ఫిన్క్యాష్ »క్రమబద్ధమైన ఉపసంహరణ ప్రణాళిక »SWP కాలిక్యులేటర్

Table of Contents

SWP కాలిక్యులేటర్ -- క్రమబద్ధమైన ఉపసంహరణ ప్రణాళిక కాలిక్యులేటర్

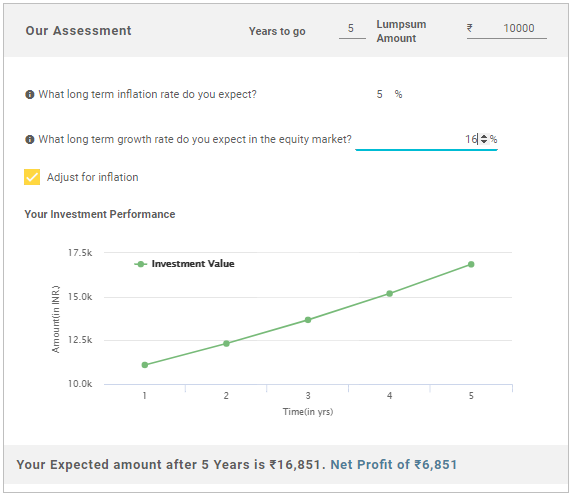

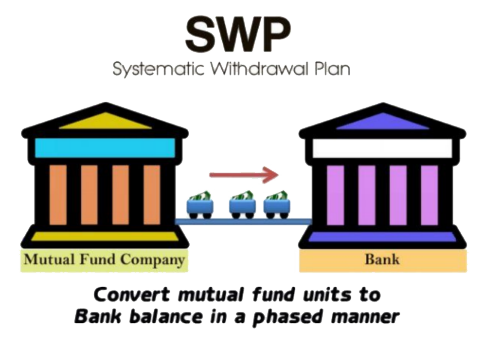

SWP కాలిక్యులేటర్ అనేది వ్యక్తులు వారి SWP పెట్టుబడి పదవీకాలంలో ఎలా ఉంటుందో లెక్కించేందుకు సహాయపడే ఒక సాధనం. SWP లేదా సిస్టమాటిక్ ఉపసంహరణ ప్రణాళిక అనేది యూనిట్లు లేదా పెట్టుబడిని రీడీమ్ చేసే సాంకేతికతమ్యూచువల్ ఫండ్స్. SWPలో, వ్యక్తులు తమ డబ్బును మ్యూచువల్ ఫండ్ స్కీమ్లో ఇన్వెస్ట్ చేసి, ఇచ్చిన వ్యవధిలో తమ పెట్టుబడులను ఉపసంహరించుకుంటారు. SWP సాధారణంగా స్థిరమైన వాటి కోసం చూస్తున్న వ్యక్తులకు అనుకూలంగా ఉంటుందిఆదాయం సాధారణ పదవీకాలానికి పైగా. సిస్టమాటిక్ ఉపసంహరణ ప్రణాళిక, SWP కాలిక్యులేటర్ ఎలా పని చేస్తుంది మరియు ఇతర సంబంధిత పారామితుల గురించిన సమగ్ర అవగాహనను వ్యాసం మీకు అందిస్తుంది.

మ్యూచువల్ ఫండ్లో SWP అంటే ఏమిటి?

మ్యూచువల్ ఫండ్స్లో సిస్టమాటిక్ విత్డ్రావల్ ప్లాన్ లేదా SWP అనేది మ్యూచువల్ ఫండ్ ఇన్వెస్ట్మెంట్ యూనిట్లను రీడీమ్ చేసే క్రమబద్ధమైన మరియు ప్రణాళికాబద్ధమైన ప్రక్రియను సూచిస్తుంది. SWP యొక్క భావన రివర్స్ పద్ధతిలో పనిచేస్తుందిSIP. SWPలో, వ్యక్తులు సాధారణంగా తక్కువ రిస్క్-ఆకలిని కలిగి ఉండే మ్యూచువల్ ఫండ్ పథకాలలో ఏకమొత్తంలో పెట్టుబడి పెడతారు.లిక్విడ్ ఫండ్స్ లేదా అల్ట్రాస్వల్పకాలిక నిధులు. వ్యక్తులు పెట్టుబడి పెట్టిన మొత్తాన్ని క్రమం తప్పకుండా విత్డ్రా చేయడం ప్రారంభిస్తారు. వ్యక్తులు వారి అవసరాల ఆధారంగా నెలవారీ, త్రైమాసికం, వార్షికం వంటి వారి ఉపసంహరణ ఫ్రీక్వెన్సీని అనుకూలీకరించవచ్చు. ఈ సందర్భంలో, మ్యూచువల్ ఫండ్స్లో పెట్టుబడి పెట్టబడిన డబ్బు కూడా వ్యక్తులకు ఆదాయాన్ని పొందుతుంది. క్రమమైన ఆదాయ వనరు కోసం వెతుకుతున్న వ్యక్తులు, ప్రత్యేకించి రిటైర్డ్ అయినవారు సిస్టమాటిక్ ఉపసంహరణ ప్రణాళికను ఎంచుకోవచ్చుమ్యూచువల్ ఫండ్స్లో పెట్టుబడి పెట్టడం.

