What is the Annual Percentage Yield (APY)?

Annual Percentage Yield meaning refers to the exact rate of return that an individual earns on their investment or a Fixed Deposit account given that the interest rate is compounded. Note that the compounding interest is totally different from the simple interest, as the former is calculated occasionally and is then included in the remaining balance of your account immediately after calculation. Now that your account balance tends to increase over time, the compounding interest that’s added periodically will also increase.

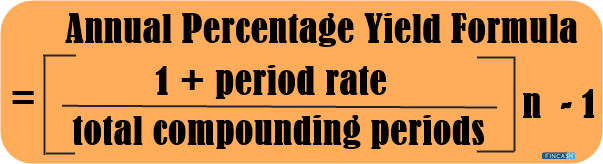

Annual Percentage Yield Formula

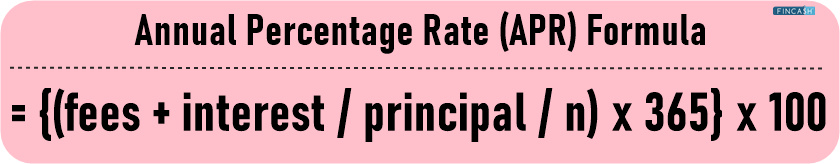

The commercial banks in the United States are supposed to mention the annual percentage yield when they are marketing the fixed deposit accounts to the customer. This gives the customer a clear picture of the total interest they can earn on their investment if they put money into the Bank for the next 12 months. This also makes it easier for them to make a decision. Below we have mentioned the formula that is applied for calculating the annual percentage yield:

APY = (1 + period rate / total compounding periods) n – 1

Let’s understand the concept with an illustration.

Example of Annual Percentage Yield

Suppose you deposited INR 10,000 in a bank for the next 4 years at the rate of 5% p.a. Now, you will earn a simple interest of 500 INR every year on your investment, which means the total profit you can make from this investment is 2,000 INR in the next 4 years. If you calculate the compound interest, then you will earn the combined amount.

For example, the compound interest for the above situation will be INR 608 in the fifth year. Now, the rate keeps changing depending on your balance. It might be the same as the simple interest in the first year, but it keeps getting bigger over time.

Talk to our investment specialist

Why is APY Important?

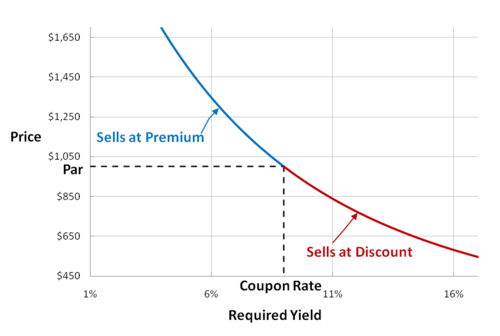

Whether you are Investing in a commodity or a Mutual Fund or a fixed deposit, the rate of return is the first thing you are going to notice in your investment. The return on the investment shows how your investment has grown over a year or two. Usually, it is calculated for 12 months. However, it may get a little challenging to compare different kinds of investments if the compounding period of each investment varies. For example, some types of investments could compound on a daily Basis while others must have an annual compounding period.

The more frequently the compounding takes place, the sooner your investment will grow. That’s because compounding will add the interest to your principal balance for that year and it will increase your principal amount. As a result, the next ROI will be calculated on a bigger amount. The APY shows the total interest you could earn over a specific period given that your money will be deposited in the bank for that duration. It is, therefore, important for customers to check the annual percentage yield of every investment before depositing their money into the bank. This will give you a basic idea of the money you can make from your investment.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.