Table of Contents

Cash Equivalents

What are Cash Equivalents?

As per the cash equivalent definition, these are highly liquid assets and can be considered as cash under practical reasons. Cash equivalents also go by the name as “Cash and Equivalents.” These are regarded as one of the three main components or asset classes when it comes to financial Investing –in addition to Bonds and stocks.

The given securities tend to have a low-return, low-risk profile and might include acceptances of the bankers, Bank certificates related to deposits, treasury bills, corporate Commercial Paper, and other instruments of money Market.

Understanding Cash Equivalents

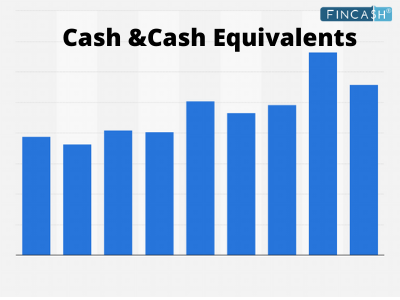

Cash equivalents are also known to serve as one of the most vital health indicators of the Financial System of the company. Analysts can also predict whether or not it is a good decision to make an investment in the specific company through the capability of generating cash & cash equivalents. This is because it helps in reflecting how the company is capable of paying the respective bills across a short period of time. Companies having large amounts of cash & cash equivalents tend to be the core targets of large-scale companies who might be planning to acquire small-scale companies.

Talk to our investment specialist

Treasury Bills

These are also known as “T-Bills.” These can be defined as securities –usually issued by the Department of Treasury by the government. When these are issues to the organizations, the companies are known to typically lend a form of government money. The companies are not paying any interest, but the amount is made available to them at a discounted rate. The overall yield of T-bill is regarded as the difference between the overall Redemption value and the purchase price.

Commercial Papers

These documents are utilized by large-scale companies for receiving funds as an answer to obligations related to short-term debt like the payroll of the corporation. These are supported by the issuing companies or banks fulfilling and paying the respective face amount on the given maturity date as provided by the note.

Marketable Securities

These are referred to as Financial Assets as well as instruments that could be easily converted into cash. Therefore, these turn out to be highly liquid. Marketable securities can be regarded as highly liquid because maturities are known to happen within or less than a year. Moreover, the rates at which the given securities might have traded tend to have minimal effect on the overall prices.

Money Market Funds

These can be in the form of checking accounts responsible for paying higher interests that are provided by the deposited amount of money. These tools are known to provide an effective and efficient way for organizations to manage their respective money. This is because they are highly stable in comparison to other variants of funds –just like Mutual Funds. The share price of Money market funds always tends to be the same.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.