SWP మ్యూచువల్ ఫండ్ కాలిక్యులేటర్

SWP కాలిక్యులేటర్ వ్యక్తులు ఇచ్చిన వ్యవధిలో మ్యూచువల్ ఫండ్ పెట్టుబడిలో వారి ఉపసంహరణలను అంచనా వేయడానికి సహాయపడుతుంది. SWP కాలిక్యులేటర్లో నమోదు చేయడానికి అవసరమైన ఇన్పుట్ డేటా వీటిని కలిగి ఉంటుంది:

- SWP/ఉపసంహరణ మొత్తం - ఇది మీరు నిర్ణీత వ్యవధిలో ఉపసంహరించుకోవాలని ప్లాన్ చేస్తున్న స్థిర ఉపసంహరణ మొత్తాన్ని సూచిస్తుంది.

- ప్రారంభ పెట్టుబడి - ప్రారంభ పెట్టుబడి అనేది మీరు మ్యూచువల్ ఫండ్ స్కీమ్లో పెట్టుబడి పెట్టాలనుకునే మొత్తం మొత్తాన్ని సూచిస్తుంది.

- ఉపసంహరణ ఫ్రీక్వెన్సీ - ఉపసంహరణ ఫ్రీక్వెన్సీ, మీరు మీ పెట్టుబడిని ఉపసంహరించుకోవాలనుకుంటున్న సమయ వ్యవధిని సూచిస్తుంది. ఇది నెలవారీ, వారానికో లేదా త్రైమాసికమైనా కావచ్చు. సాధారణంగా లెక్కలు నెలవారీగా జరుగుతాయి.

- రాబడుల అంచనా రేటు - అంటే మీ పెట్టుబడిపై మీరు ఆశించే రాబడి.

కాబట్టి, ఒక ఉదాహరణతో SWP కాలిక్యులేటర్ యొక్క భావనను వివరంగా అర్థం చేసుకుందాం.

నమూనా ఇలస్ట్రేషన్

- ప్రారంభ పెట్టుబడి మొత్తం - INR 1.20,000

- SWP మొత్తం - INR 10,000

- ఉపసంహరణ పదవీకాలం - 12 నెలలు

- ఆశించిన రాబడి రేటు - 7%

SWP పట్టిక యొక్క గణన క్రింది విధంగా ఇవ్వబడింది.

| నెల | నెల ప్రారంభంలో బ్యాలెన్స్ (INR) | విముక్తి మొత్తం (INR) | సంపాదించిన వడ్డీ (INR) | నెలాఖరులో బ్యాలెన్స్ (INR) |

|---|---|---|---|---|

| 1 | 1,20,000 | 10,000 | 642 | 1,10,642 |

| 2 | 1,10,642 | 10,000 | 587 | 1,01,229 |

| 3 | 1,01,229 | 10,000 | 532 | 91,761 |

| 4 | 91,761 | 10,000 | 477 | 82,238 |

| 5 | 82,238 | 10,000 | 421 | 72,659 |

| 6 | 72,659 | 10,000 | 366 | 63,025 |

| 7 | 63,025 | 10,000 | 309 | 53,334 |

| 8 | 53,334 | 10,000 | 253 | 43,587 |

| 9 | 43,587 | 10,000 | 196 | 33,783 |

| 10 | 33,783 | 10,000 | 139 | 23,921 |

| 11 | 23,921 | 10,000 | 81 | 14,003 |

| 12 | 14,003 | 10,000 | 23 | 4,026 |

ఈ విధంగా, పై పట్టిక నుండి, SWP లావాదేవీ ద్వారా మ్యూచువల్ ఫండ్ పథకం ద్వారా ఆర్జించిన లాభం INR 4,026 అని చెప్పవచ్చు.

VALUE AT END OF TENOR:₹4,597SWP Calculator

సిస్టమాటిక్ ఉపసంహరణ ప్రణాళిక యొక్క ప్రయోజనాలు

SWP యొక్క కొన్ని ప్రధాన ప్రయోజనాలు క్రింది విధంగా ఉన్నాయి.

