Fincash » Coronavirus- A Guide to Investors » Coronavirus Outbreak: RBI Policy

Table of Contents

Coronavirus Outbreak: Loan EMIs on hold, No RBI cuts repo rate by 75 bps, injects liquidity

The Reserve Bank (RBI) of India joined the big fight on 27th March 2020 (Friday) with a host of measures aimed at minimising the damage from Covid-19. RBI responded to Coronavirus with cutting a whopping 75 Basis Points in the repo rate, bringing it to a mere 4.4%.

This is the lowest ever fall of the repo rate. Previously it had fallen to 4.74% in April 2009 during the Global Financial Crisis.

What’s more? The central bank also cut the Cash Reserve Ratio (CRR) by 100 Basis points to 3% from March 28, 2020. This will unlock Rs. 1.37 lakh crore liquidity in the banking system. The reverse repo rate was lowered by a great 90 basis points.

EMIs and Loans on Hold

RBI (Reserve Bank of India) has announced that banks are permitted to allow a three month moratorium on EMI’s. The RBI has taken a good initiative, which will give relief to the EMI payers.

As of now, many people are financially affected due to the lockdown implementation in pan India to prevent coronavirus.

Interest Rate by Deferring 3 Months EMI

Under the relief package, the government has instructed the banks to give a grace period for the borrowers of three months. You don't have to pay loans for the upcoming three months. But, it doesn't mean that the three months EMI has been waived. It is the only grace period by the government not a wavier of the loan.

On the other hand, the banks are likely to charge interest for three months on the unpaid amount. However, people have two options, either they choose to skip the loans for 3 months or increase 3 months in the tenure.

For instance, you have deferred your EMI's and your monthly amount is Rs. 1000 and the bank is charging the outstanding at the rate of 10%, then you will end up paying Rs. 25 extra on your EMI. The interest burden for a three-month moratorium is equally divided into future EMI's.

The same goes with credit cards, the dues payable on credit cards will also get three month period of time. But, if you choose to pay the Credit Card Bill after three months then it will be charged at the rate of 6-12% and you will end up paying hefty interest costs.

Massive Repo Rate Cut

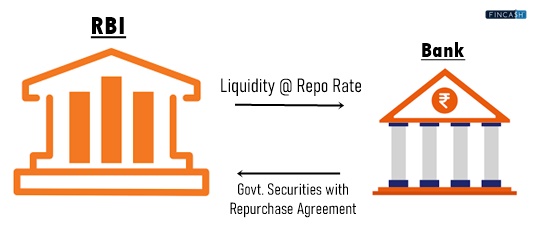

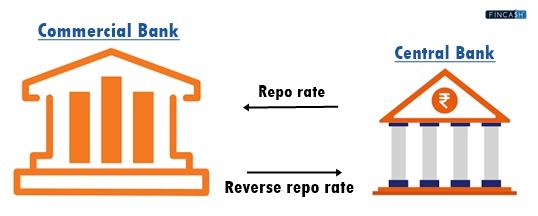

The rate at which the central bank lends money to other commercial banks during a shortfall of funds is called Repo rate. While the reverse repo rate is the rate at which RBI borrows funds from other commercial banks, Here the commercial banks keep their excess money with RBI for a short period of time.

Furthermore, the Cash Reserve Ratio (CRR) is that the percentage of total deposits that are required to be kept by banks in vaults and given to customers when the need arises. Banks are exempted from getting any interest on the money. This allows the RBI to maintain a level of control on the money supply and liquidity in the Economy. If the CRR is lower, the liquidity will be higher with banks. This goes into lending, investment, etc.

The RBI has now voted for the interest rate cut, which in turn brought the repo rate down to 4.4% from the previous rate of 5.15%. The reverse repo rate was also reduced to 90 basis points to a mere 4% to elevate the economy.

These cuts will release a huge amount of Rs.1.37 lakh crore into the economy to help stabilize the current lockdown.

Talk to our investment specialist

Liquidity Injection

The RBI governor has also announced a three-way liquidity injection related to TLTRO, CRR and MLCR.

An auction of long-term repo operation for a 3-year tenor amounting Rs. 1.00,000 crore at the Floating Rate was announced. Alongside, the accommodation under the Marginal Standing Facility will be increased from 2% to 3% on 27th March, 2020 and will go on till June 30, 2020. This will help with the release of Rs. 1.37 lakh crore into the system.

Governor Shakitkanta Das assured to support the economy as long as it required. He delivered his message saying that tough times never last, only tough people and institutions do. The RBI is at work and at mission mode. They will do everything required to mitigate the effects of Covid-19 pandemic.

Prior to this statement, he also said we enough reserves are available to defend the crisis.

RBI is working on other monetary operations for better liquidity management, but it is difficult to maintain the banking sector healthy in the midst of coronavirus.

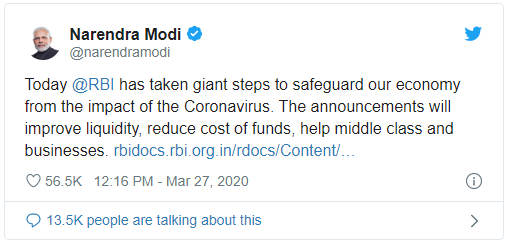

PM Narendra Modi reacts to RBI measures:

Conclusion

With the drastic measures declared by the RBI, we can expect a boost in the Economic Growth of our country. We can expect a stabilisation during the current situation and growth soon after the lockdown.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.