Table of Contents

Gold Schemes in India - 3 New Ways of Investing in Gold!

In the year 2015, the Prime Minister of India launched three gold-related schemes –namely, the Gold Sovereign Bond Scheme, Gold Monetisation Scheme (GMS), and the India Gold Coin Scheme. The major motive behind all three gold schemes is it to help curtail gold imports and utilise at least 20,000 tonnes of the precious metal owned by Indian households and institutions of India. Let us look at each of these gold schemes.

Objective Behind these Gold Schemes

India imports about 1,000 tonnes of gold every year. To be specific, India imported INR 2.1 lakh crore worth of gold in the Fiscal Year 2014-15 and INR 1.12 lakh crore in between April-September 2015. Thereby, these gold schemes are launched with an aim to reduce these whopping quantities of imports. It is also believed that these gold schemes will attract more customers towards gold investments.

The Three Gold Schemes

1. Sovereign Gold Bond

The Sovereign Gold Bond scheme is launched with an aim to reduce the demand for physical gold, thereby keeping a tab on imports of gold in India and utilising resources effectively.

This scheme offers the same benefits as of physical gold. When people invest in Sovereign Gold Bond Scheme, they get a paper against their investment instead of a gold bar or a gold coin. Investors can either buy these Bonds through Bombay Stock Exchange (BSE) at the current price or when RBI announces a fresh sale. Upon maturity, investors can redeem these bonds for cash or can sell it on stock exchanges (BSE) at current prices.

gold bonds are also available in the digital & Demat form. They can also be used as Collateral for loans.

Talk to our investment specialist

Key Features

- The minimum investment can be as low as 1 gram

- The maximum investment limit is 500 grams per fiscal year

- The bonds are tradable through stock exchanges – NSE and BSE

- The scheme has a tenure of eight years, with exit options from the 5th year

- The gold bond can be used as collateral to avail a loan

- Gold Bonds are backed by the Government of India, so they are sovereign grade

- The Gold Bond scheme is available in Demat and paper form

2. Gold Monetisation Scheme

Gold Monetisation Scheme is a modification of the existing Gold Metal Loan Scheme (GML) and the Gold Deposit Scheme (GDS). The Gold Monetization Scheme came into being to replace the existing Gold Deposit Scheme (GDS), 1999. This scheme is launched with an idea to ensure mobilisation of the gold owned by the families and Indian institutions. It is expected that the Gold Monetisation Scheme would turn gold into a productive asset in India.

The Gold Monetisation Scheme (GMS) is launched with an aim to help investors earn interest on their gold lying idle in Bank lockers. This scheme works like a gold Savings Account which will earn interest on the gold that you deposit in, based on their weight along with the appreciation in the value of gold. Investors can deposit gold in any physical form – jewellery, bars or coins.

Under this scheme, an investor can deposit gold for a short, medium and long term. The tenure for each term is as follows:

- Short Term Bank Deposits (SRBD) is of 1-3 years

- Mid-term is between 5-7 years of tenure and,

- Long Term Government Deposit (LTGD) comes under a tenure of 12-15 years.

Key Features

- Gold Monetisation Scheme accepts a minimum deposit of 30 grams of gold in the form of a coin, bar or jewellery

- There is no maximum limit of investment under this scheme

- Gold Monetisation Scheme allows premature withdrawal after a minimum lock-in period. However, it charges a penalty for such withdrawals

- Investors would earn interest on their idle gold, which would add value to their savings too

- Coins and bars can earn interest apart from the appreciation of value

- Earnings are exempt from Capital gains tax, income tax and wealth tax. There will be no Capital Gains tax on the appreciation in the value of gold deposited, or on the interest, you make from it

- All designated commercial banks would be able to implement the Gold Monetisation Scheme in India

3. Indian Gold Coins

Indian Gold Coin Scheme is the third scheme launched by the Government of India. The Indian Gold Coin is the first national gold coin which will have the image of Ashok Chakra minted on one side and the face of Mahatma Gandhi on the other side. The coin is currently available in denominations of 5gm, 10gm and 20gm. This allows even those with a small appetite to Buy Gold under this scheme.

The Indian Gold Coins are of 24 karat purity with 999 fineness. Along with this the gold coin also carries advanced anti-counterfeit features and tamper-proof packaging. These coins are hallmarked by the Bureau of Indian Standards (BIS) and are minted by the Security Printing and Minting Corporation of India Limited (SPMCIL).

The price of these coins is fixed by the MMTC (Metals and Minerals Trading Corporation of India). It is believed that the coin is 2-3 percent cheaper than the ones manufactured by most of the established corporate sellers.

Key Features

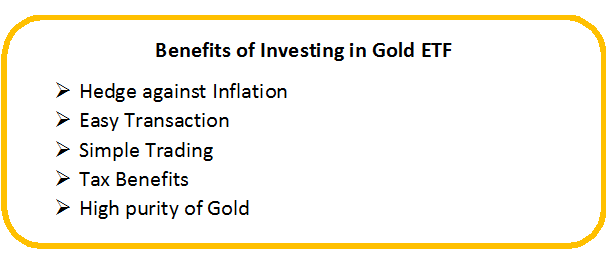

- The Indian Gold Coin is made of 24 karat gold with 999 fineness

- The coin is hallmarked by Bureau of Indian Standards (BIS)

- To avoid duplication, Indian Gold Coins are well equipped with advanced anti-counterfeit feature and tamper proof packaging

- High Purity of Gold

- It is easy to monetise. As these gold coins are backed by the MMTC, it will be easier for customers to sell gold coins in the open Market

It is believed that all three gold schemes will drastically affect the gold imports of India. This will also lure tonnes of gold from households and institutions into the banking system.

For those who have gold as an investment asset, Investing in the above schemes will ensure safety, purity and even give interest!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.