Fincash » SBI Savings Account » State Bank of India Net Banking

Table of Contents

- Features of SBI Net Banking Facility

- Eligibility for SBI Online Banking Facility

- Frequently Asked Questions

- 1. Is there a way to changing the username if I forget it?

- 2. Is it possible to change the username and password received in the kit?

- 3. Does the State Bank of India charge anything to use the net banking facility?

- 4. Is it possible to check the CIBIL score with SBI net banking?

- 5. Is there a toll-free number that can be used for SBI internet banking?

- 6. How much time does it take to activate net banking?

State Bank of India Net Banking

Undoubtedly, internet banking services have made the experience of availing banking facilities extremely convenient for customers. Also known as online banking, this type of service allows you to relish the benefits of several features and facilities that a Bank provides, including transactional activities without visiting the branch physically.

Just like every other major branch in the country, even State Bank of India has come up with an online portal that is meant for personal, retail and corporate customers. However, to use the State Bank of India net banking Facility, you would have to register online. In this post, let’s find out how that can be done with ease.

Features of SBI Net Banking Facility

With internet banking, SBI ensures that you get to avail a convenient and easy experience. Thus, keeping your comfort in mind, this service offers an array of features, such as:

- Checking bank account details, statement and last 10 transactions online

- Opening fixed deposits

- Making transactions online to own accounts/ third-party transfers to any account in SBI / interbank transfers with other banks

- Making transactions to donations

- Paying utility bills

- Ordering a cheque book

- Buying insurance

- Accessing account settings

- Activating or deactivating international transactions

- Crediting PPF accounts across SBI branches

- Requesting the issue of Demand Draft

- Opening of a new account(s)

- Closing the loan accounts

- Nominating anybody

- Checking CIBIL Score

- Updating details and changing passwords

- Updating Aadhaar and PAN details in the account

- Completing NPS payment

Keep in mind that if you have received the Internet Banking Pre-printed Kit (PPK) from the bank, you will not have to register again. The kit has a temporary username and password that you can use to log into your account.

Talk to our investment specialist

Eligibility for SBI Online Banking Facility

To be eligible for using the State Bank of India net banking facility, you must meet the criteria as specified by the bank. To begin this feature, you must:

- Have a Savings Account with the bank

- Have an ATM card

- Own a passbook with all the needed information

- Get your mobile number registered with the branch

Registering for SBI Online Net Banking with an ATM Card

- Go to the online portal of SBI

- Now, you will find two different options, Personal Banking and Corporate Banking; choose the first option and below, click on

New User / Registration option - A message dialogue will pop-up stating that if you have received your internet banking registration kit, you can straightforwardly use login credentials; however, if you have not got any kit, click OK

- A new window will open up where you will have to choose New User Registration from the two options and click Next

- Once done, on the next page, enter your details as asked, such as account number, CIF number, branch code, country, registered mobile number, the facility required (choose Full Transaction Rights from the dropdown) and captcha

- Tap Submit

- On the registered mobile number, you will receive an OTP

- Choose the option “I have my ATM card” to activate the online banking facility with an ATM card, click Submit (In case you don’t have an ATM card, you will have to request the bank personnel to activate online banking services for you)

- Then, you will have to enter your ATM card details, such as card number, expiry date, card holder’s name and the PIN; enter captcha

- Click Proceed

You will then receive a temporary user name for online banking. Once you enter this number, you will have to enter the selected login password and enter it again to confirm.

Once done, a message stating that the registration is successful will be displayed. You can also change this temporary username and password anytime later.

Checking Bank Balance with SBI Internet Banking

- Visit the SBI online portal

- Log into by using your username and password and entering captcha

- On the homepage, click on Click Here for Balance

Transferring Money Through SBI Online Personal Banking

Before you transfer money, you would have to ensure that the recipient has been added as a beneficiary in the account. To do so, you would require certain information, such as:

