+91-22-48913909

+91-22-48913909

Table of Contents

بہترین مالیاتی میوچل فنڈز 2022

ایک مالیاتیباہمی چندہ سیکٹر کا حصہ ہیں۔ایکویٹی فنڈز. ان فنڈز کو 'بینکنگ اینڈ فنانشل سروسز فنڈ' کے نام سے بھی جانا جاتا ہے۔ ان فنڈز کا مقصد پیدا کرنا ہے۔آمدنی کی طرف سےسرمایہ کاری بینکنگ سیکٹر اور مالیاتی صنعت کو پورا کرنے والی کمپنیوں کے اسٹاک/حصص میں۔ لہذا، آئیے سرمایہ کاری کے لیے بہترین مالیاتی میوچل فنڈز کے ساتھ ساتھ مالیاتی فنڈز کی مستقبل کی صلاحیت کو سمجھیں۔

Talk to our investment specialist

ہندوستان میں مالیاتی باہمی فنڈز

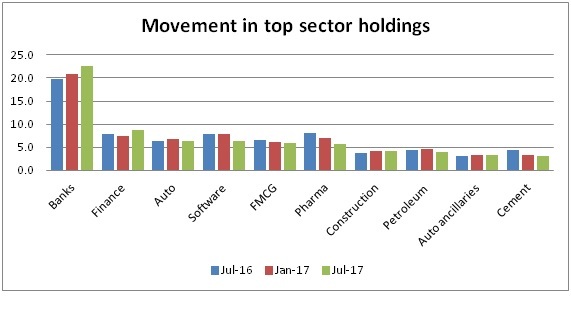

اگر ہم جولائی 2017 کے جاری کردہ اعداد و شمار پر نظر ڈالیں۔SEBI، بینکنگ اورسیکٹر فنڈز سب سے زیادہ پسندیدہ تھے. اعداد و شمار سے پتہ چلتا ہے کہبینک اور فنانس- دو سرکردہ شعبوں نے شیئر AUM میں زبردست اضافہ دکھایا ہے۔

جولائی 17 کے اعدادوشمار کے مطابق، بینکنگ سیکٹر کی اے یو ایم، جو کہ سرفہرست سیکٹر ہے، صرف چھ ماہ میں 20.9 فیصد سے بڑھ کر 22.6 فیصد ہو گئی ہے۔

فنانشل میوچل فنڈز میں آن لائن سرمایہ کاری کیسے کی جائے؟

Fincash.com پر لائف ٹائم کے لیے مفت انویسٹمنٹ اکاؤنٹ کھولیں۔

اپنی رجسٹریشن اور KYC کا عمل مکمل کریں۔

دستاویزات اپ لوڈ کریں (PAN، آدھار، وغیرہ)۔اور، آپ سرمایہ کاری کے لیے تیار ہیں!

اعلی کارکردگی کا مظاہرہ کرنے والے بہترین مالیاتی میوچل فنڈز FY 22 - 23

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) ICICI Prudential Banking and Financial Services Fund Growth ₹120.05

↑ 1.64 ₹8,843 1 -2.3 8.7 12.3 24.2 11.6 Aditya Birla Sun Life Banking And Financial Services Fund Growth ₹54.61

↑ 1.07 ₹3,011 0.4 -3.3 4.9 12.5 24.1 8.7 Invesco India Financial Services Fund Growth ₹120.39

↑ 2.28 ₹1,094 -3.5 -4.4 7.2 15.6 23.7 19.8 UTI Banking and Financial Services Fund Growth ₹171.851

↑ 3.55 ₹1,107 2 -1 8.4 13.7 23.7 11.1 Sundaram Financial Services Opportunities Fund Growth ₹94.3709

↑ 2.08 ₹1,325 0.3 -4.1 3.4 16.4 25 7.1 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 8 Apr 25