రెగ్యులర్ ఆదాయ ప్రవాహం

SWP యొక్క ప్రాథమిక ప్రయోజనాల్లో ఒకటి, వ్యక్తులు క్రమమైన ఆదాయ వనరుగా సిస్టమాటిక్ ఉపసంహరణ ప్రణాళికను ఉపయోగించవచ్చు. ఎందుకంటే విత్డ్రా చేయబడిన మొత్తం స్థిరంగా ఉంటుంది.

క్రమశిక్షణతో కూడిన ఉపసంహరణ అలవాటు

SWP అనేది వ్యక్తులలో క్రమశిక్షణతో కూడిన ఉపసంహరణ అలవాటును సృష్టిస్తుంది, ఎందుకంటే నిర్ణీత మొత్తం మాత్రమే ఉపసంహరించబడుతుంది మరియు మిగిలిన డబ్బు మ్యూచువల్ ఫండ్లలో పెట్టుబడి పెట్టబడుతుంది. ఇది నిరోధిస్తుందిరాజధాని పెట్టుబడిపై కోత. అలాగే, మ్యూచువల్ ఫండ్స్లో పెట్టుబడి రాబడిని ఇస్తుంది.

పెన్షన్ కోసం ప్రత్యామ్నాయం

SWP పదవీ విరమణ పొందిన వ్యక్తుల విషయంలో పెన్షన్కు ప్రత్యామ్నాయంగా పనిచేస్తుంది. పదవీ విరమణ పొందినవారు SWP ద్వారా సాధారణ ఆదాయానికి హామీ ఇవ్వగలరు.

Talk to our investment specialist

2022 కోసం ఉత్తమ SWP మ్యూచువల్ ఫండ్లు

SWP సాధారణంగా లిక్విడ్ ఫండ్స్ వంటి తక్కువ స్థాయి రిస్క్ను కలిగి ఉండే మ్యూచువల్ ఫండ్ పథకాలలో చేయబడుతుంది. కాబట్టి, లిక్విడ్/అల్ట్రాషార్ట్ కేటగిరీ కింద ఉన్న కొన్ని ఉత్తమ మ్యూచువల్ ఫండ్ పథకాలు నికర ఆస్తుల కంటే ఎక్కువగా ఉన్నాయి1000 కోట్లు ఈ క్రింది విధంగా క్రింద ఇవ్వబడ్డాయి.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Aditya Birla Sun Life Savings Fund Growth ₹540.322

↑ 0.27 ₹14,988 2.2 4.1 7.9 7 7.9 7.84% 5M 19D 7M 20D SBI Magnum Ultra Short Duration Fund Growth ₹5,895.05

↑ 1.29 ₹11,987 2.1 3.8 7.5 6.7 7.4 7.53% 5M 5D 8M 8D ICICI Prudential Ultra Short Term Fund Growth ₹27.3166

↑ 0.01 ₹13,017 2.1 3.8 7.5 6.8 7.5 7.74% 5M 1D 7M 6D Invesco India Ultra Short Term Fund Growth ₹2,661.8

↑ 0.47 ₹1,337 2.1 3.8 7.4 6.6 7.5 7.5% 5M 13D 5M 29D BOI AXA Liquid Fund Growth ₹2,970.29

↑ 0.50 ₹1,741 1.9 3.7 7.4 6.9 7.4 6.98% 1M 20D 1M 20D Kotak Savings Fund Growth ₹42.3103

↑ 0.01 ₹12,726 2.1 3.7 7.3 6.6 7.2 7.63% 5M 23D 6M 7D Axis Liquid Fund Growth ₹2,872.2

↑ 0.48 ₹42,867 1.9 3.7 7.3 6.8 7.4 7.17% 1M 9D 1M 9D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 17 Apr 25

The primary objective of the schemes is to generate regular income through investments in debt and money market instruments. Income maybe generated through the receipt of coupon payments or the purchase and sale of securities in the underlying portfolio. The schemes will under normal market conditions, invest its net assets in fixed income securities, money market instruments, cash and cash equivalents. Aditya Birla Sun Life Savings Fund is a Debt - Ultrashort Bond fund was launched on 16 Apr 03. It is a fund with Moderately Low risk and has given a Below is the key information for Aditya Birla Sun Life Savings Fund Returns up to 1 year are on (Erstwhile SBI Magnum InstaCash Fund) To provide the investors an opportunity to earn returns through investment in

