Table of Contents

వివాహ ప్రణాళిక కాలిక్యులేటర్

వివాహం అనేది చాలా కాలంగా ఎదురుచూస్తున్న జీవిత సంఘటనలలో ఒకటి మరియు ప్రతి తల్లిదండ్రులు ఎదురుచూసేది. అయితే, పెళ్లిళ్లు రోజురోజుకు అంగరంగ వైభవంగా మారడంతో రేటు పెరుగుతోందిద్రవ్యోల్బణం, నువ్వు చేయగలవుభూమి మీరు మీ ఖర్చులను ముందస్తుగా ప్లాన్ చేయకుంటే కఠినంగా ఉండండి. అందువల్ల, వివాహ ప్రణాళిక కాలిక్యులేటర్ పెద్ద రోజు కోసం మీ డబ్బును ముందుగానే ప్లాన్ చేసి పెట్టుబడి పెట్టడంలో మీకు సహాయపడుతుంది.

వివాహ ప్రణాళిక కాలిక్యులేటర్ అంటే ఏమిటి?

కాలిక్యులేటర్ మీరు పెళ్లి కోసం మీ పెట్టుబడి నుండి ఎంత రాబడిని ఆశించవచ్చో అంచనా వేస్తుంది.

Know Your Monthly SIP Amount

కాలిక్యులేటర్ ఎలా పని చేస్తుంది?

కాలిక్యులేటర్ యొక్క పని చాలా సులభం. మీరు చేయాల్సిందల్లా మీ పిల్లల వయస్సు, అతని/ఆమె వివాహానికి సంబంధించిన సుమారు వయస్సు, వివాహానికి మీకు కావలసిన మొత్తం మరియు వడ్డీ రేటు వివరాలను నమోదు చేయండి. కాలిక్యులేటర్ నమోదు చేసిన విలువల ఆధారంగా త్వరగా ఫలితాలను ఉత్పత్తి చేస్తుంది మరియు లక్ష్యాన్ని చేరుకోవడానికి మీరు నెలవారీ ఎంత ఆదా చేయాలి అనే ఆలోచనను పొందుతారు.

వివాహ కాలిక్యులేటర్ యొక్క ప్రయోజనాలు

- గణన నిమిషాల్లో ఉచితంగా ఆన్లైన్లో చేయవచ్చు

- కాలిక్యులేటర్ మీ ఆర్థిక స్థితిని ప్రభావితం చేసే అన్ని అంశాలను పరిగణనలోకి తీసుకుంటుంది మరియు వాస్తవిక అంచనాను ఇస్తుంది

- ఉత్పత్తి చేయబడిన ఫలితాల ఆధారంగా మీరు చాలా సరైన పెట్టుబడిని ఎంచుకోవచ్చు

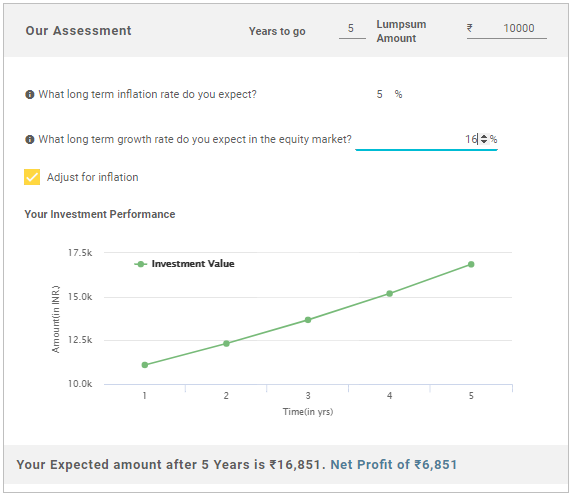

గమనిక/ నిరాకరణ: గణనలు 6% ద్రవ్యోల్బణం రేటును ఊహిస్తూ రూపొందించబడ్డాయి మరియు విలువలు సచిత్రంగా ఉంటాయి. అసలు ఖర్చు మీ పెట్టుబడి యొక్క భవిష్యత్తు పనితీరుపై ఆధారపడి ఉంటుంది మరియు దానికి లోబడి ఉంటుందిసంత పరిస్థితులు

Talk to our investment specialist

మీరు మీ పిల్లల వివాహాన్ని ముందుగానే ఎందుకు ప్లాన్ చేసుకోవాలి?