جب ہم ہندوستان کے بینکنگ اور فنانس سیکٹر کے بارے میں بات کرتے ہیں تو ہمارے پاس بہت سے بڑے کھلاڑی ہیں۔آئی سی آئی سی آئی بینک لمیٹڈ، ایچ ڈی ایف سی بینک لمیٹڈ، اسٹیٹ بینک آف انڈیا، یس بینک لمیٹڈ، ایکسس بینک لمیٹڈ، وغیرہ۔ ہندوستانی بینکنگ سسٹم 26 نجی شعبے کے بینکوں، 27 پبلک سیکٹر کے بینکوں، 1,574 شہری کوآپریٹو بینکوں، 56 علاقائی دیہی بینکوں، 46 غیر ملکی بینکوں پر مشتمل ہے۔ اور کوآپریٹو کریڈٹ اداروں کے علاوہ 93,913 دیہی کوآپریٹو بینک۔

وہ کمپنیاں جو بینکنگ اور مالیاتی صنعت کے اندر کام کرتی ہیں انتہائی منظم ہیں۔ بہت سی اچھی کمپنیاں سالوں میں مسلسل کارکردگی اور منافع فراہم کرنے کا مقصد رکھتی ہیں، نتیجتاً، یہ ان سرمایہ کاروں کے لیے اعتماد پیدا کرتی ہے جو سیکٹر فنڈز میں سرمایہ کاری کرنے کا منصوبہ بنا رہے ہیں۔ تاہم، ایسے فنڈز کے خطرے کے عوامل کو ہمیشہ ذہن میں رکھنا چاہیے۔ یہ فنڈز، بعض اوقات، دو انتہاؤں پر ہو سکتے ہیں، یہ اچھے منافع فراہم کر سکتے ہیں اور بعض اوقات بری کارکردگی کا مظاہرہ بھی کر سکتے ہیں۔ اس لیے یہ مشورہ دیا جاتا ہے کہ ایسے سرمایہ کار جو اس طرح کے سیکٹر فنڈز میں سرمایہ کاری کرنے کا ارادہ رکھتے ہیں، ان کے پاس اعلیخطرے کی بھوک اور طویل مدت تک سرمایہ کاری میں رہنا چاہیے۔ مثالی طور پر، تنوع کے مقصد کے لیے ایسے فنڈز میں سرمایہ کاری کرنی چاہیے۔

ICICI Prudential Banking and Financial Services Fund is an Open-ended equity scheme that seeks to generate long-term capital appreciation to unitholders from a portfolio that is invested predominantly in equity and equity related securities of companies engaged in banking and financial services. However, there can be no assurance that the investment objective of the Scheme will be realized. ICICI Prudential Banking and Financial Services Fund is a Equity - Sectoral fund was launched on 22 Aug 08. It is a fund with High risk and has given a Below is the key information for ICICI Prudential Banking and Financial Services Fund Returns up to 1 year are on The primary investment objective of the Scheme is to generate long-term capital appreciation to unit holders from a portfolio that is invested predominantly in equity and equity related securities of companies engaged in banking and financial services. The Scheme does not guarantee/indicate any returns. There can be no assurance that the schemes’ objectives will be achieved. Aditya Birla Sun Life Banking And Financial Services Fund is a Equity - Sectoral fund was launched on 14 Dec 13. It is a fund with High risk and has given a Below is the key information for Aditya Birla Sun Life Banking And Financial Services Fund Returns up to 1 year are on (Erstwhile Invesco India Banking Fund) The investment objective of the Scheme is to generate long-term capital growth from a portfolio of equity and equity-related securities of companies engaged in the business of banking and financial services. Invesco India Financial Services Fund is a Equity - Sectoral fund was launched on 14 Jul 08. It is a fund with High risk and has given a Below is the key information for Invesco India Financial Services Fund Returns up to 1 year are on (Erstwhile UTI Banking Sector Fund) Investment objective is "capital appreciation" through investments in the stocks of the companies/institutions engaged in the banking and financial services activities. UTI Banking and Financial Services Fund is a Equity - Sectoral fund was launched on 7 Apr 04. It is a fund with High risk and has given a Below is the key information for UTI Banking and Financial Services Fund Returns up to 1 year are on Seek capital appreciation by investing predominantly in equity and equity related securities of indian companies engaged in banking and financial Services. Sundaram Financial Services Opportunities Fund is a Equity - Sectoral fund was launched on 10 Jun 08. It is a fund with High risk and has given a Below is the key information for Sundaram Financial Services Opportunities Fund Returns up to 1 year are on 1. ICICI Prudential Banking and Financial Services Fund

