Table of Contents

- What is the Gap and Go Strategy?

- Types of Price Gaps

- Why the Gap and Go Strategy Works in Indian Markets

- How to Implement the Gap and Go Strategy

- Advanced Tips for Indian Traders

- Case Study: Gap and Go Strategy in Action

- Benefits and Challenges of the Gap and Go Strategy

- Gap and Go Strategy FAQs

- Final Thoughts

What is Gap and Go Strategy?

The Gap and Go strategy is a powerful trading technique that allows intraday traders to profit from price gaps created between the previous day’s closing price and the current day’s opening price. This strategy leverages momentum and is particularly useful in dynamic markets like India’s. In this article, we’ll break down the essentials of the Gap and Go strategy, its application in Indian markets, and advanced tips for maximising profits.

What is the Gap and Go Strategy?

The Gap and Go strategy focuses on:

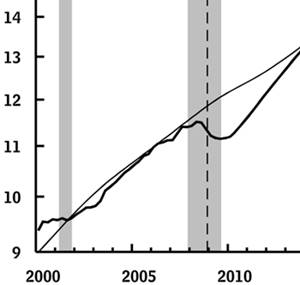

- Price Gaps: The difference between a stock’s closing price on one day and its opening price on the next.

- Momentum Trading: Riding the early price movements that follow such gaps.

Types of Price Gaps

- Gap-Up: The stock opens higher than the previous day’s close.

- Example: Reliance Industries opens at ₹2,550, up from the previous close of ₹2,500, due to strong quarterly results.

- Gap-Down: The stock opens lower than the previous day’s close.

- Example: Infosys opens at ₹1,350, down from ₹1,400, following disappointing Earnings.

Why the Gap and Go Strategy Works in Indian Markets

Indian markets, like the NSE (National Stock Exchange) and BSE (Bombay Stock Exchange), experience regular price gaps due to:

- Global Market Impact: Overnight news or events in the US, Europe, or Asia-Pacific regions.

- Earnings Reports: Quarterly results often lead to significant price gaps.

- Macroeconomic Announcements: RBI monetary policy, GDP data, or Union Budget announcements.

For example, during the 2024 Union Budget, many stocks in the Financial Sector experienced gap-up openings, creating excellent opportunities for intraday traders.

How to Implement the Gap and Go Strategy

Step 1: Identify the Right Stocks

- Look for High liquidity: Focus on stocks from indices like Nifty 50 or Bank Nifty.

- Watch for Pre-Market Gaps: Use tools like NSE Pre-Open Market Data to identify gap-up or gap-down stocks.

Step 2: Confirm with Volume

A price gap must be supported by high trading volume. This confirms the strength of the momentum.

Step 3: Use Technical Indicators

Combine the strategy with indicators like:

- VWAP (Volume Weighted Average Price): Helps identify entry and exit points.

- RSI (Relative Strength Index): Ensures the stock is not overbought or oversold.

Step 4: Set Entry, Stop-Loss, and Target

- Entry Point: For gap-ups, buy when the price breaks above the opening Range high.

- Stop-Loss: Place it below the opening range low to manage risk.

- Target: Exit once you hit 1:2 or 1:3 risk-reward.

Talk to our investment specialist

Advanced Tips for Indian Traders

1. Focus on Sectoral Trends

During bullish phases, sectors like IT and Banking often exhibit gap-ups. In bearish markets, defensive sectors like FMCG perform better.

2. Analyse Global Cues

Track indices like the Dow Jones Futures and SGX Nifty to anticipate gap openings. Risk Management:

- Never risk more than 1-2% of your trading Capital on a single trade.

- Use trailing stop-losses to lock in profits.

3. Avoid False Breakouts

Verify gaps using volume and avoid trades in Illiquid stocks that may show misleading price movements.

Case Study: Gap and Go Strategy in Action

Stock Example: HDFC Bank

- Scenario: Positive Q3 results announced after market hours.

- Gap-Up: Opened 5% higher at ₹1,750 compared to the previous close of ₹1,670.

- Volume Confirmation: Trading volume was 3x the daily average in the first 15 minutes.

- Strategy Execution:

- Entry: ₹1,760 (breakout of the opening range)

- Stop-Loss: ₹1,740 (below the low of the day)

- Exit: ₹1,820 (achieved a 1:3 risk-reward ratio)

Benefits and Challenges of the Gap and Go Strategy

Benefits

- Quick Profits: Traders can make gains within the first 30 minutes to 1 hour of market opening.

- Defined Risk: Stop-loss levels are clear and easy to manage.

Challenges:

- High Volatility: Indian markets can be unpredictable, especially during major events.

- Emotional Discipline: Traders often exit too early or hold on too long, missing optimal profit opportunities.

Gap and Go Strategy FAQs

1. Can beginners use the Gap and Go strategy?

A: Yes, but they should start with a small capital, focus on liquid stocks, and practice in a simulated environment.

2. What are the best tools for intraday trading?

A: Use platforms like Zerodha Kite, Upstox, or ICICI Direct, which offer pre-market data and technical charts.

3. How much capital is required?

A: For Indian markets, traders can start with ₹50,000–₹1,00,000 and gradually scale up.

4. Is the Gap and Go strategy profitable in volatile markets?

A: Yes, but it requires strict risk management.

Final Thoughts

The Gap and Go strategy is an effective tool for day traders in the Indian market. By focusing on price gaps, confirming momentum with volume, and combining technical indicators, traders can capitalise on early market opportunities. However, success lies in continuous learning, disciplined execution, and robust risk management. If you’re an intraday trader, it’s time to master the Gap and Go strategy and take your trading game to the next level.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.