+91-22-48913909

+91-22-48913909

Table of Contents

بہترین متوازن میوچل فنڈز انڈیا 2022

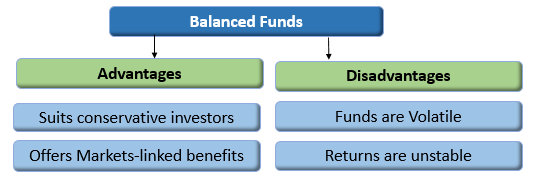

اوپرمتوازن فنڈ ہیںباہمی چندہ جو اپنے اثاثوں کا 65 فیصد سے زیادہ سرمایہ کاری کرتے ہیں۔ایکوئٹیز اور قرض کے آلات میں بقیہ اثاثے اچھی مجموعی واپسی کے لیے۔ متوازن میوچل فنڈز ان سرمایہ کاروں کے لیے فائدہ مند ہیں جو ایک لینے کے لیے تیار ہیں۔مارکیٹ خطرے کے ساتھ ساتھ کچھ مقررہ واپسی کی تلاش میں۔ ایکوئٹی اور اسٹاک میں لگائے گئے اثاثے مارکیٹ سے منسلک منافع پیش کرتے ہیں جبکہ قرض کے آلات میں لگائے گئے اثاثے مقررہ منافع پیش کرتے ہیں۔ ایکویٹی اور قرض دونوں کا مجموعہ ہونے کی وجہ سے، سرمایہ کاروں کو بہت محتاط رہنا چاہیے۔سرمایہ کاری ان فنڈز میں. سرمایہ کاروں کو مشورہ دیا جاتا ہے کہ وہ متوازن میوچل فنڈز میں سرمایہ کاری کرنے سے پہلے اعلیٰ متوازن فنڈز تلاش کریں۔ ہم نے ذیل میں اعلیٰ متوازن میوچل فنڈز کی فہرست دی ہے۔

Talk to our investment specialist

ہندوستان میں 2022 - 2023 میں سرمایہ کاری کے لیے سرفہرست 7 متوازن میوچل فنڈز

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) Sundaram Equity Hybrid Fund Growth ₹135.137

↑ 0.78 ₹1,954 0.5 10.5 27.1 16 14.2 SBI Dynamic Asset Allocation Fund Growth ₹15.9463

↑ 0.03 ₹655 3.9 6.2 25.1 6.9 8.3 Baroda Pioneer Hybrid Equity Fund Growth ₹81.2894

↑ 0.36 ₹389 -3.5 -0.8 14.8 14.3 11.2 IDBI Hybrid Equity Fund Growth ₹17.1253

↓ -0.01 ₹179 7.8 9.8 12.1 14.4 7.1 DSP BlackRock Equity and Bond Fund Growth ₹331.292

↓ -1.04 ₹9,795 -2.6 -5.4 11.4 12.6 18.9 17.7 DSP BlackRock Dynamic Asset Allocation Fund Growth ₹26.105

↓ -0.04 ₹3,106 -0.5 -1.9 9.4 9.7 11.9 12.4 Essel Regular Savings Fund Growth ₹26.1285

↑ 0.02 ₹36 0.8 3.8 9.4 5.4 5.8 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 31 Dec 21

