How to Start SIP Investment in India?

Many people want to start Investing through SIP (Systematic Investment plan) but are unsure about where and how to begin. While SIP is considered one of the simplest ways to invest in Mutual Funds, first-time investors often find the process confusing due to the number of fund options and investment choices available.

A Systematic Investment Plan allows individuals to invest a fixed amount regularly in mutual fund schemes. With a small monthly investment, investors can plan important Financial goals such as higher education, buying a house, or long-term wealth creation without disturbing their current expenses. However, knowing what SIP is not enough. Investors also need clarity on how much amount to invest, how long to stay invested, how to choose suitable mutual fund schemes, and whether SIP can be started online or without an agent.

This article explains how to start SIP investment step by step, how SIP calculators help in planning investments, how to invest in SIP online, and the important factors every investor should understand before starting a SIP.

Who Should Start a SIP?

This guide is ideal for:

- Beginners starting their first investment

- Salaried individuals with monthly savings

- Self-employed investors seeking disciplined investing

- Parents planning children’s education

- Investors planning long-term goals such as retirement or house purchase

If you can invest even ₹100 / ₹500 per month consistently, SIP investing is suitable for you.

What is SIP or Systematic Investment Plan?

Systematic Investment Plan is an investment mode in Mutual Funds where investors contribute a fixed amount at regular intervals — monthly, quarterly or weekly. Instead of investing a lump sum, SIP allows you to invest small amounts over time. SIP is considered one of the most effective investment methods because:

- It promotes disciplined saving

- It reduces the risk of market timing

- It benefits from rupee cost averaging

- It enables long-term wealth creation through compounding

People commonly invest through SIPs to achieve goals such as buying a house, funding higher education, Retirement planning, or building long-term wealth.

Mutual Fund Calculator

A sip calculator helps investors estimate how their monthly investments may grow over time. By entering details such as:

- monthly SIP amount

- expected return

- investment duration

you can get an approximate future value of your investment.

This helps in realistic goal planning and deciding the right monthly SIP amount.

Fund Selection Methodology used to find 5 funds

Top and Best Performing SIP 2026

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) DSP World Gold Fund Growth ₹59.9338

↑ 1.72 ₹1,756 500 40.2 94.3 155.6 51.3 26.6 167.1 SBI PSU Fund Growth ₹35.398

↑ 0.50 ₹5,817 500 5 13.6 21.6 32.8 28.6 11.3 Invesco India PSU Equity Fund Growth ₹67.71

↑ 0.48 ₹1,449 500 1.5 9.3 21.3 32.1 27.1 10.3 Franklin India Opportunities Fund Growth ₹253.547

↑ 5.61 ₹8,380 500 -3.8 1.7 7.3 30.2 20.2 3.1 LIC MF Infrastructure Fund Growth ₹49.8427

↑ 0.68 ₹1,003 1,000 -2.5 1 11.9 29 24.3 -3.7 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 3 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary DSP World Gold Fund SBI PSU Fund Invesco India PSU Equity Fund Franklin India Opportunities Fund LIC MF Infrastructure Fund Point 1 Lower mid AUM (₹1,756 Cr). Upper mid AUM (₹5,817 Cr). Bottom quartile AUM (₹1,449 Cr). Highest AUM (₹8,380 Cr). Bottom quartile AUM (₹1,003 Cr). Point 2 Established history (18+ yrs). Established history (15+ yrs). Established history (16+ yrs). Oldest track record among peers (25 yrs). Established history (17+ yrs). Point 3 Top rated. Rating: 2★ (bottom quartile). Rating: 3★ (upper mid). Rating: 3★ (lower mid). Not Rated. Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: Moderately High. Risk profile: High. Point 5 5Y return: 26.60% (lower mid). 5Y return: 28.57% (top quartile). 5Y return: 27.06% (upper mid). 5Y return: 20.22% (bottom quartile). 5Y return: 24.33% (bottom quartile). Point 6 3Y return: 51.29% (top quartile). 3Y return: 32.80% (upper mid). 3Y return: 32.09% (lower mid). 3Y return: 30.17% (bottom quartile). 3Y return: 28.98% (bottom quartile). Point 7 1Y return: 155.59% (top quartile). 1Y return: 21.61% (upper mid). 1Y return: 21.30% (lower mid). 1Y return: 7.30% (bottom quartile). 1Y return: 11.94% (bottom quartile). Point 8 Alpha: 1.32 (top quartile). Alpha: -0.22 (upper mid). Alpha: -1.90 (lower mid). Alpha: -4.27 (bottom quartile). Alpha: -18.43 (bottom quartile). Point 9 Sharpe: 3.42 (top quartile). Sharpe: 0.33 (upper mid). Sharpe: 0.27 (lower mid). Sharpe: -0.10 (bottom quartile). Sharpe: -0.21 (bottom quartile). Point 10 Information ratio: -0.67 (bottom quartile). Information ratio: -0.47 (bottom quartile). Information ratio: -0.37 (lower mid). Information ratio: 1.69 (top quartile). Information ratio: 0.28 (upper mid). DSP World Gold Fund

