Fincash » Investment Plan » Investing Secrets from John Bogle

Table of Contents

Top 5 Investing Secrets from Investment Tycoon John Bogle

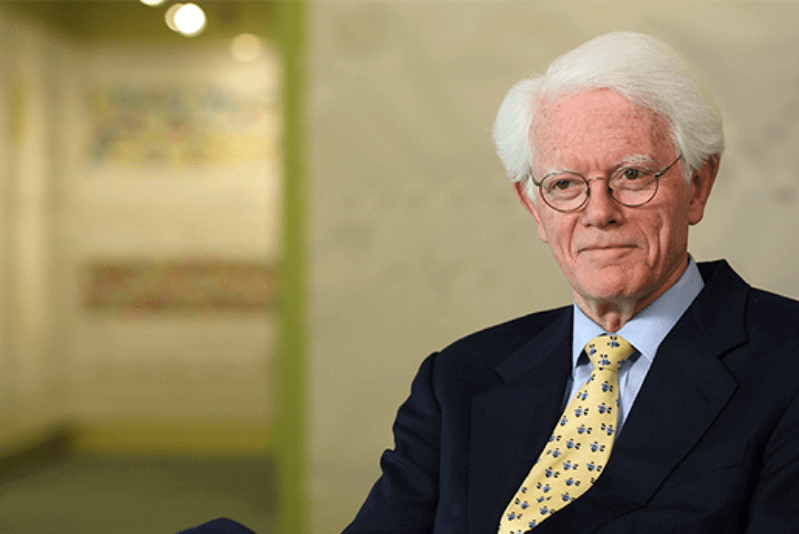

John Clifton Bogle was an American investor, business tycoon and a philanthropist. He was the founder and the CEO of the Vanguard Group of Investment Companies, which grew to hold $4.9 trillion under his management. The company created the first index mutual fund in 1975.

John Bogle was always on the forefront when it came to giving out Investing advice. He was the author of best-selling book - ‘Common Sense on Mutual Funds: New Imperatives for the Intelligent Investor’ in 1999. This book is considered a classic within the investment community.

| Details | Description |

|---|---|

| Name | John Clifton Bogle |

| Birthdate | May 8, 1929 |

| Birthplace | Montclair, New Jersey, U.S. |

| Death date | January 16, 2019 (aged 89) Bryn Mawr, Pennsylvania, U.S. |

| Occupation | Investor, business magnate, and philanthropist |

| Net worth | US$180 million (2019) |

| Nationality | American |

| Alma mater | Princeton University |

His empire was built on investing and he sternly believed in it. According to a recent report, Mr Bogle invested 100% of his money in Vanguard Funds. In 2015, Mr Bogle allowed the masses to get a peek into his retirement Portfolio allocation.

This had shifted towards a 50/50 allocation with 50% in equities and 50% in Bonds. Prior to this, he had followed the standard allocation of 60/40. Mr Bogle had also revealed that his non-retirement portfolio had an Asset Allocation of 80% bonds and 20% stocks.

John. C. Bogle passed away on January 16, 2019, leaving behind an investment legacy and a successful investment empire.

1. Investing is a Must

John Bogle always said the biggest mistake anyone can make is to not get involved with investments. It may not be always a winning situation, but if you don’t invest, you will definitely lose.

He always believed the money you invest today will yield better returns in the future. No one would like to be a loser, then by not investing now. Investors are often worried about the fluctuations in the stock Market. To this Mr Bogle always said that the risk investors face is not the short-term fluctuations of share prices, but in the little returns, one’s Capital accumulates.

Investment should surpass every barrier be it age, class, race, language or even religion.

