Accretion of Discount

What is Accretion of Discount?

Accretion of discount is the increase in discounted instrument’s value with the passage of time and the maturity date coming closer. The instrument’s value will grow at the interest rate that is implied by the discounted issuance price, the value at the time of maturity and the maturity term.

Accretion of Discount Breakup

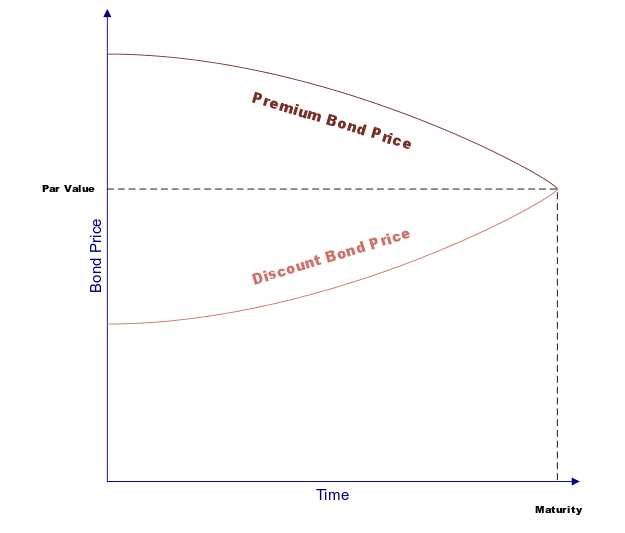

A bond can be bought at a premium, a discount, or at par. Irrespective of the purchase price, all of the Bonds at matured at par value. This one is the amount of money that the investor gets back at the time of maturity.

If the bond has been purchased at a premium, it has value more than the Par. As this bond gets nearer to its maturity date, the value decreases until it is at par on the date of maturity. This decrease in value is known as the amortization of premium.

Furthermore, if the bond is purchased at a discount, it would have less value than the par. As the bond closes the maturity date, it increases in value until it gets converged with the par value. This value increase is known as the accretion of discount.

Accretion of Discount Example

Now, let’s take an accretion example here. Let’s assume there is a bond with a maturity date of three-years and a Face Value of Rs. 1,000. This bond gets issued at Rs. 975. Between maturity and issuance, the bond’s value will increase until it reaches Rs. 1,000, which is the par value and the investor will get this amount back at the time of maturity.

Talk to our investment specialist

Here, to calculate the accretion amount, the following formula is being used:

Accretion Amount = Purchase Basis x (ytm / Accrual periods per year) - Coupon Interest

The first step here is to comprehend the yield to maturity (YTM), which is the yield that the investor earns by holding the bond until its maturity. This amount is dependent on the frequency of compounded yield.

For instance, let’s assume there is a bond with par value of Rs. 100 and a coupon rate of 2%. It gets issued for Rs. 75 with a maturity period of 10-years.

Now, if this bond is compounded annually, the YTM can be calculated as:

- Rs. 100 par value = Rs. 75 x (1 + r)10

- Rs. 100/ Rs. 75 = (1 + r)10

- 1.3333 = (1 + r)10

r = 2.92%

Since coupon interest is 2% x Rs. 100 par value = Rs. 2. Thus,

- Accretion = (Rs. 75 x 2.92%) – Coupon interest

- Accretion = Rs. 2.19 – Rs. 2

- Accretion = Rs. 0.19

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Thanks for the detailed guide and examples of discount calculations!