Table of Contents

What is Enterprise Value-to-Sales (EV/Sales)?

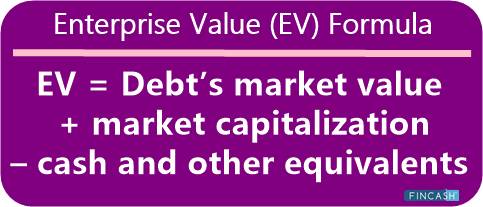

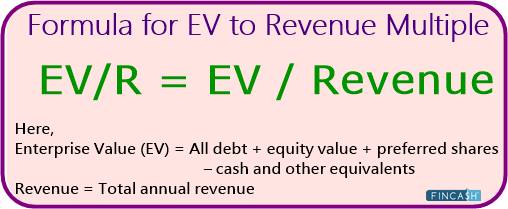

The EV/Sales ratio compares a company's overall value (measured in Enterprise Value) to its total sales revenue. It can also be expressed as the EV per dollar of sales. It indicates that as the ratio rises, the company becomes more "expensive" or valuable, and vice versa. When researching a significant investment, it is used for financial analysis and valuation procedures.

Investors can obtain a better picture of the cost per unit sold, which is essential when considering whether to invest in a firm or not. Investors can better comprehend whether the company is over or under-valued by determining the stated value.

Enterprise Value-to-Sales Ratio Analysis

A more excellent EV/Sales ratio indicates that the company is more expensive. There is a significant amount of enterprise value for every dollar of revenue. A high ratio is often unappealing to investors because they will not see a quick return on their investment.

When the EV/Sales ratio is high, it usually suggests the company is overvalued. On the other hand, some investors are unconcerned by the high ratio if they feel future sales will climb dramatically and offer them higher profits.

A corporation is considered undervalued if its EV/Sales ratio is less than one. There is a lower amount of enterprise value for every dollar of revenue. It is generally regarded as a positive investment opportunity by investors since it indicates that the firm is undervalued and can give an immediate advantage to investors.

With both high and low EV/Sales in mind, it's critical to compare the ratio to its competitors and Industry. A low EV/Sales ratio compared to the broader Market may be relatively high in its particular business, making it an unattractive investment.

There are also many other qualitative and quantitative elements to consider within the company before making a purchasing decision just on this one ratio.

If the cash or any other cash equivalent portion of the company is more than market capitalization, debt, preferred shares, and minority interest, the EV/Sales ratio might be negative. It means the company has enough cash on hand to pay off all of its debts and effectively purchase itself. It's an unusual occurrence that doesn't happen very often, and when it does, it usually doesn't persist long because it's inefficient.

Talk to our investment specialist

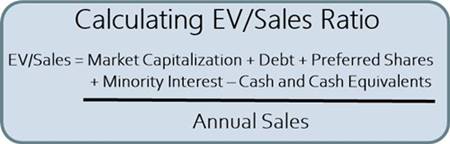

Calculating EV/Sales Ratio

The simplest straightforward method for calculating enterprise value-to-sales is as follows:

EV/Sales = (MC + MI + PS + D – CC) / Annual Sales

Here,

- MC – Market Capitalization

- D – Debt

- PS – Preferred Shares

- MI – Minority Interest

- CC – Cash and Cash Equivalents

Price-to-Sales vs Enterprise Value-to-Sales

The EV-to-sales ratio takes into consideration a company's debt and cash. However, the price-to-sales ratio does not. With merely a company's market valuation as the numerator, the price-to-sales ratio is easier to compute. In contrast, Debt holders have a claim on sales and should, in theory, be included in the valuation.

Limitations of Enterprise Value-to-Sales Analysis

Calculating the enterprise value, which needs a little more delving into financial data, is required for the EV/sales ratio. EV is commonly used to value acquisitions in which the buyer will absorb the company's debt while also receiving cash. Another drawback is that sales do not account for a business's expenses or Taxes.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.