- ముందస్తు ప్రణాళిక సహాయపడుతుందిహ్యాండిల్ వివాహానికి సంబంధించిన దాచిన ఖర్చులు

- పెరుగుతున్న ద్రవ్యోల్బణం రేట్ల ప్రభావాన్ని ఎదుర్కోవడానికి సకాలంలో పెట్టుబడులు సహాయపడతాయి

- ప్రారంభపెట్టుబడి పెడుతున్నారు మీ ఆర్థిక జీవితాన్ని క్రమశిక్షణగా ఉంచుతుంది

- మీరు మీ డిస్టర్బ్ చేయవలసిన అవసరం లేదుపదవీ విరమణ అదనపు డబ్బు అవసరమైతే ఫండ్

- ప్రతి నెలా నిర్ణీత మొత్తాన్ని ఉంచడం ద్వారా స్థిరమైన కార్పస్ను నిర్మించడం ఆర్థిక ఒత్తిడి నుండి ఉపశమనం పొందడంలో సహాయపడుతుంది

2022 కోసం టాప్ ఫండ్లు

* 3 సంవత్సరాల పనితీరు ఆధారంగా ఉత్తమ నిధులు.

The objective of the scheme would be to provide investors with opportunities for long-term growth in capital along with the liquidity of an open-ended scheme through an active management of investments in a diversified basket of equity stocks of domestic Public Sector Undertakings and in debt and money market instruments issued by PSUs AND others. SBI PSU Fund is a Equity - Sectoral fund was launched on 7 Jul 10. It is a fund with High risk and has given a Below is the key information for SBI PSU Fund Returns up to 1 year are on To seek long-term capital appreciation by investing predominantly in equity and equity related securities of companies engaged in or expected to benefit from growth and development of infrastructure. HDFC Infrastructure Fund is a Equity - Sectoral fund was launched on 10 Mar 08. It is a fund with High risk and has given a Below is the key information for HDFC Infrastructure Fund Returns up to 1 year are on 1. SBI PSU Fund

CAGR/Annualized return of 7.7% since its launch. Ranked 31 in Sectoral category. Return for 2024 was 23.5% , 2023 was 54% and 2022 was 29% . SBI PSU Fund

Growth Launch Date 7 Jul 10 NAV (01 Apr 25) ₹29.8507 ↓ -0.05 (-0.16 %) Net Assets (Cr) ₹4,149 on 28 Feb 25 Category Equity - Sectoral AMC SBI Funds Management Private Limited Rating ☆☆ Risk High Expense Ratio 2.3 Sharpe Ratio -0.57 Information Ratio -0.1 Alpha Ratio 3.02 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹13,883 31 Mar 22 ₹17,382 31 Mar 23 ₹19,831 31 Mar 24 ₹37,078 31 Mar 25 ₹39,285 Returns for SBI PSU Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 1 Apr 25 Duration Returns 1 Month 12.8% 3 Month -1.9% 6 Month -11.9% 1 Year 6% 3 Year 31.2% 5 Year 31.5% 10 Year 15 Year Since launch 7.7% Historical performance (Yearly) on absolute basis

Year Returns 2023 23.5% 2022 54% 2021 29% 2020 32.4% 2019 -10% 2018 6% 2017 -23.8% 2016 21.9% 2015 16.2% 2014 -11.1% Fund Manager information for SBI PSU Fund

Name Since Tenure Rohit Shimpi 1 Jun 24 0.75 Yr. Data below for SBI PSU Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Financial Services 35.9% Utility 24.13% Energy 17.02% Industrials 10.67% Basic Materials 6.34% Asset Allocation

Asset Class Value Cash 5.81% Equity 94.07% Debt 0.12% Top Securities Holdings / Portfolio

Name Holding Value Quantity State Bank of India (Financial Services)

Equity, Since 31 Jul 10 | SBIN14% ₹591 Cr 8,577,500 GAIL (India) Ltd (Utilities)

Equity, Since 31 May 24 | 5321559% ₹380 Cr 24,350,000 Power Grid Corp Of India Ltd (Utilities)

Equity, Since 31 Jul 10 | 5328989% ₹380 Cr 15,135,554

↑ 950,000 Bharat Electronics Ltd (Industrials)

Equity, Since 30 Jun 24 | BEL8% ₹334 Cr 13,575,000

↑ 800,000 Bharat Petroleum Corp Ltd (Energy)