debt & money market securities, while having the benefit of a very high degree of liquidity. SBI Magnum Ultra Short Duration Fund is a Debt - Ultrashort Bond fund was launched on 21 May 99. It is a fund with Low risk and has given a Below is the key information for SBI Magnum Ultra Short Duration Fund Returns up to 1 year are on (Erstwhile ICICI Prudential Regular Income Fund) The fund’s objective is to generate regular income through investments primarily in debt and money market instruments. As a secondary objective, the Scheme also seeks to generate long term capital appreciation from the portion of equity investments under the Scheme. ICICI Prudential Ultra Short Term Fund is a Debt - Ultrashort Bond fund was launched on 3 May 11. It is a fund with Moderate risk and has given a Below is the key information for ICICI Prudential Ultra Short Term Fund Returns up to 1 year are on (Erstwhile Invesco India Medium Term Bond Fund) The objective is to generate regular income and capital appreciation by investing in a portfolio of medium term debt and money market instruments. Invesco India Ultra Short Term Fund is a Debt - Ultrashort Bond fund was launched on 30 Dec 10. It is a fund with Moderate risk and has given a Below is the key information for Invesco India Ultra Short Term Fund Returns up to 1 year are on Objective The Scheme seeks to deliver reasonable market related returns with lower risk and higher liquidity through a portfolio of debt and money market instruments.

However there can be no assurance that the investment objectives of the Scheme will be realized. BOI AXA Liquid Fund is a Debt - Liquid Fund fund was launched on 16 Jul 08. It is a fund with Low risk and has given a Below is the key information for BOI AXA Liquid Fund Returns up to 1 year are on (Erstwhile Kotak Treasury Advantage Fund) The investment objective of the Scheme is to generate returns through investments in debt and money market instruments with a view to reduce the interest rate risk. However, there is no assurance or guarantee that the investment objective of the scheme will be achieved. Kotak Savings Fund is a Debt - Ultrashort Bond fund was launched on 13 Aug 04. It is a fund with Moderately Low risk and has given a Below is the key information for Kotak Savings Fund Returns up to 1 year are on To provide a high level of liquidity with reasonable returns commensurating with low risk through a portfolio of money market and debt securities. However there can be no assurance that the investment objective of the scheme will be achieved. Axis Liquid Fund is a Debt - Liquid Fund fund was launched on 9 Oct 09. It is a fund with Low risk and has given a Below is the key information for Axis Liquid Fund Returns up to 1 year are on 1. Aditya Birla Sun Life Savings Fund

CAGR/Annualized return of 7.4% since its launch. Ranked 6 in Ultrashort Bond category. Return for 2024 was 7.9% , 2023 was 7.2% and 2022 was 4.8% . Aditya Birla Sun Life Savings Fund

Growth Launch Date 16 Apr 03 NAV (17 Apr 25) ₹540.322 ↑ 0.27 (0.05 %) Net Assets (Cr) ₹14,988 on 28 Feb 25 Category Debt - Ultrashort Bond AMC Birla Sun Life Asset Management Co Ltd Rating ☆☆☆☆☆ Risk Moderately Low Expense Ratio 0.54 Sharpe Ratio 3.52 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 1,000 Exit Load NIL Yield to Maturity 7.84% Effective Maturity 7 Months 20 Days Modified Duration 5 Months 19 Days Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹10,634 31 Mar 22 ₹11,077 31 Mar 23 ₹11,676 31 Mar 24 ₹12,543 31 Mar 25 ₹13,517 Returns for Aditya Birla Sun Life Savings Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Apr 25 Duration Returns 1 Month 1.1% 3 Month 2.2% 6 Month 4.1% 1 Year 7.9% 3 Year 7% 5 Year 6.3% 10 Year 15 Year Since launch 7.4% Historical performance (Yearly) on absolute basis

Year Returns 2024 7.9% 2023 7.2% 2022 4.8% 2021 3.9% 2020 7% 2019 8.5% 2018 7.6% 2017 7.2% 2016 9.2% 2015 8.9% Fund Manager information for Aditya Birla Sun Life Savings Fund

Name Since Tenure Sunaina Cunha 20 Jun 14 10.7 Yr. Kaustubh Gupta 15 Jul 11 13.64 Yr. Monika Gandhi 22 Mar 21 3.95 Yr. Data below for Aditya Birla Sun Life Savings Fund as on 28 Feb 25

Asset Allocation

Asset Class Value Cash 40.5% Debt 59.18% Other 0.32% Debt Sector Allocation

Sector Value Corporate 69.04% Cash Equivalent 24.5% Government 6.14% Credit Quality

Rating Value AA 33.14% AAA 66.86% Top Securities Holdings / Portfolio

Name Holding Value Quantity Shriram Finance Company Limited

Debentures | -4% ₹603 Cr 60,000 Nirma Limited

Debentures | -3% ₹485 Cr 48,500 364 DTB

Sovereign Bonds | -3% ₹471 Cr 47,500,000 National Housing Bank

Debentures | -3% ₹400 Cr 40,000 182 DTB 29082025

Sovereign Bonds | -2% ₹340 Cr 35,000,000 Mankind Pharma Ltd

Debentures | -2% ₹305 Cr 30,500 Avanse Financial Services Ltd 9.40%

Debentures | -2% ₹299 Cr 30,000 Axis Bank Ltd.

