Fincash » Coronavirus- A Guide to Investors » Over Rs. 70,000 crore NBFC Debt Maturing in Quarter 1 of FY2020

Table of Contents

Over Rs. 70,000 crore NBFC Debt Maturing in Quarter 1 of FY2020

With all the negative news about stock and finance markets doing the rounds amid the ongoing global pandemic, a piece of good news has made its way. Over Rs. 70,000 crore of debt issued by at least 60 Non-Banking Finance Companies (NBFCs) is maturing in the first quarter of the financial year 2020.

More than half of the debt lies with the top 15 borrowers who have a strong parentage. Moreover, a portion of that has already been redeemed. Many of these issuers have floated Bonds last month that was liquid. This happened even where there has hardly been any offtake of retail loans since the lockdown that took place on 27th March 2020.

According to a recent report, many private and public sector banks are providing a moratorium to eligible NBFCs. However, the report said that the problem most of the NBFCs would face will be related to the recovery of loans and not in terms of raising liquidity.

Loan and Liquidity Concerns

1. Housing Loan

According to a recent report, rating agencies have marked housing loans as least risky in the finance sector. The extent of moratorium received by home loans borrowers is lower compared to other segments.

2. Liquidity cover for Maximum NBFCs

The rating agency, Crisil, had mentioned in early April that almost three-fourths of NBFCs would have a liquidity cover of over three times to meet the Capital Market debt obligations up to the end of May 2020.

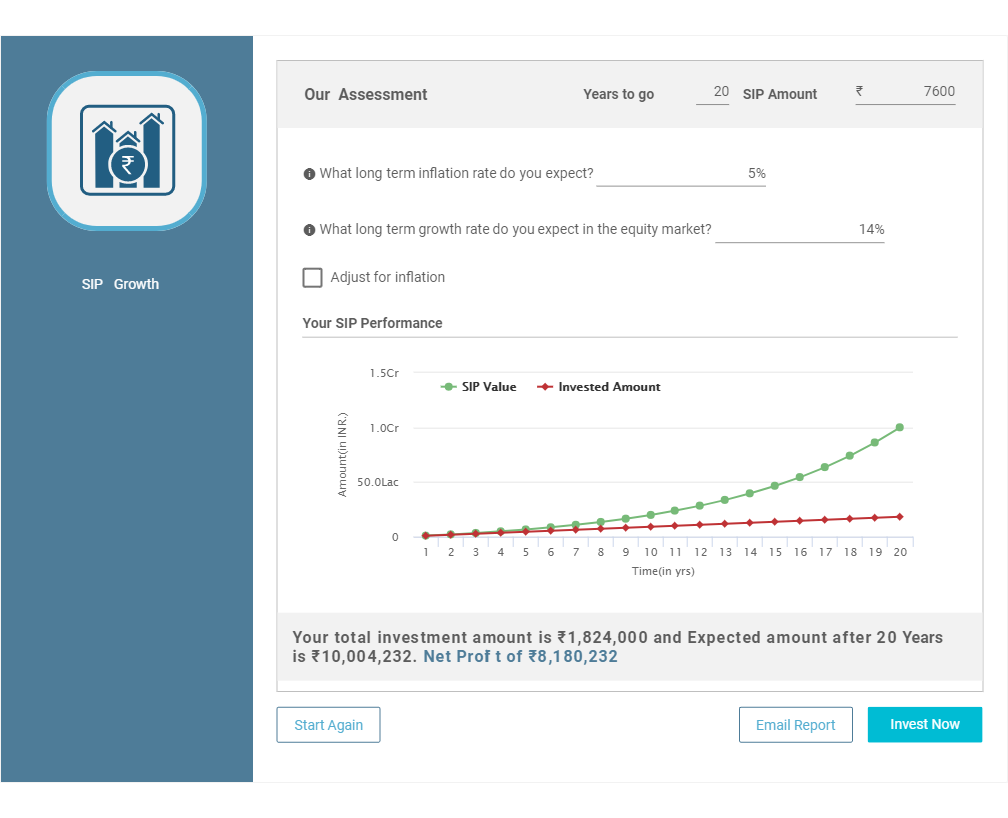

Talk to our investment specialist

3. Only 3% of NBFCs faced liquidity cover concern

The report also mentioned that only 3% of NBFCs faced an issue with less than one-time liquidity cover. Liquidity cover of less than one time is indicative that there was an inability to make complete debt repayments on time. However, this is exempted from the benefits of collections, other sources of external support, access to additional funding or credit sources.

Big News

1. Reliance Industries sells papers

Reliance Industries mopped up over Rs. 10,000 crores by selling papers with tenors of over three years, said a recent report on 13th May 2020. This move is expected to help Reliance Industries to reduce borrowing costs.

Reliance Industries sold bonds in three series. The company issued three years and four-month papers at 7.05% raising Rs. 4235 crores and mopped Rs. 5000 crores Offering 6.95% with nearly 3-year maturity.

The report further mentioned that the company is in the process of raising up to Rs. 1.5 billion overseas loans from a group of 10-15 foreign banks.

2. HDFC could be the largest subscriber

HDFC group consists of HDFC Mutual Fund and HDFC Bank. They could be the largest subscriber to shorter-duration bonds, said the report.

A Glance at the Past

A report in 2018 mentioned that top NBFCs needed Rs. 95,000 crores to repay debts of which Rs. 70,000 crores were commercial papers maturing in November 2018. Banks were to lend more to this particular sector to avoid Default. This happened because of the IL&FS defaults, and the BNFCs was facing a crisis of confidence. This forced the Reserve Bank of India (RBI) to open a special window.

Conclusion

The NBFCs and the banks are both vital for the survival and growth of the Indian Economy. Banks, NBFCs and businesses working together towards helping India fight the various challenges could be a boon for the economy amid a pandemic.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.