CAGR/Annualized return of 16.1% since its launch. Return for 2024 was 11.6% , 2023 was 17.9% and 2022 was 11.9% . ICICI Prudential Banking and Financial Services Fund

Growth Launch Date 22 Aug 08 NAV (08 Apr 25) ₹120.05 ↑ 1.64 (1.39 %) Net Assets (Cr) ₹8,843 on 28 Feb 25 Category Equity - Sectoral AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆☆☆ Risk High Expense Ratio 1.98 Sharpe Ratio 0.27 Information Ratio 0.31 Alpha Ratio -4.12 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,701 31 Mar 22 ₹19,901 31 Mar 23 ₹21,205 31 Mar 24 ₹26,444 31 Mar 25 ₹30,205 Returns for ICICI Prudential Banking and Financial Services Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 8 Apr 25 Duration Returns 1 Month 3.3% 3 Month 1% 6 Month -2.3% 1 Year 8.7% 3 Year 12.3% 5 Year 24.2% 10 Year 15 Year Since launch 16.1% Historical performance (Yearly) on absolute basis

Year Returns 2023 11.6% 2022 17.9% 2021 11.9% 2020 23.5% 2019 -5.5% 2018 14.5% 2017 -0.4% 2016 45.1% 2015 21.1% 2014 -7.2% Fund Manager information for ICICI Prudential Banking and Financial Services Fund

Name Since Tenure Roshan Chutkey 29 Jan 18 7.09 Yr. Sharmila D’mello 30 Jun 22 2.67 Yr. Data below for ICICI Prudential Banking and Financial Services Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Financial Services 92.1% Industrials 0.18% Technology 0.07% Asset Allocation

Asset Class Value Cash 7.65% Equity 92.35% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Oct 08 | HDFCBANK21% ₹1,887 Cr 10,891,127 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 08 | ICICIBANK18% ₹1,619 Cr 13,445,003 Axis Bank Ltd (Financial Services)

Equity, Since 28 Feb 19 | 5322158% ₹730 Cr 7,188,596

↑ 173,125 State Bank of India (Financial Services)

Equity, Since 31 Oct 08 | SBIN6% ₹568 Cr 8,244,914

↑ 1,706,850 SBI Life Insurance Co Ltd (Financial Services)

Equity, Since 30 Sep 17 | SBILIFE5% ₹477 Cr 3,332,802

↑ 255,647 IndusInd Bank Ltd (Financial Services)

Equity, Since 30 Apr 24 | INDUSINDBK5% ₹433 Cr 4,371,007 HDFC Life Insurance Co Ltd (Financial Services)

Equity, Since 30 Sep 23 | HDFCLIFE4% ₹330 Cr 5,423,546

↑ 984,400 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 31 Jan 23 | KOTAKBANK3% ₹284 Cr 1,491,184

↓ -480,000 ICICI Lombard General Insurance Co Ltd (Financial Services)

Equity, Since 30 Sep 19 | ICICIGI3% ₹236 Cr 1,396,761

↑ 311,863 Max Financial Services Ltd (Financial Services)

Equity, Since 31 Aug 19 | 5002712% ₹169 Cr 1,697,397

↑ 34,116 2. Aditya Birla Sun Life Banking And Financial Services Fund

CAGR/Annualized return of 16.2% since its launch. Ranked 3 in Sectoral category. Return for 2024 was 8.7% , 2023 was 21.7% and 2022 was 11.5% . Aditya Birla Sun Life Banking And Financial Services Fund

Growth Launch Date 14 Dec 13 NAV (08 Apr 25) ₹54.61 ↑ 1.07 (2.00 %) Net Assets (Cr) ₹3,011 on 28 Feb 25 Category Equity - Sectoral AMC Birla Sun Life Asset Management Co Ltd Rating ☆☆☆☆☆ Risk High Expense Ratio 1.99 Sharpe Ratio -0.16 Information Ratio 0.14 Alpha Ratio -10.69 Min Investment 1,000 Min SIP Investment 1,000 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,760 31 Mar 22 ₹19,860 31 Mar 23 ₹20,711 31 Mar 24 ₹27,001 31 Mar 25 ₹30,038 Returns for Aditya Birla Sun Life Banking And Financial Services Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 8 Apr 25 Duration Returns 1 Month 4.6% 3 Month 0.4% 6 Month -3.3% 1 Year 4.9% 3 Year 12.5% 5 Year 24.1% 10 Year 15 Year Since launch 16.2% Historical performance (Yearly) on absolute basis