SBI PSU Fund

Invesco India PSU Equity Fund

Franklin India Opportunities Fund

LIC MF Infrastructure Fund

SIP funds having AUM/Net Assets above 500 Crore. Sorted on Last 3 Year Return.

Talk to our investment specialist

Steps to Start a SIP Investment

Starting a SIP does not require large capital or complicated procedures. With online platforms and simplified KYC norms, investors can begin a SIP within minutes. However, before investing, it is important to understand each step clearly to ensure the SIP aligns with your financial goals and risk capacity.

1. Determine Your Objectives

Every SIP investment should begin with a clear financial objective. Before selecting any mutual fund scheme, ask yourself why you are investing. Your goal determines the type of fund you should choose and the period for which you must stay invested.

Common investment goals include:

Buying a car, gadgets, down payment for a house or planning a vacation in 2–3 years → Suitable for debt mutual funds

Funding a child’s education or marriage expenses in 5–7 years → Suitable for hybrid, Balanced Fund and Large cap funds

Planning retirement or long-term wealth creation after 7+ years → Suitable for Equity Mutual Funds

Defining your goal helps you decide:

- the investment horizon

- the level of risk you can take

- the expected return required

Without a clear objective, investors often choose unsuitable funds and exit prematurely during market Volatility.

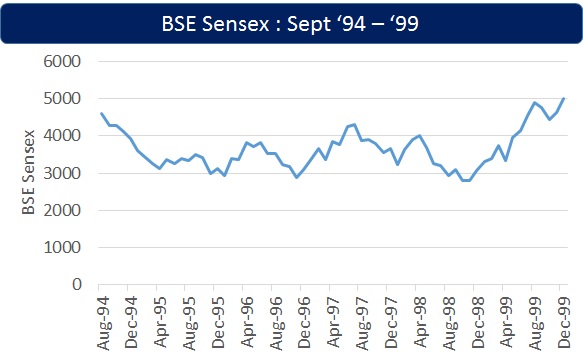

2. Determining Tenure of Investment

Investment tenure plays a crucial role in SIP returns. Mutual fund performance varies significantly depending on how long you remain invested. Equity markets can be volatile in the short term, but volatility reduces as the investment horizon increases.

Based on tenure:

Short-term (below 3 years): Debt-oriented mutual funds are preferred due to lower volatility.

Medium-term (3–7 years): Hybrid or balanced funds provide a mix of stability and growth.

Long-term (7 years or more): Equity mutual funds historically offer higher return potential.

Longer investment periods allow SIPs to benefit from:

- rupee cost averaging

- compounding of returns

- recovery during market corrections

This is why SIPs are most effective when planned for long-term goals.

3. Complete Your KYC

KYC (Know Your Customer) compliance is mandatory for investing in mutual funds.

You can complete KYC through:

- Online eKYC: using PAN, Aadhaar and OTP verification

- Offline KYC: by submitting documents to authorised intermediaries

Documents generally required include:

KYC is a one-time process. Once completed, you can invest in any mutual fund scheme across fund houses without repeating the procedure.

4. Choose the Right Mutual Fund Scheme

Selecting the appropriate mutual fund scheme is one of the most important steps in SIP investing. Before choosing a fund, investors should analyse:

- fund performance across 5 years or more

- consistency across market cycles

- risk level and volatility

- fund manager’s experience and tenure

- reputation of the Asset Management Company (AMC)

- expense ratio and applicable exit load

It is advisable to avoid selecting funds solely based on recent high returns, as short-term performance may not sustain across different market conditions.

A suitable SIP fund is one that matches your:

- investment goal

- risk tolerance

- investment horizon

rather than one that tops recent return charts.

5. Decide SIP Amount and SIP Date

The SIP amount should be comfortable and sustainable. Choose an amount that does not disturb your monthly household expenses or emergency savings.