Debentures | -2% ₹279 Cr 6,000

↑ 6,000 ICICI Home Finance Company Limited

Debentures | -2% ₹270 Cr 27,000 Bajaj Housing Finance Ltd. 8%

Debentures | -2% ₹250 Cr 25,000

↓ -5,000 2. SBI Magnum Ultra Short Duration Fund

CAGR/Annualized return of 7.1% since its launch. Return for 2024 was 7.4% , 2023 was 7% and 2022 was 4.5% . SBI Magnum Ultra Short Duration Fund

Growth Launch Date 21 May 99 NAV (17 Apr 25) ₹5,895.05 ↑ 1.29 (0.02 %) Net Assets (Cr) ₹11,987 on 28 Feb 25 Category Debt - Ultrashort Bond AMC SBI Funds Management Private Limited Rating ☆☆☆ Risk Low Expense Ratio 0.54 Sharpe Ratio 2.38 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load NIL Yield to Maturity 7.53% Effective Maturity 8 Months 8 Days Modified Duration 5 Months 5 Days Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹10,516 31 Mar 22 ₹10,893 31 Mar 23 ₹11,453 31 Mar 24 ₹12,277 31 Mar 25 ₹13,186 Returns for SBI Magnum Ultra Short Duration Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Apr 25 Duration Returns 1 Month 1% 3 Month 2.1% 6 Month 3.8% 1 Year 7.5% 3 Year 6.7% 5 Year 5.7% 10 Year 15 Year Since launch 7.1% Historical performance (Yearly) on absolute basis

Year Returns 2024 7.4% 2023 7% 2022 4.5% 2021 3.4% 2020 5.9% 2019 8% 2018 7.9% 2017 6.6% 2016 7.7% 2015 8.3% Fund Manager information for SBI Magnum Ultra Short Duration Fund

Name Since Tenure Rajeev Radhakrishnan 27 Dec 24 0.26 Yr. Ardhendu Bhattacharya 1 Dec 23 1.33 Yr. Data below for SBI Magnum Ultra Short Duration Fund as on 28 Feb 25

Asset Allocation

Asset Class Value Cash 61.18% Debt 38.53% Other 0.29% Debt Sector Allocation

Sector Value Cash Equivalent 46.36% Corporate 33.97% Government 19.38% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity 182 DTB 31072025

Sovereign Bonds | -4% ₹454 Cr 46,500,000

↓ -3,500,000 National Bank For Agriculture And Rural Development

Debentures | -4% ₹421 Cr 4,250 7.3% Govt Stock 2028

Sovereign Bonds | -4% ₹417 Cr 41,500,000

↓ -16,500,000 Power Finance Corporation Limited

Debentures | -3% ₹384 Cr 3,850 Hdb Financial Services Limited

Debentures | -3% ₹345 Cr 34,500 INDIA UNIVERSAL TRUST AL2

Unlisted bonds | -3% ₹340 Cr 400 Citicorp Finance (India) Limited

Debentures | -2% ₹250 Cr 25,000 Rec Limited

Debentures | -2% ₹241 Cr 2,450 Tata Capital Housing Finance Limited

Debentures | -2% ₹220 Cr 2,200 08.18 HR UDAY 2025

Domestic Bonds | -2% ₹211 Cr 21,000,000 3. ICICI Prudential Ultra Short Term Fund

CAGR/Annualized return of 7.5% since its launch. Ranked 27 in Ultrashort Bond category. Return for 2024 was 7.5% , 2023 was 6.9% and 2022 was 4.5% . ICICI Prudential Ultra Short Term Fund

Growth Launch Date 3 May 11 NAV (17 Apr 25) ₹27.3166 ↑ 0.01 (0.03 %) Net Assets (Cr) ₹13,017 on 15 Mar 25 Category Debt - Ultrashort Bond AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆ Risk Moderate Expense Ratio 0.86 Sharpe Ratio 1.8 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-1 Months (0.5%),1 Months and above(NIL) Yield to Maturity 7.74% Effective Maturity 7 Months 6 Days Modified Duration 5 Months 1 Day Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹10,589 31 Mar 22 ₹11,009 31 Mar 23 ₹11,594 31 Mar 24 ₹12,428 31 Mar 25 ₹13,344 Returns for ICICI Prudential Ultra Short Term Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Apr 25 Duration Returns 1 Month 1% 3 Month 2.1% 6 Month 3.8% 1 Year 7.5% 3 Year 6.8% 5 Year 6% 10 Year 15 Year Since launch 7.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 7.5% 2023 6.9% 2022 4.5% 2021 4% 2020 6.5% 2019 8.4% 2018 7.5% 2017 6.9% 2016 9.8% 2015 9.1% Fund Manager information for ICICI Prudential Ultra Short Term Fund