ٹاپ 7 بیلنسڈ فنڈز

(Erstwhile Sundaram Balanced Fund) The scheme seeks to generate capital appreciation and current income through a judicious mix of investments in equities and fixed income securities. Sundaram Equity Hybrid Fund is a Hybrid - Hybrid Equity fund was launched on 23 Jun 00. It is a fund with Moderately High risk and has given a Below is the key information for Sundaram Equity Hybrid Fund Returns up to 1 year are on The objective of the fund will be to provide investors with an opportunity to invest in a portfolio of a mix of equity and equity related securities and fixed income instruments. The allocation between fixed income and equity instruments will be managed dynamically so as to provide investors with long term capital appreciation However, there can be no assurance that the investment objective of the Scheme will be achieved. SBI Dynamic Asset Allocation Fund is a Hybrid - Dynamic Allocation fund was launched on 26 Mar 15. It is a fund with Moderately High risk and has given a Below is the key information for SBI Dynamic Asset Allocation Fund Returns up to 1 year are on (Erstwhile Baroda Pioneer Balance Fund) The scheme is targeted for long-term capital appreciation along with stability through a well balanced portfolio comprising of equity,equity related instruments, money market instrument and debt securities. Baroda Pioneer Hybrid Equity Fund is a Hybrid - Hybrid Equity fund was launched on 12 Sep 03. It is a fund with Moderately High risk and has given a Below is the key information for Baroda Pioneer Hybrid Equity Fund Returns up to 1 year are on (Erstwhile IDBI Prudence Fund) The investment objective of the scheme would be to generate opportunities for capital appreciation along with income by investing in a diversified basket of equity and equity related instruments, debt and money market instruments. However, there can be no assurance that the investment objective of the scheme will be realized. IDBI Hybrid Equity Fund is a Hybrid - Hybrid Equity fund was launched on 24 Oct 16. It is a fund with Moderately High risk and has given a Below is the key information for IDBI Hybrid Equity Fund Returns up to 1 year are on Seeks to generate long term capital appreciation and current income from a portfolio constituted of equity and equity related securities as well as fixed income securities. DSP BlackRock Equity and Bond Fund is a Hybrid - Hybrid Equity fund was launched on 27 May 99. It is a fund with Moderately High risk and has given a Below is the key information for DSP BlackRock Equity and Bond Fund Returns up to 1 year are on The investment objective of the Scheme is to seek capital appreciation by managing the asset allocation between specified equity mutual fund schemes and debt mutual fund schemes of DSP BlackRock Mutual Fund. The Scheme will dynamically manage the asset allocation between the specified equity mutual funds schemes and debt mutual funds schemes of DSP BlackRock Mutual Fund based on the relative valuation of equity and debt markets. The Scheme may also invest a certain portion of its corpus in money market securities and/ or money market/liquid schemes of DSP BlackRock Mutual Fund, in order to meet liquidity requirements from time to time. DSP BlackRock Dynamic Asset Allocation Fund is a Hybrid - Dynamic Allocation fund was launched on 6 Feb 14. It is a fund with Moderate risk and has given a Below is the key information for DSP BlackRock Dynamic Asset Allocation Fund Returns up to 1 year are on (Erstwhile Essel Income Plus Fund) To generate regular income through a portfolio of predominantly high quality fixed income securities and with a marginal exposure to equity & equity related securities. However, there can be no assurance that the investment objective of the scheme will be achieved. The scheme does not assure or guarantee any returns. Essel Regular Savings Fund is a Hybrid - Hybrid Debt fund was launched on 29 Jul 10. It is a fund with Moderate risk and has given a Below is the key information for Essel Regular Savings Fund Returns up to 1 year are on 1. Sundaram Equity Hybrid Fund

CAGR/Annualized return of 12.8% since its launch. Ranked 25 in Hybrid Equity category. . Sundaram Equity Hybrid Fund

Growth Launch Date 23 Jun 00 NAV (31 Dec 21) ₹135.137 ↑ 0.78 (0.58 %) Net Assets (Cr) ₹1,954 on 30 Nov 21 Category Hybrid - Hybrid Equity AMC Sundaram Asset Management Company Ltd Rating ☆☆ Risk Moderately High Expense Ratio 2.18 Sharpe Ratio 2.64 Information Ratio -0.12 Alpha Ratio 5.81 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹14,627 Returns for Sundaram Equity Hybrid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 1.8% 3 Month 0.5% 6 Month 10.5% 1 Year 27.1% 3 Year 16% 5 Year 14.2% 10 Year 15 Year Since launch 12.8% Historical performance (Yearly) on absolute basis

Year Returns 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 Fund Manager information for Sundaram Equity Hybrid Fund

Name Since Tenure Data below for Sundaram Equity Hybrid Fund as on 30 Nov 21

Asset Allocation

Asset Class Value Equity Sector Allocation

Sector Value Debt Sector Allocation

Sector Value Credit Quality

Rating Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 2. SBI Dynamic Asset Allocation Fund

CAGR/Annualized return of 7.7% since its launch. . SBI Dynamic Asset Allocation Fund