Year Returns 2023 8.7% 2022 21.7% 2021 11.5% 2020 16.8% 2019 1.1% 2018 14.9% 2017 -2.4% 2016 47.6% 2015 15.7% 2014 -0.5% Fund Manager information for Aditya Birla Sun Life Banking And Financial Services Fund

Name Since Tenure Dhaval Gala 26 Aug 15 9.52 Yr. Dhaval Joshi 21 Nov 22 2.28 Yr. Data below for Aditya Birla Sun Life Banking And Financial Services Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Financial Services 97.02% Technology 1.09% Asset Allocation

Asset Class Value Cash 1.89% Equity 98.11% Other 0% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Bank Ltd (Financial Services)

Equity, Since 31 Dec 13 | ICICIBANK20% ₹601 Cr 4,993,129 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Dec 13 | HDFCBANK19% ₹578 Cr 3,336,948 Bajaj Finance Ltd (Financial Services)

Equity, Since 30 Sep 16 | 5000347% ₹199 Cr 233,725 Axis Bank Ltd (Financial Services)

Equity, Since 31 Oct 18 | 5322157% ₹196 Cr 1,927,100 State Bank of India (Financial Services)

Equity, Since 31 Oct 17 | SBIN5% ₹162 Cr 2,351,492 Cholamandalam Financial Holdings Ltd (Financial Services)

Equity, Since 31 Jan 20 | CHOLAHLDNG4% ₹110 Cr 667,972 Shriram Finance Ltd (Financial Services)

Equity, Since 30 Jun 23 | SHRIRAMFIN3% ₹97 Cr 1,577,700 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 31 Jan 19 | KOTAKBANK3% ₹89 Cr 469,972 AU Small Finance Bank Ltd (Financial Services)

Equity, Since 30 Nov 23 | 5406112% ₹74 Cr 1,308,861 Repco Home Finance Ltd (Financial Services)

Equity, Since 31 Dec 13 | 5353222% ₹58 Cr 1,751,838

↓ -180,986 3. Invesco India Financial Services Fund

CAGR/Annualized return of 16% since its launch. Ranked 5 in Sectoral category. Return for 2024 was 19.8% , 2023 was 26% and 2022 was 12.8% . Invesco India Financial Services Fund

Growth Launch Date 14 Jul 08 NAV (08 Apr 25) ₹120.39 ↑ 2.28 (1.93 %) Net Assets (Cr) ₹1,094 on 28 Feb 25 Category Equity - Sectoral AMC Invesco Asset Management (India) Private Ltd Rating ☆☆☆☆ Risk High Expense Ratio 2.39 Sharpe Ratio -0.09 Information Ratio 0.58 Alpha Ratio -8.25 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹16,232 31 Mar 22 ₹18,053 31 Mar 23 ₹19,068 31 Mar 24 ₹26,174 31 Mar 25 ₹29,776 Returns for Invesco India Financial Services Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 8 Apr 25 Duration Returns 1 Month 4.3% 3 Month -3.5% 6 Month -4.4% 1 Year 7.2% 3 Year 15.6% 5 Year 23.7% 10 Year 15 Year Since launch 16% Historical performance (Yearly) on absolute basis

Year Returns 2023 19.8% 2022 26% 2021 12.8% 2020 14% 2019 2.4% 2018 21.2% 2017 -0.3% 2016 45.2% 2015 10.4% 2014 -2.1% Fund Manager information for Invesco India Financial Services Fund

Name Since Tenure Dhimant Kothari 1 Jun 18 6.75 Yr. Hiten Jain 19 May 20 4.79 Yr. Data below for Invesco India Financial Services Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Financial Services 94.38% Health Care 1.22% Technology 0.93% Asset Allocation