Name Since Tenure Manish Banthia 15 Nov 16 8.3 Yr. Ritesh Lunawat 15 Jun 17 7.72 Yr. Data below for ICICI Prudential Ultra Short Term Fund as on 15 Mar 25

Asset Allocation

Asset Class Value Cash 45.31% Debt 54.4% Other 0.29% Debt Sector Allocation

Sector Value Corporate 56.83% Cash Equivalent 24.3% Government 18.59% Credit Quality

Rating Value AA 20.39% AAA 79.61% Top Securities Holdings / Portfolio

Name Holding Value Quantity 7.3% Govt Stock 2028

Sovereign Bonds | -4% ₹583 Cr 58,000,000

↑ 10,000,000 India (Republic of)

- | -4% ₹484 Cr 50,000,000

↑ 50,000,000 LIC Housing Finance Limited

Debentures | -3% ₹434 Cr 4,350 Bharti Telecom Limited

Debentures | -3% ₹351 Cr 35,000

↑ 2,500 National Bank For Agriculture And Rural Development

Debentures | -2% ₹304 Cr 30,500 L&T Metro Rail (Hyderabad) Limited

Debentures | -2% ₹299 Cr 3,000 Small Industries Development Bank Of India

Debentures | -2% ₹299 Cr 3,000 National Bank For Agriculture And Rural Development

Debentures | -2% ₹249 Cr 2,500 LIC Housing Finance Limited

Debentures | -2% ₹225 Cr 2,250

↓ -500 Oberoi Realty Ltd.

Debentures | -2% ₹200 Cr 20,000 4. Invesco India Ultra Short Term Fund

CAGR/Annualized return of 7.1% since its launch. Ranked 40 in Ultrashort Bond category. Return for 2024 was 7.5% , 2023 was 6.6% and 2022 was 4.1% . Invesco India Ultra Short Term Fund

Growth Launch Date 30 Dec 10 NAV (17 Apr 25) ₹2,661.8 ↑ 0.47 (0.02 %) Net Assets (Cr) ₹1,337 on 28 Feb 25 Category Debt - Ultrashort Bond AMC Invesco Asset Management (India) Private Ltd Rating ☆☆☆ Risk Moderate Expense Ratio 0.74 Sharpe Ratio 1.38 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load NIL Yield to Maturity 7.5% Effective Maturity 5 Months 29 Days Modified Duration 5 Months 13 Days Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹10,449 31 Mar 22 ₹10,784 31 Mar 23 ₹11,305 31 Mar 24 ₹12,113 31 Mar 25 ₹12,995 Returns for Invesco India Ultra Short Term Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Apr 25 Duration Returns 1 Month 1% 3 Month 2.1% 6 Month 3.8% 1 Year 7.4% 3 Year 6.6% 5 Year 5.4% 10 Year 15 Year Since launch 7.1% Historical performance (Yearly) on absolute basis

Year Returns 2024 7.5% 2023 6.6% 2022 4.1% 2021 3% 2020 5.1% 2019 7.6% 2018 7.3% 2017 7.1% 2016 9.1% 2015 8.3% Fund Manager information for Invesco India Ultra Short Term Fund

Name Since Tenure Krishna Cheemalapati 4 Jan 20 5.24 Yr. Vikas Garg 27 Jul 21 3.68 Yr. Data below for Invesco India Ultra Short Term Fund as on 28 Feb 25

Asset Allocation

Asset Class Value Cash 42.85% Debt 56.81% Other 0.34% Debt Sector Allocation

Sector Value Corporate 52.93% Cash Equivalent 30.8% Government 15.92% Credit Quality

Rating Value AA 26.25% AAA 73.75% Top Securities Holdings / Portfolio

Name Holding Value Quantity 182 DTB 15052025

Sovereign Bonds | -4% ₹49 Cr 5,000,000

↑ 5,000,000 Cholamandalam Investment And Finance Company Limited

Debentures | -4% ₹40 Cr 4,000,000 Export Import Bank Of India

Debentures | -4% ₹40 Cr 4,000,000 Small Industries Development Bank Of India

Debentures | -3% ₹35 Cr 3,500,000 Ongc Petro Additions Limited

Debentures | -3% ₹30 Cr 3,000,000 Export Import Bank Of India

Debentures | -3% ₹30 Cr 3,000,000 Bharti Telecom Limited

Debentures | -2% ₹25 Cr 2,500,000 Godrej Industries Limited

Debentures | -2% ₹25 Cr 2,500,000 Bharti Telecom Limited

Debentures | -2% ₹25 Cr 2,500,000 Torrent Power Limited

Debentures | -2% ₹25 Cr 2,500,000 5. BOI AXA Liquid Fund

CAGR/Annualized return of 6.7% since its launch. Ranked 34 in Liquid Fund category. Return for 2024 was 7.4% , 2023 was 7% and 2022 was 4.9% . BOI AXA Liquid Fund