Equity, Since 31 Aug 24 | 5005476% ₹230 Cr 9,700,000 NMDC Ltd (Basic Materials)

Equity, Since 31 Oct 23 | 5263714% ₹174 Cr 27,900,000 NTPC Ltd (Utilities)

Equity, Since 31 Jul 10 | 5325554% ₹170 Cr 5,443,244 Bank of Baroda (Financial Services)

Equity, Since 31 Aug 24 | 5321344% ₹154 Cr 7,800,000 General Insurance Corp of India (Financial Services)

Equity, Since 31 May 24 | GICRE4% ₹153 Cr 4,150,000

↑ 550,000 SBI Cards and Payment Services Ltd Ordinary Shares (Financial Services)

Equity, Since 31 Oct 24 | SBICARD3% ₹138 Cr 1,650,000 2. HDFC Infrastructure Fund

CAGR/Annualized return of since its launch. Ranked 26 in Sectoral category. Return for 2024 was 23% , 2023 was 55.4% and 2022 was 19.3% . HDFC Infrastructure Fund

Growth Launch Date 10 Mar 08 NAV (01 Apr 25) ₹43.239 ↓ -0.03 (-0.07 %) Net Assets (Cr) ₹2,105 on 28 Feb 25 Category Equity - Sectoral AMC HDFC Asset Management Company Limited Rating ☆☆☆ Risk High Expense Ratio 2.31 Sharpe Ratio -0.55 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 300 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,356 31 Mar 22 ₹21,727 31 Mar 23 ₹25,279 31 Mar 24 ₹45,346 31 Mar 25 ₹47,548 Returns for HDFC Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 1 Apr 25 Duration Returns 1 Month 9.3% 3 Month -6.9% 6 Month -13.4% 1 Year 4.9% 3 Year 29.8% 5 Year 36.6% 10 Year 15 Year Since launch Historical performance (Yearly) on absolute basis

Year Returns 2023 23% 2022 55.4% 2021 19.3% 2020 43.2% 2019 -7.5% 2018 -3.4% 2017 -29% 2016 43.3% 2015 -1.9% 2014 -2.5% Fund Manager information for HDFC Infrastructure Fund

Name Since Tenure Srinivasan Ramamurthy 12 Jan 24 1.13 Yr. Dhruv Muchhal 22 Jun 23 1.69 Yr. Data below for HDFC Infrastructure Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Industrials 38.42% Financial Services 20.62% Basic Materials 10.93% Utility 7.4% Energy 6.96% Communication Services 3.76% Health Care 1.73% Technology 0.98% Real Estate 0.94% Consumer Cyclical 0.58% Asset Allocation

Asset Class Value Cash 6.48% Equity 92.31% Debt 1.21% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 09 | ICICIBANK7% ₹157 Cr 1,300,000 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Aug 23 | HDFCBANK6% ₹121 Cr 700,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Jun 12 | LT6% ₹120 Cr 380,000

↑ 30,000 J Kumar Infraprojects Ltd (Industrials)

Equity, Since 31 Oct 15 | JKIL5% ₹98 Cr 1,450,000

↓ -50,000 NTPC Ltd (Utilities)

Equity, Since 31 Dec 17 | 5325553% ₹69 Cr 2,200,000 InterGlobe Aviation Ltd (Industrials)

Equity, Since 31 Dec 21 | INDIGO3% ₹67 Cr 150,000 Kalpataru Projects International Ltd (Industrials)

Equity, Since 31 Jan 23 | KPIL3% ₹67 Cr 758,285 Coal India Ltd (Energy)

Equity, Since 31 Oct 18 | COALINDIA3% ₹63 Cr 1,700,000 Reliance Industries Ltd (Energy)

Equity, Since 31 May 24 | RELIANCE3% ₹60 Cr 500,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Sep 20 | BHARTIARTL3% ₹55 Cr 350,000

↓ -50,000

ఇక్కడ అందించిన సమాచారం ఖచ్చితమైనదని నిర్ధారించడానికి అన్ని ప్రయత్నాలు చేయబడ్డాయి. అయినప్పటికీ, డేటా యొక్క ఖచ్చితత్వానికి సంబంధించి ఎటువంటి హామీలు ఇవ్వబడవు. దయచేసి ఏదైనా పెట్టుబడి పెట్టే ముందు పథకం సమాచార పత్రంతో ధృవీకరించండి.