What is Annualize?

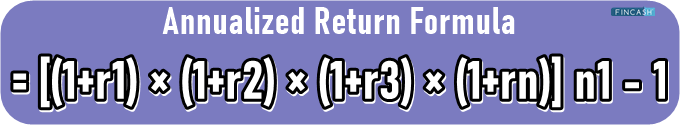

As per the Annualize term, it refers to the conversion of a short-term or temporary rate into an annual rate. This is specially done when the investor needs to know the annual rate of return they could expect from their investment. Annualizing means converting the short-term calculation into a long-term, i.e. the yearly calculation to find out the potential growth or returns an individual can expect from their investment.

As mentioned earlier, the method is used to check and compare different securities and select the one that could yield the highest return for the year. Note that the compounding interest, dividends, and all other components associated with the investment are taken into account for annualization. Usually, it is done on the rates that are for less than 12 months. The primary objective behind annualization is to analyze the Financial Performance of the organization.

In annualization, the individual takes the short-term rate of the company into account for calculating the annual performance. In other words, the temporary data is used to predict the growth of the company for the next twelve months. Let’s check a few examples of when companies annualize their rates and growth percentage.

How to Annualize Performance of the Organization?

It is important to note that annualization does not necessarily give accurate data. It’s rather similar to the run rate, which evaluates the performance of the organization based on the available data. The person evaluating the data assumes that the current position of the company, as well as performance, will continue for the next twelve months. In other words, they believe that the company will grow at the same rate for the rest of the year.

Talk to our investment specialist

Loans

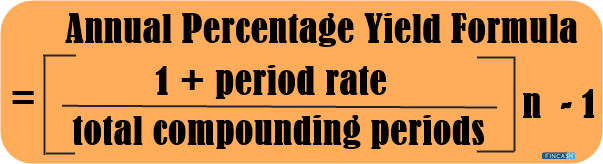

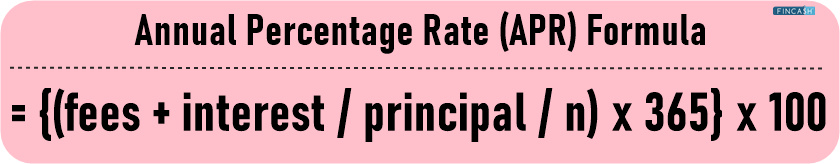

Banks calculate the annualized cost of their loans and advertise it as the annual percentage rate. You must have heard of the APR associated with credit cards as well as all kinds of personal loans. Well, the borrower is supposed to pay APR for using credit cards. Similarly, if they Fail to make loan payments in a timely manner, then they will pay the penalty APR. Banks can annualize all kinds of short-term loans to help customers get a clear picture of the additional amount they must be spending on their borrowings in the next 12 months. Let’s understand this with an example-

Suppose you borrow a title or payday loan from a private Bank and they charge a Flat INR 500 fee every month for using the borrowed money. Now, INR 500 does not seem expensive initially, but if you have borrowed a loan that has a term of 12 months, then add an extra 6,000 bucks to your budget for the fee. This can be super exorbitant.

For Tax Purposes

Just like loans and a company’s performance, the taxpayer can convert the short-term Tax Rate into the annual rate through annualization. This makes it easier for the taxpayer to manage their annual tax payments by implementing an easy and effective plan that works with the annualized tax rate.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.