Growth Launch Date 16 Jul 08 NAV (20 Apr 25) ₹2,970.29 ↑ 0.50 (0.02 %) Net Assets (Cr) ₹1,741 on 28 Feb 25 Category Debt - Liquid Fund AMC BOI AXA Investment Mngrs Private Ltd Rating ☆☆☆ Risk Low Expense Ratio 0.1 Sharpe Ratio 5.55 Information Ratio -0.77 Alpha Ratio 0.04 Min Investment 5,000 Min SIP Investment 1,000 Exit Load NIL Yield to Maturity 6.98% Effective Maturity 1 Month 20 Days Modified Duration 1 Month 20 Days Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹10,353 31 Mar 22 ₹10,704 31 Mar 23 ₹11,316 31 Mar 24 ₹12,140 31 Mar 25 ₹13,036 Returns for BOI AXA Liquid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Apr 25 Duration Returns 1 Month 0.7% 3 Month 1.9% 6 Month 3.7% 1 Year 7.4% 3 Year 6.9% 5 Year 5.5% 10 Year 15 Year Since launch 6.7% Historical performance (Yearly) on absolute basis

Year Returns 2024 7.4% 2023 7% 2022 4.9% 2021 3.3% 2020 4.1% 2019 6.4% 2018 7.4% 2017 6.7% 2016 7.6% 2015 8.3% Fund Manager information for BOI AXA Liquid Fund

Name Since Tenure Mithraem Bharucha 17 Aug 21 3.62 Yr. Data below for BOI AXA Liquid Fund as on 28 Feb 25

Asset Allocation

Asset Class Value Cash 99.79% Other 0.21% Debt Sector Allocation

Sector Value Cash Equivalent 71.33% Corporate 17.78% Government 10.68% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity Punjab National Bank

Certificate of Deposit | -5% ₹98 Cr 10,000,000

↑ 10,000,000 India (Republic of)

- | -5% ₹93 Cr 9,382,500

↑ 9,382,500 Axis Bank Ltd.

Certificate of Deposit | -4% ₹80 Cr 8,100,000 Union Bank Of India

Certificate of Deposit | -4% ₹75 Cr 7,500,000

↓ -2,500,000 LIC Housing Finance Ltd

Commercial Paper | -4% ₹75 Cr 7,500,000 HDFC Securities Limited

Commercial Paper | -4% ₹74 Cr 7,500,000 India (Republic of)

- | -4% ₹74 Cr 7,500,000

↑ 7,500,000 Canara Bank

Domestic Bonds | -4% ₹74 Cr 7,500,000

↑ 7,500,000 Kotak Securities Ltd

Commercial Paper | -3% ₹50 Cr 5,000,000 National Bank For Agriculture And Rural Development

Commercial Paper | -3% ₹50 Cr 5,000,000 6. Kotak Savings Fund

CAGR/Annualized return of 7.2% since its launch. Ranked 44 in Ultrashort Bond category. Return for 2024 was 7.2% , 2023 was 6.8% and 2022 was 4.5% . Kotak Savings Fund

Growth Launch Date 13 Aug 04 NAV (17 Apr 25) ₹42.3103 ↑ 0.01 (0.03 %) Net Assets (Cr) ₹12,726 on 28 Feb 25 Category Debt - Ultrashort Bond AMC Kotak Mahindra Asset Management Co Ltd Rating ☆☆☆ Risk Moderately Low Expense Ratio 0.8 Sharpe Ratio 0.73 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load NIL Yield to Maturity 7.63% Effective Maturity 6 Months 7 Days Modified Duration 5 Months 23 Days Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹10,510 31 Mar 22 ₹10,871 31 Mar 23 ₹11,437 31 Mar 24 ₹12,236 31 Mar 25 ₹13,117 Returns for Kotak Savings Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Apr 25 Duration Returns 1 Month 1% 3 Month 2.1% 6 Month 3.7% 1 Year 7.3% 3 Year 6.6% 5 Year 5.6% 10 Year 15 Year Since launch 7.2% Historical performance (Yearly) on absolute basis

Year Returns 2024 7.2% 2023 6.8% 2022 4.5% 2021 3.2% 2020 5.8% 2019 7.8% 2018 7.4% 2017 6.7% 2016 8.2% 2015 8.6% Fund Manager information for Kotak Savings Fund

Name Since Tenure Deepak Agrawal 15 Apr 08 16.89 Yr. Manu Sharma 1 Nov 22 2.33 Yr. Data below for Kotak Savings Fund as on 28 Feb 25

Asset Allocation

Asset Class Value Cash 59.38% Debt 40.3% Other 0.31% Debt Sector Allocation

Sector Value Corporate 59.06% Cash Equivalent 24.21% Government 16.42% Credit Quality

