Table of Contents

Understanding Sovereign Gold Bond

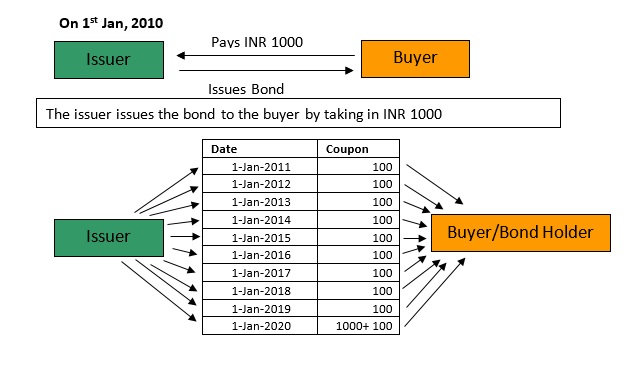

On November’15, Government of India launched the Sovereign Gold Bond (SGB) scheme as an alternative to purchasing physical gold. When people invest in gold Bonds, they get a paper against their investment instead of a gold bar or a gold coin. Sovereign Gold Bonds are also available in the digital & Demat form and can also be used as Collateral for loans.

SGB can be sold or traded on stock exchanges. Investors will get returns based on the prevailing gold price.

Sovereign Gold Bond Scheme

The Sovereign Gold Bond scheme is an investment in gold that is issued by the Reserve Bank of India (RBI) on behalf of the Government of India. This scheme aims to reduce the demand for physical gold, thereby keeping a tab on imports of gold in India and utilising resources effectively. It also offers the same benefits as of physical gold. The value of gold bond increases with the Market rate of gold.

Investors can either buy these bonds through the Bombay Stock Exchange (BSE) when RBI announces a fresh sale or they can also purchase it at the current price. Upon the maturity, investors can redeem these bonds for cash or can sell it on BSE at current prices.

With the Reserve Bank of India issuing this scheme, there is a high level of trust Factor on transparency and safety.

Latest: Sovereign Gold Bond Next Issue and Upcoming Issues

The Reserve Bank of India (RBI) recently announced two tranches of the Sovereign Gold Bonds (SGB) scheme 2023-24. The SGB 2023-24 Series III will be open for subscription from 18 to 22 December 2023.

The date of issuance for this SGB tranche is December 28

The second tranche of the Sovereign Gold Bonds scheme will be open for subscription from 12 to 16 February 2024, and will be issued on February 21, 2024

Sovereign Gold Bond Rate 2025

The Sovereign Gold Bonds are known to be denominated in the form of multiples of a single gram of gold featuring the minimum unit of one gram. The interest for the given bonds has been fixed at 2.50 percent per annum. The same can be paid on a semi-annual Basis on the respective nominal value. The bond’s tenure is expected to be 8 years. There is the presence of an exit option as well – made available on the 5th, 6th, and 7th year on the specific dates of paying the interests.

This interest rate can be changed by the government as per its policies.

Key Things to Know About Sovereign Gold Bond

- Minimum investment under this scheme is 1 gram.

- Maximum investment is 500 grams per person per Fiscal Year (April-March).

- The Gold Bond scheme is available in Demat and paper form.

- The bonds are tradable through stock exchanges – NSE and BSE.

- The scheme has a tenure of eight years, with exit options from the 5th year.

- The gold bond can be used as collateral to avail a loan.

- Gold Bonds are backed by the Government of India, so they are sovereign grade.

Talk to our investment specialist

RBI Sovereign Gold Bond

Gold bonds in India fall under the field of Debt fund. These were introduced in 2015 to serve as the ideal alternative of purchasing gold physically. Sovereign Gold Bonds are available in the form of government securities. These are also regarded as highly secured investment tools because of its less susceptibility to market fluctuations and risks.

Gold Bond Investment

Sovereign Gold Bond turns out to be one of the most profitable investment strategies because of its wide Range of benefits and fewer restrictions. Investors out there having an appetite for low risk, but looking for substantial Return on Investment can opt for making an investment in the Sovereign Gold Bonds as they are known to deliver the highest returns-bearing capabilities.

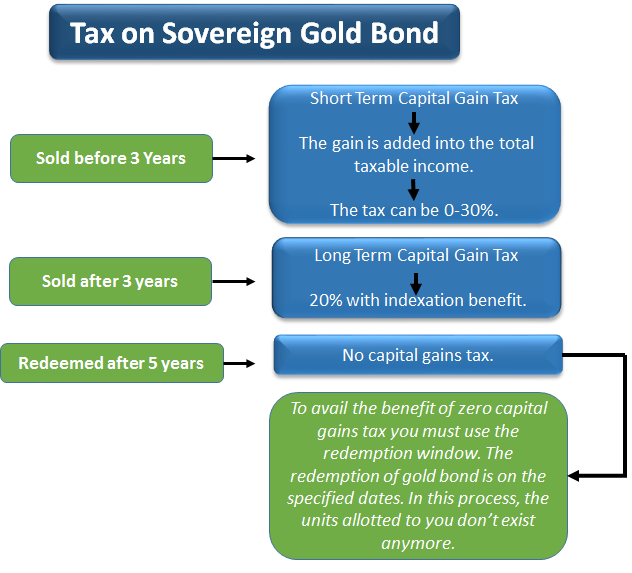

Tax on Gold Bond

The tax on the Sovereign Gold Bond is levied similar to the physical gold. There is no Capital gains tax if it is redeemed after 5 years.

The current Tax Rate of the gold bond is given below. Please do consult a tax advisor before buying gold bonds.

Eligibility for Sovereign Gold Bond Scheme

- Indian Residents

- Individuals/Groups – Individuals, associations, trusts, etc. are all eligible to invest in this scheme, provided they are Indian residents

- Minors – This bond can be purchased by parents or guardians on behalf of minors

Where can you buy SGB Scheme?

Investors can apply for the Sovereign Gold Bond scheme through scheduled commercial banks and designated post offices. They would be authorised to collect the application form and submit to the respective authorities.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Clear Picture !