Table of Contents

When Should I Start Investing? Now or Wait?

A lot of investors face this dilemma of "when to start Investing?". Should I wait for a Market correction? The news and a lot of people seem to be saying that the market is "high", "overvalued", "extended", etc. It may be wise to wait and let it cool off and then invest. Obviously, the starting point matters a lot!

When the market is on an upswing, nobody really worries, however when the market has been going up for a while, this is where most of the queries come in. Also when the markets are in a downturn, then also, since most investors expect the markets to go down further.

So, is marking-timing all that important? Does it make sense to wait, watch & invest?

Let's find out the answers to some of the questions above.

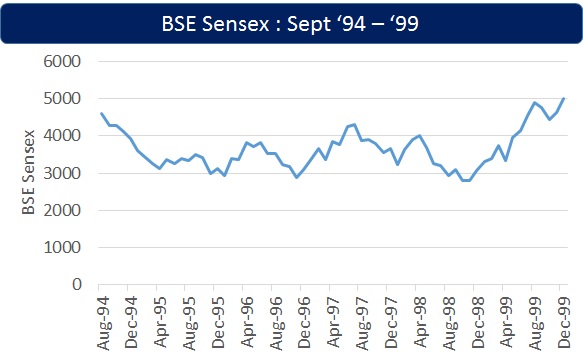

Look at the graph below...

This was the worst period to get into the equity markets! The investor who got in around September 1994 had to wait nearly 5 years to gain the lost value! But we know that smart investors cost average, they are the ones who keep investing regularly.

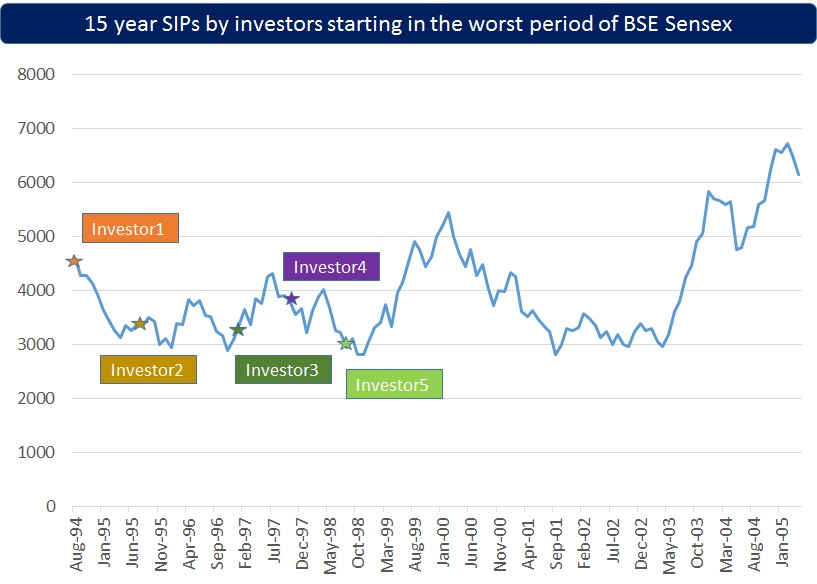

So, we analysed investors who invested in a SIP starting from the worst time (September '94) for a period of 15 years. We also took investors who started investing in this very bad period, one year apart.

The above were the 5 investors who started their SIPs in the worst period, one investor incidentally started at the end of the worst period!

Talk to our investment specialist

So, what were their returns like? Have a look at the below :

| Starting Period | Annualized Returns | |

|---|---|---|

| Investor 1 | Sep-94 | 15-6% |

| Investor 2 | Sep-95 | 16.7% |

| Investor 3 | Sep-96 | 13.4% |

| Investor 4 | Sep-97 | 13.9% |

| Investor 5 | Sep-98 | 13.2% |

So, the investor who started at the worst time in fact earned the 2nd highest return among all of them! The one who stayed away the longest earned the lowest!

So, what do we learn from this? Clearly, what is most important is spending time in the market, secondly, do not time the market! in the long run, it is important to invest regularly and stay invested, this will give you returns!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.