Rating Value AA 9.91% AAA 90.09% Top Securities Holdings / Portfolio

Name Holding Value Quantity 182 DTB 15052025

Sovereign Bonds | -4% ₹495 Cr 50,000,000 Rural Electrification Corporation Limited

Debentures | -4% ₹474 Cr 47,500 Mankind Pharma Ltd

Debentures | -2% ₹300 Cr 30,000 National Bank For Agriculture And Rural Development

Debentures | -2% ₹299 Cr 30,000 National Bank For Agriculture And Rural Development

Debentures | -2% ₹229 Cr 2,300 Bharti Telecom Limited

Debentures | -2% ₹226 Cr 2,250 08.49 Tn SDL 2026

Sovereign Bonds | -2% ₹204 Cr 20,080,000 Vedanta Limited

Debentures | -2% ₹199 Cr 20,000 Axis Bank Ltd.

Debentures | -1% ₹186 Cr 20,000

↑ 20,000 Small Industries Development Bank of India

Debentures | -1% ₹186 Cr 20,000

↑ 20,000 7. Axis Liquid Fund

CAGR/Annualized return of 7% since its launch. Ranked 21 in Liquid Fund category. Return for 2024 was 7.4% , 2023 was 7.1% and 2022 was 4.9% . Axis Liquid Fund

Growth Launch Date 9 Oct 09 NAV (20 Apr 25) ₹2,872.2 ↑ 0.48 (0.02 %) Net Assets (Cr) ₹42,867 on 28 Feb 25 Category Debt - Liquid Fund AMC Axis Asset Management Company Limited Rating ☆☆☆☆ Risk Low Expense Ratio 0.23 Sharpe Ratio 3.92 Information Ratio 0 Alpha Ratio 0 Min Investment 500 Min SIP Investment 1,000 Exit Load NIL Yield to Maturity 7.17% Effective Maturity 1 Month 9 Days Modified Duration 1 Month 9 Days Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹10,358 31 Mar 22 ₹10,710 31 Mar 23 ₹11,322 31 Mar 24 ₹12,142 31 Mar 25 ₹13,034 Returns for Axis Liquid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Apr 25 Duration Returns 1 Month 0.7% 3 Month 1.9% 6 Month 3.7% 1 Year 7.3% 3 Year 6.8% 5 Year 5.5% 10 Year 15 Year Since launch 7% Historical performance (Yearly) on absolute basis

Year Returns 2024 7.4% 2023 7.1% 2022 4.9% 2021 3.3% 2020 4.3% 2019 6.6% 2018 7.5% 2017 6.7% 2016 7.6% 2015 8.4% Fund Manager information for Axis Liquid Fund

Name Since Tenure Devang Shah 5 Nov 12 12.41 Yr. Aditya Pagaria 13 Aug 16 8.64 Yr. Sachin Jain 3 Jul 23 1.75 Yr. Data below for Axis Liquid Fund as on 28 Feb 25

Asset Allocation

Asset Class Value Cash 99.82% Other 0.18% Debt Sector Allocation

Sector Value Cash Equivalent 73.61% Corporate 16.99% Government 9.21% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity India (Republic of)

- | -5% ₹2,218 Cr 225,000,000

↑ 225,000,000 91 Days Tbill

Sovereign Bonds | -4% ₹1,770 Cr 178,500,000 Canara Bank

Domestic Bonds | -3% ₹1,474 Cr 30,000

↑ 30,000 Export-Import Bank of India

Commercial Paper | -3% ₹1,449 Cr 29,500

↑ 29,500 India (Republic of)

- | -3% ₹1,280 Cr 130,000,000

↑ 130,000,000 National Bank for Agriculture and Rural Development

Commercial Paper | -3% ₹1,213 Cr 24,700

↑ 24,700 91 DTB 28032025

Sovereign Bonds | -3% ₹1,198 Cr 120,000,000 Reliance Retail Ventures Limited

Commercial Paper | -2% ₹1,011 Cr 20,500

↓ -500 HDFC Bank Ltd.

Debentures | -2% ₹983 Cr 20,000

↑ 20,000 Bank Of Baroda

Certificate of Deposit | -2% ₹983 Cr 20,000

↑ 20,000

ఇక్కడ అందించిన సమాచారం ఖచ్చితమైనదని నిర్ధారించడానికి అన్ని ప్రయత్నాలు చేయబడ్డాయి. అయినప్పటికీ, డేటా యొక్క ఖచ్చితత్వానికి సంబంధించి ఎటువంటి హామీలు ఇవ్వబడవు. దయచేసి ఏదైనా పెట్టుబడి పెట్టే ముందు పథకం సమాచార పత్రంతో ధృవీకరించండి.