Asset Class Value Cash 3.47% Equity 96.53% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 09 | ICICIBANK21% ₹232 Cr 1,927,995 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jul 08 | HDFCBANK20% ₹217 Cr 1,251,578

↑ 131,127 Axis Bank Ltd (Financial Services)

Equity, Since 31 May 18 | 5322156% ₹66 Cr 645,964 State Bank of India (Financial Services)

Equity, Since 31 Aug 20 | SBIN5% ₹58 Cr 838,841 Cholamandalam Investment and Finance Co Ltd (Financial Services)

Equity, Since 31 Jul 17 | CHOLAFIN3% ₹35 Cr 248,287

↑ 21,739 Shriram Finance Ltd (Financial Services)

Equity, Since 28 Feb 25 | SHRIRAMFIN3% ₹32 Cr 518,214

↑ 518,214 PB Fintech Ltd (Financial Services)

Equity, Since 30 Nov 21 | 5433903% ₹30 Cr 202,712 HDFC Asset Management Co Ltd (Financial Services)

Equity, Since 31 Jul 24 | HDFCAMC3% ₹29 Cr 78,652

↓ -30,996 Muthoot Finance Ltd (Financial Services)

Equity, Since 31 Jul 24 | 5333983% ₹28 Cr 129,828

↑ 14,519 Karur Vysya Bank Ltd (Financial Services)

Equity, Since 30 Sep 22 | 5900032% ₹27 Cr 1,332,287 4. UTI Banking and Financial Services Fund

CAGR/Annualized return of 14.5% since its launch. Ranked 20 in Sectoral category. Return for 2024 was 11.1% , 2023 was 19.5% and 2022 was 15.1% . UTI Banking and Financial Services Fund

Growth Launch Date 7 Apr 04 NAV (08 Apr 25) ₹171.851 ↑ 3.55 (2.11 %) Net Assets (Cr) ₹1,107 on 28 Feb 25 Category Equity - Sectoral AMC UTI Asset Management Company Ltd Rating ☆☆☆ Risk High Expense Ratio 2.28 Sharpe Ratio -0.04 Information Ratio 0.29 Alpha Ratio -7.9 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,413 31 Mar 22 ₹18,931 31 Mar 23 ₹20,398 31 Mar 24 ₹25,837 31 Mar 25 ₹29,643 Returns for UTI Banking and Financial Services Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 8 Apr 25 Duration Returns 1 Month 5.2% 3 Month 2% 6 Month -1% 1 Year 8.4% 3 Year 13.7% 5 Year 23.7% 10 Year 15 Year Since launch 14.5% Historical performance (Yearly) on absolute basis

Year Returns 2023 11.1% 2022 19.5% 2021 15.1% 2020 14.3% 2019 -5.3% 2018 11.6% 2017 -6.8% 2016 43.5% 2015 13% 2014 -11.3% Fund Manager information for UTI Banking and Financial Services Fund

Name Since Tenure Preethi S 2 May 22 2.83 Yr. Data below for UTI Banking and Financial Services Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Financial Services 95.39% Technology 0.08% Asset Allocation

Asset Class Value Cash 4.54% Equity 95.46% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Bank Ltd (Financial Services)

Equity, Since 30 Apr 04 | ICICIBANK18% ₹202 Cr 1,675,000 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Mar 09 | HDFCBANK16% ₹174 Cr 1,005,927 Axis Bank Ltd (Financial Services)

Equity, Since 30 Jun 18 | 5322156% ₹68 Cr 670,000 Shriram Finance Ltd (Financial Services)

Equity, Since 31 Jan 24 | SHRIRAMFIN5% ₹61 Cr 983,680 India Shelter Finance Corporation Ltd (Financial Services)

Equity, Since 31 Dec 23 | INDIASHLTR5% ₹52 Cr 714,617 State Bank of India (Financial Services)

Equity, Since 28 Feb 18 | SBIN5% ₹52 Cr 750,000 Bajaj Finance Ltd (Financial Services)

Equity, Since 30 Nov 19 | 5000344% ₹49 Cr 57,257

↑ 15,000 HDFC Life Insurance Co Ltd (Financial Services)

Equity, Since 31 Jul 24 | HDFCLIFE4% ₹42 Cr 697,890 Karur Vysya Bank Ltd (Financial Services)