For example:

If your monthly surplus is ₹5,000, starting SIPs of ₹2,500–₹5,000 allows flexibility without financial stress. You can always increase your SIP amount later through:

SIP top-ups

additional SIPs as income grows

Selecting the SIP date is equally important. Most investors prefer a date shortly after their salary credit to ensure timely deductions and disciplined investing.

6. Monitor and Review Periodically

Although SIPs are designed for long-term investing, periodic review is essential.

Investors should:

- review SIP performance every 6–12 months

- compare returns with benchmark indices

- ensure the fund continues to align with financial goals

Short-term market corrections should not trigger panic withdrawals. SIPs work best when investors remain disciplined during market volatility. Rebalancing may be required when:

- financial goals change

- risk appetite reduces or increases

- one asset class becomes over-allocated

Patience, consistency and long-term discipline are the key factors behind successful SIP investing.

Can You Stop or Modify SIP Anytime?

Yes.

- SIPs can be stopped anytime without penalty

- Amount and date can be modified

- Missed SIP instalments do not attract fines

- Only ELSS SIPs have a 3-year lock-in

This flexibility makes SIP ideal for long-term investors.

However, Should You Stop a SIP Frequently?

While SIPs allow you to stop or modify investments anytime, we strongly advise against discontinuing SIPs unless it is absolutely necessary. Stopping a SIP before achieving your financial goal can significantly impact long-term wealth creation. Here’s why:

- SIPs benefit most from long-term compounding

- Market volatility averages out only over time

- Early exits break the power of disciplined investing

- Missing years of compounding can reduce final wealth drastically

For example, a SIP stopped after 5 years may generate only a fraction of the wealth that the same SIP could create over 15–20 years.

When Is It Reasonable to Stop or Modify a SIP?

You may consider pausing or adjusting your SIP only in situations such as:

- medical emergencies

- sudden job loss or income disruption

- major life changes affecting cash flow

- nearing your financial goal and shifting to safer assets

In such cases, reducing the SIP amount or temporarily pausing is usually better than stopping it. Markets will rise and fall — that is normal. Your SIP works best when it continues through volatility, not away from it.

Taxation on SIP Investments

Equity Mutual Funds

- Long-term Capital Gains after 1 year

- ₹1.25 lakh LTCG exemption annually

- Gains above taxed at 12.5%

Debt Mutual Funds

- Taxed as per income slab (post April 2023 rules)

ELSS SIP

- Eligible for deduction under Section 80C

- Lock-in period of 3 years

How to Invest in SIP with Fincash?

Open Free Investment Account for Lifetime at Fincash.com.

Complete your Registration and KYC Process

Upload Documents (PAN, Aadhaar, etc.). And, You are Ready to Invest!

Conclusion

Starting a SIP investment is one of the most practical ways to build long-term wealth. By investing small amounts regularly, investors can benefit from market volatility, compounding and disciplined saving — without needing to time the market. Choosing the right fund, staying invested and reviewing periodically are the keys to successful SIP investing.

FAQs

1. What is a Top-Up SIP?

A: A Top-Up SIP allows investors to increase their SIP amount at regular intervals. If your income rises or your existing SIPs are performing well, a top-up helps you invest more gradually without financial strain. This approach supports long-term wealth creation by increasing contributions over time.

2. What is a flexible SIP?

A: A Flexible SIP allows you to increase or decrease your investment amount based on your cash flow. When income is higher, you may invest more, and during tight months, you may reduce the amount. However, regular investing remains important to maintain discipline.

3. What is a perpetual SIP?

A: A Perpetual SIP does not have a fixed end date in the mandate. The SIP continues automatically until the investor decides to stop it. You may choose to discontinue a perpetual SIP after one, three, or five years — or continue it for longer-term financial goals.

4. Is SIP KYC compliant?

A: Yes. SIP investments fall under mutual funds and therefore require KYC compliance. Investors must complete the KYC process through a bank, AMC, or authorised intermediary. This is a one-time requirement applicable across all mutual fund investments.

5. How can I evaluate the best SIPs for investment?

A: Before investing in SIPs, you should first determine your investment amount and financial goals. Then evaluate mutual funds based on:

- long-term performance

- risk level and volatility

- consistency across market cycles

- expense ratio and exit load

Choose SIPs that align with your investment horizon and return expectations rather than short-term rankings.

6. What documents are required to invest in SIPs?

A: To start a SIP investment, you typically need:

- PAN card

- address proof (Aadhaar card, passport, or Voter ID)

- bank account details

Once submitted, these documents remain valid for future mutual fund investments.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

I am interested