Table of Contents

Realization Multiple

Realization multiple meaning implies measurement for private equity revealing how much is paid out to the investors. It helps in measuring the return that has been realized from the given investment. Private Equity Funds tend to be unique in the way that they are known for holding assets that get pulled together from all types of Illiquid sources –including startups, LBO or leveraged buyouts, and so more.

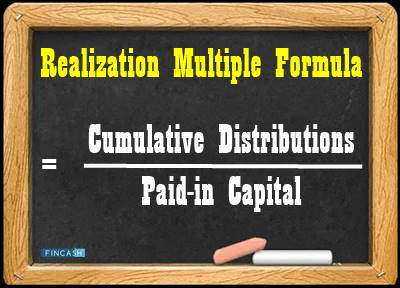

The realization multiple is analyzed by dividing the respective cumulative distributions from some fund, project, or company by the respective paid-in Capital.

Realization Multiple Formula

The realization multiple also goes by the name as DPI or Distributed to Paid-In Capital.

Realization Multiple = (Cumulative Distributions) / (Paid-in Capital)

The term serves to be a famous terminology amongst private equity investors and venture capitalists. It is because the given parameter tends to focus on what has been paid out in real terms to the investors. If the private equity fund is giving out some amount to the investors every year, then the respective realization capital is going to rise. This is because there are several distributions within the respective books. The given phenomenon allows the investors to spot some fund easily that turns out to be successful in returning money back to the respective investors.

Realization Multiple As a Whole

The parameter of realization multiple is not known to tell the entire story of the overall performance of the private equity fund. It is, therefore, combined with other valid measures like the PIC (Paid-in Capital), investment multiple, and RVPI (or Residual Value to Paid In Multiple), and TVPI (or Total Value to Paid in Multiple). Indeed, the overall internal rate of return of the fund since the beginning is also made use of as a major measure. Investors keep searching for the respective funds capable of generating huge return (investment multiple) and might not be hesitant about returning its investors on a regular Basis.

Talk to our investment specialist

Like with most of the common private equity measures out there, the Factor of realization multiple is known to ignore the time-specific value of money. This helps in differentiating the given factor from various other valuation methods –like the net present value or internal rate of return. Private equity funds tend to be difficult to analyze because of the various kinds of investments they are capable of holding. There is not the presence of some deep Market for establishing evaluation on a regular basis. Therefore, the investors, in this case, are bound to ensure guesses along with leaps of faith for putting a specific number on the remaining value.

The realization multiple helps in stripping some sort of uncertainty away while concluding on what investors might have observed from the given fund in real returned funds. The only catch here is that in the era of private equity Investing, previous events are only known to influence the upcoming events to some extent.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.