Talk to our investment specialist

2. Time is Money

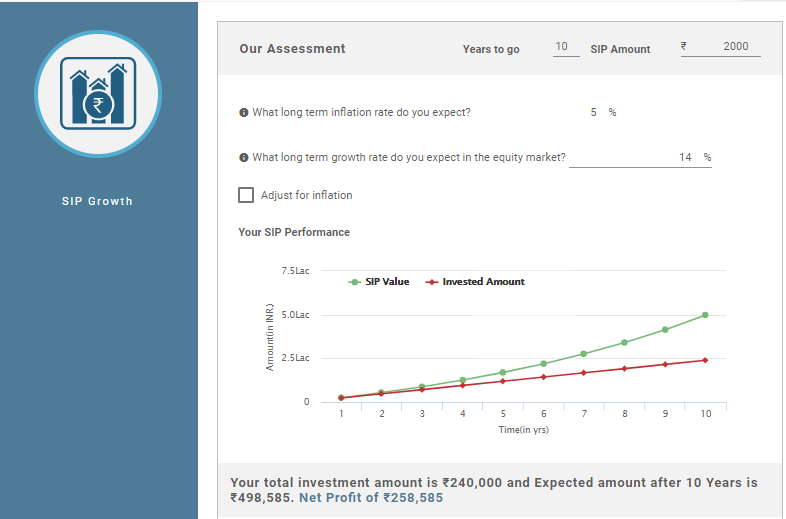

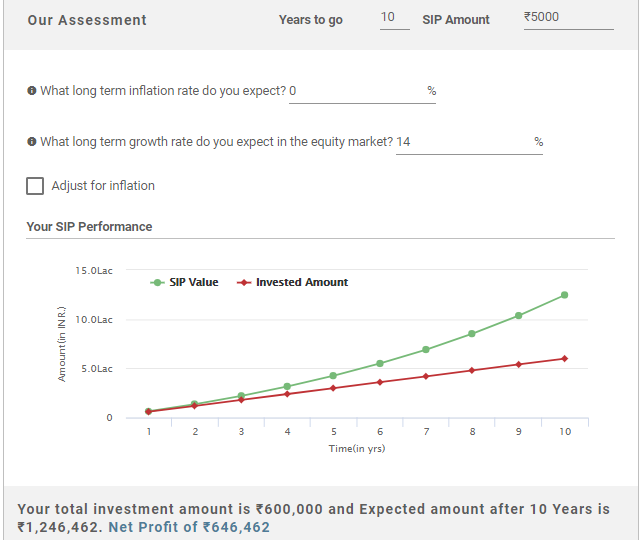

John Bogle always believed that time is money and success in investment takes time. Even when going through a financial crunch, if you can invest a modest amount, you will see yourself working towards big financial success.

There’s no right time to start investing. It is important to start investing today even if you feel like you don’t know anything much about the investment or you aren’t good enough to start investing since you feel the need to hone your skills.

You can start with small amounts, and gradually increase the amount as per your understanding of investments.

3. Long-term Investment

John Bogle once said that wise investors won’t try to outsmart the market. They will diversify the portfolio and invest for long-term. He made it clear that long-term investment will take you a long way when it comes to investments. So, hold for the long-term even when it seems risky because they are most likely to produce the best returns with time.

Mr Bogle also said that if one is going to have lower returns, the worst thing one can do is to reach for more yield and save more.

4. Don’t get Emotional

Investors are bound to make emotional decisions when it comes to investments. Many-a-times people will end up cancelling investments or transferring because of sudden panic or peer pressure. Mr Bogle addressed this issue once and said to eliminate emotion from the investment program.

Have rational expectations for future returns and avoid changing those expectations in response to the ephemeral noise coming from the stock market. Getting emotional can lead to losses and irrational choices.

5. Don’t Depend on Past Performance

John Bogle said that buying based purely on past performance is one of the stupidest things an investor can do. This is truly a common mistake mutual fund investors make. Investors might see a fund or a stock doing great in the past and may choose the same in the present without looking for any red flags.

Mutual funds and stocks depend on market conditions and various other factors. An investor should always focus on the long-term results and expect that the funds do well in the future.

Conclusion

John Bogle left behind words and examples of financial success to help generations of investors to get through any of the issues. Following his advice even as a beginner in investment will help you reach heights. If there is one thing John Bogle stressed on through his investment career, it is the need to have the patience for long-term returns and not get emotional. Our nature can always lead us to make irrational decisions. But in such times it becomes important to use common sense before taking the big leap.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.