- Name of the beneficiary

- Account number

- Bank name

- IFSC code

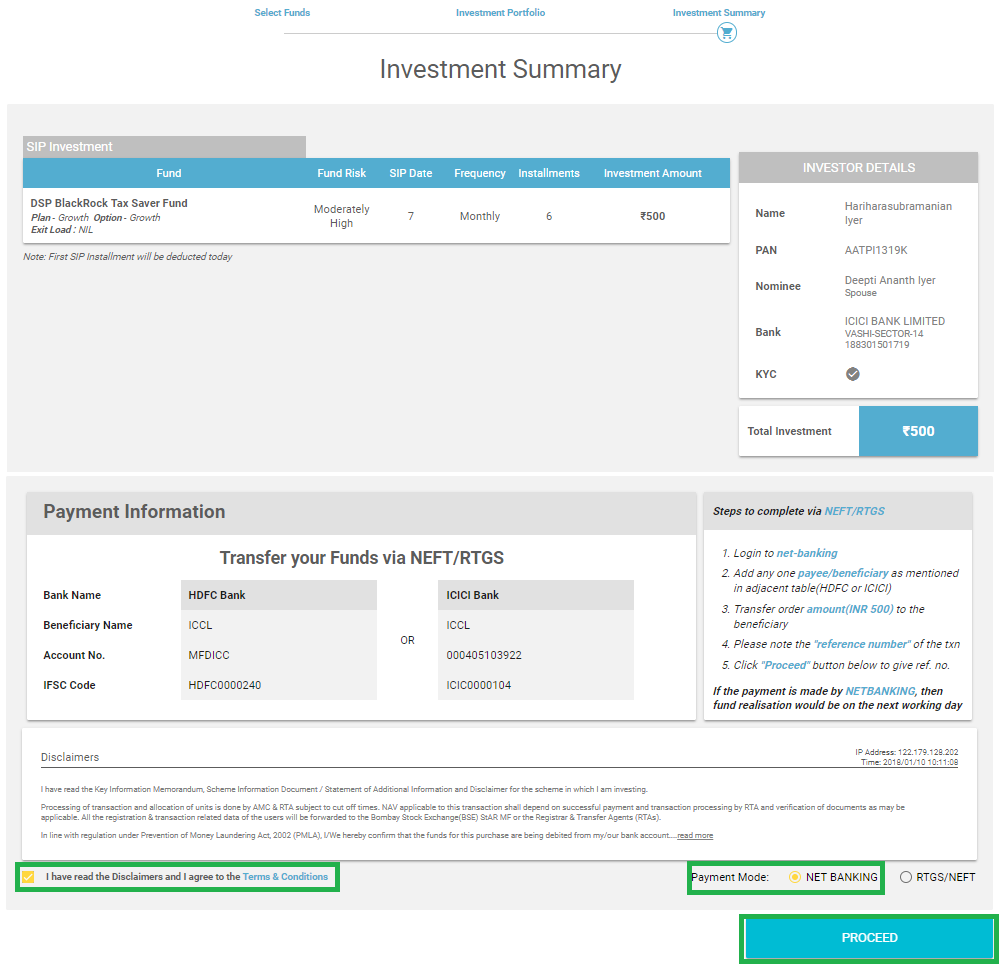

Then, follow these steps to make a transaction:

- Complete the SBI Net Banking login with your username and password

- Under Payments / Transfer category, choose Other Bank Transfer if the account is in another bank

- However, if the account is in the same bank like SBI, choose Accounts of Others – Within SBI

- On the next screen, select the type of transaction and click Proceed

- From the given list, select the account to which you would like to transfer the funds

- Then, enter the amount and remarks (if any)

- Select the beneficiary

- Check the box in front of Terms and Conditions

- Click Submit

- Another screen will open up with the details for review; once satisfied, click Confirm

- On your registered mobile number, you will receive an OTP; enter the same and click Confirm

Then, a confirmation message will display on the screen.

Transaction Limits and Applicable Charges

| Transaction Type | Per Day Limit | Charges |

|---|---|---|

| IMPS | ₹2,00,000 | Nil |

| Quick Transfer | ₹25,000 | Nil |

| NEFT | ₹10,00,000 | ₹1,00,000 |

| RTGS | ₹10,00,000 | Nil |

| UPI | ₹1,00,000 | Nil |

| Transfer within self accounts | ₹2,00,000 | Nil |

| Transaction limit for a new account | ₹1,00,000 | Nil |

| Third-party transfer within SBI | ₹10,00,000 | Nil |

Things to Keep in Mind When Activating SBI Net Banking

- When trying to complete SBI net banking online registration, keep your ATM card, cheque book and passbook handy

- Enter the same mobile number that you have used before when opening the account

- Don’t share your username, password and other account details with anybody

- Never share One Time Password (OTP) with anybody

- Choose such a password and hint answer that would be easy to remember for you but difficult to guess for others

Frequently Asked Questions

1. Is there a way to changing the username if I forget it?

A. If you have forgotten the username, you cannot change it online, but you would have to visit the nearest branch to get the re-registration done.

2. Is it possible to change the username and password received in the kit?

A. Yes, it is. In fact, it is mandatory to change both the things once you are done with your first login. However, later, you would only be able to change the password and not your username.

3. Does the State Bank of India charge anything to use the net banking facility?

A. No, the online banking facility comes without any charges or cost.

4. Is it possible to check the CIBIL score with SBI net banking?

A. Yes, SBI offers an option to check the CIBIL score through net banking. However, you may have to pay a fee of Rs. 440 to get this report.

5. Is there a toll-free number that can be used for SBI internet banking?

A. If you have any complaints or queries regarding SBI online banking, you can Call on 1800-112-221

6. How much time does it take to activate net banking?

A. If you are activating one single account with registered mobile number and ATM card, activation is almost immediate. However, if it is a joint account, it might take anywhere between 5-7 working days.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.