Growth Launch Date 26 Mar 15 NAV (02 Jul 21) ₹15.9463 ↑ 0.03 (0.18 %) Net Assets (Cr) ₹655 on 31 May 21 Category Hybrid - Dynamic Allocation AMC SBI Funds Management Private Limited Rating Risk Moderately High Expense Ratio 2.07 Sharpe Ratio 2.59 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹13,256 Returns for SBI Dynamic Asset Allocation Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 1% 3 Month 3.9% 6 Month 6.2% 1 Year 25.1% 3 Year 6.9% 5 Year 8.3% 10 Year 15 Year Since launch 7.7% Historical performance (Yearly) on absolute basis

Year Returns 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 Fund Manager information for SBI Dynamic Asset Allocation Fund

Name Since Tenure Data below for SBI Dynamic Asset Allocation Fund as on 31 May 21

Asset Allocation

Asset Class Value Equity Sector Allocation

Sector Value Debt Sector Allocation

Sector Value Credit Quality

Rating Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 3. Baroda Pioneer Hybrid Equity Fund

CAGR/Annualized return of 12% since its launch. Ranked 21 in Hybrid Equity category. . Baroda Pioneer Hybrid Equity Fund

Growth Launch Date 12 Sep 03 NAV (11 Mar 22) ₹81.2894 ↑ 0.36 (0.45 %) Net Assets (Cr) ₹389 on 31 Jan 22 Category Hybrid - Hybrid Equity AMC Baroda Pioneer Asset Management Co. Ltd. Rating ☆☆☆ Risk Moderately High Expense Ratio 2.48 Sharpe Ratio 2.59 Information Ratio -0.07 Alpha Ratio 6.53 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹15,320 Returns for Baroda Pioneer Hybrid Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month -2.8% 3 Month -3.5% 6 Month -0.8% 1 Year 14.8% 3 Year 14.3% 5 Year 11.2% 10 Year 15 Year Since launch 12% Historical performance (Yearly) on absolute basis

Year Returns 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 Fund Manager information for Baroda Pioneer Hybrid Equity Fund

Name Since Tenure Data below for Baroda Pioneer Hybrid Equity Fund as on 31 Jan 22

Asset Allocation

Asset Class Value Equity Sector Allocation

Sector Value Debt Sector Allocation

Sector Value Credit Quality

Rating Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 4. IDBI Hybrid Equity Fund

CAGR/Annualized return of 8.3% since its launch. . IDBI Hybrid Equity Fund

Growth Launch Date 24 Oct 16 NAV (28 Jul 23) ₹17.1253 ↓ -0.01 (-0.05 %) Net Assets (Cr) ₹179 on 30 Jun 23 Category Hybrid - Hybrid Equity AMC IDBI Asset Management Limited Rating Risk Moderately High Expense Ratio 2.52 Sharpe Ratio 1.03 Information Ratio -1.03 Alpha Ratio -0.26 Min Investment 5,000 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹14,275 31 Mar 22 ₹16,558 31 Mar 23 ₹16,049 Returns for IDBI Hybrid Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 2.1% 3 Month 7.8% 6 Month 9.8% 1 Year 12.1% 3 Year 14.4% 5 Year 7.1% 10 Year 15 Year Since launch 8.3% Historical performance (Yearly) on absolute basis

Year Returns 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 Fund Manager information for IDBI Hybrid Equity Fund

Name Since Tenure Data below for IDBI Hybrid Equity Fund as on 30 Jun 23

Asset Allocation

Asset Class Value Equity Sector Allocation

Sector Value Debt Sector Allocation

Sector Value Credit Quality

Rating Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 5. DSP BlackRock Equity and Bond Fund

CAGR/Annualized return of 14.5% since its launch. Ranked 9 in Hybrid Equity category. Return for 2024 was 17.7% , 2023 was 25.3% and 2022 was -2.7% . DSP BlackRock Equity and Bond Fund

Growth Launch Date 27 May 99 NAV (09 Apr 25) ₹331.292 ↓ -1.04 (-0.31 %) Net Assets (Cr) ₹9,795 on 28 Feb 25 Category Hybrid - Hybrid Equity AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.79 Sharpe Ratio 0.37 Information Ratio 0.55 Alpha Ratio 7.45 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹15,199 31 Mar 22 ₹17,138 31 Mar 23 ₹17,023 31 Mar 24 ₹21,867 31 Mar 25 ₹25,577 Returns for DSP BlackRock Equity and Bond Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 1.4% 3 Month -2.6% 6 Month -5.4% 1 Year 11.4% 3 Year 12.6% 5 Year 18.9% 10 Year 15 Year Since launch 14.5% Historical performance (Yearly) on absolute basis

