value meaning in simple words, it is the measurement of asset’s worth. This measure can be accomplished by means of calculating an objective or via a complex financial model rather than with the help of the present trading price of that asset in the Market.

In terms of financial analysis, intrinsic value is generally used in combination with the task of identifying the Underlying value of a certain company and the cash flow. However, as far as the intrinsic value of options and their pricing is concerned, it signifies the difference between the current price of the asset and the strike price of the option.

Calculating the Intrinsic Value of Shares

Coming to shares and stocks, determining the intrinsic value of share can be a bit complex, considering the availability of multiple methods to use the same. Jotted down below are a few methods that investors can use to figure out the value:

Analysis on the Basis of Financial Metric

Several investors make use of varied metrics, such as price-to-Earnings (P/E) ratio to comprehend the intrinsic value. For instance, suppose if an average stock has been traded 15 times. If there is a stock that is traded for 12 times earnings, it will be considered undervalued. Generally, this one is the least scientific method and is used with additional factors.

Discounted Cash Flow Analysis

This method uses the time value of money with the estimation of the cash flow of a company. The sum of the current value of future cash flows turns out to be the intrinsic value. However, there is an array of variables that are used in this analysis.

Asset-based Valuation

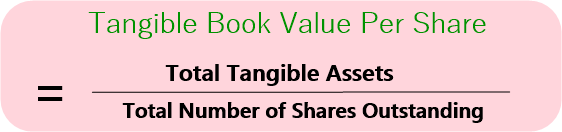

Another significant method of comprehending the value comprises a simple way of adding all of the assets of the company, both intangible and tangible, and subtracting them from the liabilities of the company.

Talk to our investment specialist

Advantages of Intrinsic Value

The primary intention of Value investing is to discover such stocks that are trading for lesser than the intrinsic value. Although there is no specific intrinsic value method of figuring out this value; however, the basic idea is to purchase stocks by spending less than their real worth. And, nothing but assessing intrinsic value can help you with that.

Challenges with Intrinsic Value

Though you have ways, but it is not all that easy. One of the major challenges that you may face while calculating this value is that this exercise is quite subjective. You would have to make several assumptions, and the final net present value could be sensitive to changes occurring in those assumptions.

Moreover, each of these assumptions can be calculated in varying ways; however, the assumption regarding a probability or confidence Factor is completely subjective. Fundamentally, when it is about predicting the future, undeniably, it is uncertain.

Keeping this in mind, all of the successful investors look at the same, old information of a company and come at different intrinsic value and figures.

Conclusion

Deriving the intrinsic value of a share is extremely important as it helps you assess whether you are going to be in profit or not. If you are a newbie in the market, taking help of a professional can help substantially. Irrespective of the decision you take, ensure that it is well-thought and cautious.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.