Bank Reconciliation

Bank Reconciliation Simple Meaning

A Bank reconciliation is one such process that matches a company’s balances mentioned in the account record for a specific cash account to the information given on the bank statement. The objective of bank reconciliation is to ensure that there is no significant difference between these two.

However, it is quite unlikely that the cash balance of a company is identical to that of the bank as there are multiple deposits and payments that remain in transit. And then, bank charges, penalties and more are always there that the company might not record.

Not just for one, but bank reconciliation should be completed for every bank account periodically to ascertain that the cash records of the company are precise. Moreover, this process also helps to detect frauds and can be used to create better regulation over the cash payment and receipt.

Bank Reconciliation Example

Suppose there is a company that is closing books for the month end of May 31st. Now, the controller of the company has to prepare a bank reconciliation on the basis of the following issues:

- The bank statement has an ending bank balance of Rs. 320,000.

- The bank statement has Rs. 200 cheque printing charge for the new cheque book ordered.

- The bank statement has Rs. 150 service charge for bank account operations.

- The bank statement rejected a deposit of Rs. 500 because of non-sufficient funds and charges Rs. 10 for this rejection.

- The bank statement has Rs. 30 as the interest income.

- The company has issued Rs. 80,000 of cheques that haven’t been cleared by the bank.

- The company has deposited Rs. 25,000 of cheques at the month-end; however, they couldn’t appear on the bank statement as these cheques were not deposited on time.

Now, the controller will be creating a report with this bank reconciliation statement format:

| Adjustment to Books | ||

|---|---|---|

| Bank Balance | Rs. 320,000 | |

| Cheque Printing Charges | -200 | Debit expense, credit cash |

| Service Charge | -150 | Debit expense, credit cash |

| Penalty | -10 | Debit expense, credit cash |

| Deposit Rejection | -500 | Debit receivable, credit cash |

| Interest Income | +30 | Debit cash, credit interest income |

| Uncleared Cheques | -80,000 | None |

| Deposits in transit | +25,000 | None |

| Book Balance | Rs. 264,170 | None |

Talk to our investment specialist

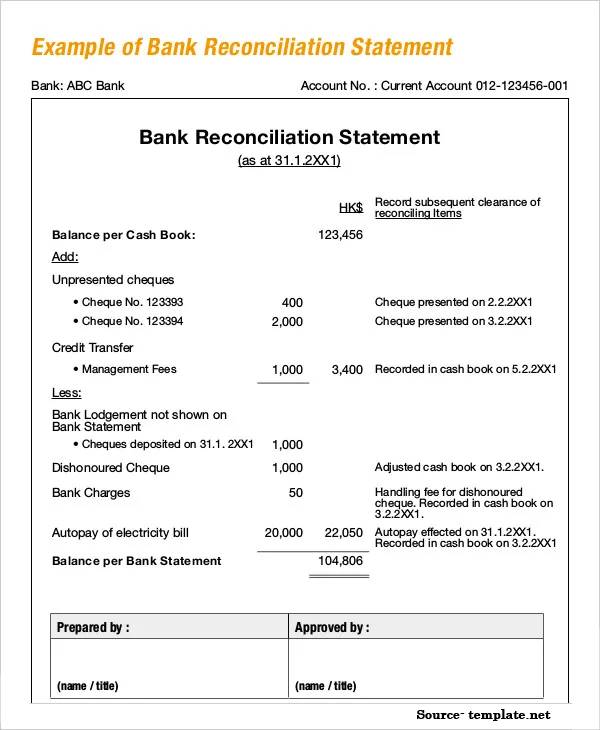

Bank Reconciliation Statement

When the reconciliation process gets complete, you get to print a report that displays book and bank balances, the discovered differences between the two and remaining unreconciled differences. This report is known as a bank reconciliation statement that the auditors would want to check at the end of the year.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.