Year Returns 2023 17.7% 2022 25.3% 2021 -2.7% 2020 24.2% 2019 17% 2018 14.2% 2017 -5.1% 2016 27.6% 2015 8.3% 2014 4.8% Fund Manager information for DSP BlackRock Equity and Bond Fund

Name Since Tenure Abhishek Singh 1 Mar 24 1 Yr. Shantanu Godambe 1 Aug 24 0.58 Yr. Data below for DSP BlackRock Equity and Bond Fund as on 28 Feb 25

Asset Allocation

Asset Class Value Cash 6.04% Equity 68.79% Debt 25.17% Equity Sector Allocation

Sector Value Financial Services 31.37% Consumer Cyclical 8.45% Health Care 7.7% Consumer Defensive 6.17% Basic Materials 4.71% Technology 3.74% Industrials 2.87% Communication Services 1.45% Utility 1.35% Energy 1% Debt Sector Allocation

Sector Value Government 16.63% Corporate 8.54% Cash Equivalent 6.04% Credit Quality

Rating Value AA 9.93% AAA 90.07% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jan 14 | HDFCBANK8% ₹740 Cr 4,270,582 ICICI Bank Ltd (Financial Services)

Equity, Since 30 Nov 15 | ICICIBANK5% ₹444 Cr 3,688,426 7.34% Govt Stock 2064

Sovereign Bonds | -4% ₹363 Cr 34,500,000

↑ 5,000,000 Mahindra & Mahindra Ltd (Consumer Cyclical)

Equity, Since 31 Mar 24 | M&M3% ₹341 Cr 1,317,286

↑ 96,216 Axis Bank Ltd (Financial Services)

Equity, Since 30 Sep 18 | 5322153% ₹328 Cr 3,227,520

↑ 504,984 Cipla Ltd (Healthcare)

Equity, Since 31 May 24 | 5000873% ₹304 Cr 2,156,479 SBI Life Insurance Co Ltd (Financial Services)

Equity, Since 30 Apr 24 | SBILIFE3% ₹284 Cr 1,984,938

↑ 145,622 7.14% Madhya Pradesh SDL 2043

Sovereign Bonds | -3% ₹258 Cr 25,000,000 ITC Ltd (Consumer Defensive)

Equity, Since 31 Mar 24 | ITC3% ₹250 Cr 6,335,914

↑ 889,196 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 31 Jul 24 | KOTAKBANK2% ₹241 Cr 1,268,082 6. DSP BlackRock Dynamic Asset Allocation Fund

CAGR/Annualized return of 9% since its launch. Return for 2024 was 12.4% , 2023 was 17.1% and 2022 was 0.1% . DSP BlackRock Dynamic Asset Allocation Fund

Growth Launch Date 6 Feb 14 NAV (09 Apr 25) ₹26.105 ↓ -0.04 (-0.14 %) Net Assets (Cr) ₹3,106 on 28 Feb 25 Category Hybrid - Dynamic Allocation AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆ Risk Moderate Expense Ratio 1.89 Sharpe Ratio 0.26 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹13,067 31 Mar 22 ₹13,846 31 Mar 23 ₹13,874 31 Mar 24 ₹16,631 31 Mar 25 ₹18,722 Returns for DSP BlackRock Dynamic Asset Allocation Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month 0.9% 3 Month -0.5% 6 Month -1.9% 1 Year 9.4% 3 Year 9.7% 5 Year 11.9% 10 Year 15 Year Since launch 9% Historical performance (Yearly) on absolute basis

Year Returns 2023 12.4% 2022 17.1% 2021 0.1% 2020 9.3% 2019 12.9% 2018 8.8% 2017 3.6% 2016 12.5% 2015 7.7% 2014 4.5% Fund Manager information for DSP BlackRock Dynamic Asset Allocation Fund

Name Since Tenure Rohit Singhania 1 Nov 23 1.41 Yr. Dhaval Gada 1 Sep 22 2.58 Yr. Shantanu Godambe 1 Jan 25 0.24 Yr. Kaivalya Nadkarni 1 Oct 24 0.5 Yr. Data below for DSP BlackRock Dynamic Asset Allocation Fund as on 28 Feb 25