Equity, Since 31 Dec 18 | 5900033% ₹38 Cr 1,876,541 Max Financial Services Ltd (Financial Services)

Equity, Since 30 Sep 22 | 5002713% ₹31 Cr 314,018 5. Sundaram Financial Services Opportunities Fund

CAGR/Annualized return of 14.3% since its launch. Ranked 23 in Sectoral category. Return for 2024 was 7.1% , 2023 was 31.1% and 2022 was 16.8% . Sundaram Financial Services Opportunities Fund

Growth Launch Date 10 Jun 08 NAV (08 Apr 25) ₹94.3709 ↑ 2.08 (2.26 %) Net Assets (Cr) ₹1,325 on 28 Feb 25 Category Equity - Sectoral AMC Sundaram Asset Management Company Ltd Rating ☆☆☆ Risk High Expense Ratio 2.24 Sharpe Ratio -0.27 Information Ratio 0.86 Alpha Ratio -10.88 Min Investment 100,000 Min SIP Investment 100 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,095 31 Mar 22 ₹18,755 31 Mar 23 ₹20,630 31 Mar 24 ₹28,468 31 Mar 25 ₹30,814 Returns for Sundaram Financial Services Opportunities Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 8 Apr 25 Duration Returns 1 Month 3.7% 3 Month 0.3% 6 Month -4.1% 1 Year 3.4% 3 Year 16.4% 5 Year 25% 10 Year 15 Year Since launch 14.3% Historical performance (Yearly) on absolute basis

Year Returns 2023 7.1% 2022 31.1% 2021 16.8% 2020 15.3% 2019 2.7% 2018 26.4% 2017 -3.7% 2016 33.3% 2015 12.8% 2014 -9% Fund Manager information for Sundaram Financial Services Opportunities Fund

Name Since Tenure Rohit Seksaria 30 Dec 17 7.17 Yr. Ashish Aggarwal 1 Jan 22 3.16 Yr. Data below for Sundaram Financial Services Opportunities Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Financial Services 94.17% Asset Allocation

Asset Class Value Cash 3.84% Equity 95.06% Debt 1.09% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Dec 08 | HDFCBANK18% ₹241 Cr 1,390,056

↑ 7,660 ICICI Bank Ltd (Financial Services)

Equity, Since 30 Jun 10 | ICICIBANK12% ₹161 Cr 1,339,673

↑ 10,584 Axis Bank Ltd (Financial Services)

Equity, Since 28 Feb 10 | 53221510% ₹128 Cr 1,259,449 State Bank of India (Financial Services)

Equity, Since 31 Dec 08 | SBIN5% ₹65 Cr 949,469

↑ 64,175 Shriram Finance Ltd (Financial Services)

Equity, Since 30 Sep 23 | SHRIRAMFIN5% ₹64 Cr 1,036,445 IndusInd Bank Ltd (Financial Services)

Equity, Since 30 Jun 20 | INDUSINDBK4% ₹60 Cr 601,270 Bajaj Finance Ltd (Financial Services)

Equity, Since 31 Jul 18 | 5000344% ₹58 Cr 68,102

↓ -5,238 Ujjivan Small Finance Bank Ltd Ordinary Shares (Financial Services)

Equity, Since 31 May 24 | UJJIVANSFB4% ₹49 Cr 15,383,384

↑ 412,458 CSB Bank Ltd Ordinary Shares (Financial Services)

Equity, Since 30 Jun 20 | CSBBANK4% ₹48 Cr 1,697,765

↑ 3,396 PNB Housing Finance Ltd (Financial Services)

Equity, Since 31 Jul 24 | PNBHOUSING4% ₹47 Cr 616,144

↑ 39,470

یہاں فراہم کردہ معلومات کے درست ہونے کو یقینی بنانے کے لیے تمام کوششیں کی گئی ہیں۔ تاہم، ڈیٹا کی درستگی کے حوالے سے کوئی ضمانت نہیں دی جاتی ہے۔ براہ کرم کوئی بھی سرمایہ کاری کرنے سے پہلے اسکیم کی معلومات کے دستاویز کے ساتھ تصدیق کریں۔