Table of Contents

Magnetic Ink Character Recognition Line (MICR)

What is the Magnetic Ink Character Recognition Line?

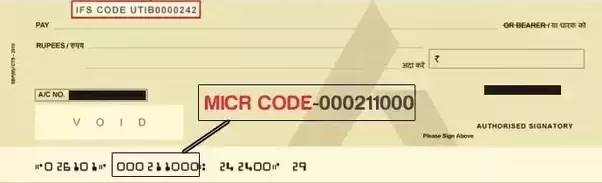

MICR definition is a series of numbers printed on personal checks. Basically, it is a line featuring three series of numbers that include the account number, routing number, and the check number. These numbers are printed on the check with the technology that allows computers to interpret the number. Launched in 1950, the Magnetic Ink Character Recognition Line was designed mainly for the banks and financial institutions in the United States.

This technology makes it easier for the computers to read and process the information (especially, the account number as well as routing number) mentioned on the personal checks. It is important to note that the MICR number should not be confused with the user’s Bank account number.

MICR Fonts

It is the MICR number that automates the check clearing process. Not only are these numbers readable to computers, but users can also check the MICR number to verify the information. You will find the MICR numbers in either CMC-7 or E-13B font. These are the most popular fonts for the Magnetic Ink Character Recognition Line. E-13B font is used for printing personal checks in Australia, UK, and North America. Then, there is the CMC-7 font, which is commonly used for printing checks in South America and Europe.

The primary use of this technology is to print the MICR number on checks. However, MICR technology isn’t only limited to the checks. It has multiple applications, such as printing direct mail and coupons. The Magnetic Ink Character Recognition Line is also used for printing the credit card invoices.

Talk to our investment specialist

Benefits of MICR Number

The major benefit of MICR technology is to enable computers to read and verify the bank’s routing number. This nine-digit code is used for clearing checks and transferring money. In the United States, all transactions are processed after the verification of the bank’s routing number. It also acts as the number confirming that the particular bank in the United States holds the amount that is to be transferred to the recipient’s account. The bank’s unique routing number is a must for all types of direct deposits and wire transfers.

You will find this number at the bottom of the check (one inch above the bottom). The surprising part is that the Magnetic Ink Character Recognition Line enables computers to interpret the check number, account number, and bank routing number printed at the bottom even when these digits are covered with the users’ signature. You must have seen the bank stamps, signatures, cancellation stamps, and other information covering the MICR number on a check.

Bankruptcy and security fraud are not uncommon in today’s digital age. One way to prevent deposits and payment frauds is by using the Magnetic Ink Character Recognition Line. The MICR technology can prevent these frauds with its unique ink as well as fonts. It is not possible to alter the credit card invoices and checks featuring MICR number. In other words, the fraudster cannot change the account holder’s name and the amount on the check.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.