Asset Allocation

Asset Class Value Cash 39.98% Equity 29.33% Debt 30.69% Equity Sector Allocation

Sector Value Financial Services 24.33% Energy 7.62% Industrials 6.7% Basic Materials 6.69% Utility 4.58% Consumer Cyclical 4.51% Consumer Defensive 3.67% Technology 2.82% Health Care 2.34% Communication Services 1.67% Real Estate 0.58% Debt Sector Allocation

Sector Value Cash Equivalent 39.98% Corporate 16.6% Government 14.09% Credit Quality

Rating Value AA 13.32% AAA 86.68% Top Securities Holdings / Portfolio

Name Holding Value Quantity Future on HDFC Bank Ltd

Derivatives | -5% -₹161 Cr 925,100

↑ 29,700 HDFC Bank Ltd (Financial Services)

Equity, Since 28 Feb 18 | HDFCBANK5% ₹160 Cr 925,758

↑ 29,700 7.32% Govt Stock 2030

Sovereign Bonds | -4% ₹110 Cr 10,500,000 Future on Adani Enterprises Ltd

Derivatives | -3% -₹92 Cr 436,500 Adani Enterprises Ltd (Energy)

Equity, Since 30 Apr 23 | 5125993% ₹91 Cr 436,500 State Bank of India (Financial Services)

Equity, Since 31 Mar 23 | SBIN3% ₹91 Cr 1,324,635

↓ -206,548 Axis Bank Ltd (Financial Services)

Equity, Since 30 Sep 18 | 5322153% ₹88 Cr 867,084

↑ 112,622 Future on Tata Power Co Ltd

Derivatives | -2% -₹70 Cr 2,070,900 Tata Power Co Ltd (Utilities)

Equity, Since 31 Oct 20 | 5004002% ₹70 Cr 2,070,900 Future on State Bank of India

Derivatives | -2% -₹65 Cr 937,500 7. Essel Regular Savings Fund

CAGR/Annualized return of 6.9% since its launch. Ranked 52 in Hybrid Debt category. . Essel Regular Savings Fund

Growth Launch Date 29 Jul 10 NAV (14 Nov 24) ₹26.1285 ↑ 0.02 (0.06 %) Net Assets (Cr) ₹36 on 30 Sep 24 Category Hybrid - Hybrid Debt AMC Essel Funds Management Company Ltd Rating ☆ Risk Moderate Expense Ratio 1.95 Sharpe Ratio 1.55 Information Ratio -0.87 Alpha Ratio -0.73 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹11,390 31 Mar 22 ₹11,883 31 Mar 23 ₹12,190 31 Mar 24 ₹13,474 Returns for Essel Regular Savings Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 31 Dec 21 Duration Returns 1 Month -0.8% 3 Month 0.8% 6 Month 3.8% 1 Year 9.4% 3 Year 5.4% 5 Year 5.8% 10 Year 15 Year Since launch 6.9% Historical performance (Yearly) on absolute basis

Year Returns 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 Fund Manager information for Essel Regular Savings Fund

Name Since Tenure Data below for Essel Regular Savings Fund as on 30 Sep 24

Asset Allocation

Asset Class Value Equity Sector Allocation

Sector Value Debt Sector Allocation

Sector Value Credit Quality

Rating Value Top Securities Holdings / Portfolio

Name Holding Value Quantity

بیلنسڈ فنڈز میں آن لائن سرمایہ کاری کیسے کریں؟

Fincash.com پر لائف ٹائم کے لیے مفت انویسٹمنٹ اکاؤنٹ کھولیں۔

اپنی رجسٹریشن اور KYC کا عمل مکمل کریں۔

دستاویزات اپ لوڈ کریں (PAN، آدھار، وغیرہ)۔اور، آپ سرمایہ کاری کے لیے تیار ہیں!

یہاں فراہم کردہ معلومات کے درست ہونے کو یقینی بنانے کے لیے تمام کوششیں کی گئی ہیں۔ تاہم، ڈیٹا کی درستگی کے حوالے سے کوئی ضمانت نہیں دی جاتی ہے۔ براہ کرم کوئی بھی سرمایہ کاری کرنے سے پہلے اسکیم کی معلومات کے دستاویز کے ساتھ تصدیق کریں۔