Table of Contents

NAV or Net Asset Value

Those new to Mutual Funds always seem to ask common questions on the Net Asset Value around "what is Mutual fund NAV ?", "how do you calculate NAV?", "Where can I the the Mutual Fund NAV history ?" or "what is the Net Asset Value formula?".

Net Asset Value for a layman may be understood as being very similar to the price of a share in the stock Market, but here it's calculated not for a share but for a Mutual Fund. Also, the frequency of NAV calculation is something which is governed by the regulator for Mutual Funds, SEBI, and there is a set frequency by which Mutual Fund Companies have to publish this.

What is Net Asset Value (NAV)?

The definition of Net Asset Value(NAV) is assets minus liabilities of the fund, per unit of the fund. Essentially this definition tries to calculate (while it may seem technical) the price of the fund. Like investors who monitor the share price to monitor their gain or loss, investors in Mutual funds can do the same by estimating their profit or loss looking at its value( adjusting for dividends etc, if any of course!)

How is NAV Calculated?

NAV is calculated at the end of every market day, after taking into account the closing market prices of the securities in its Portfolio. When selecting a mutual fund for investments, remember that daily changes in NAV don't matter. It is best to look at the annualised / CAGR return of a fund over different time frames to estimate the performance of the fund.

Latest MF NAV

The latest Net Asset Value of a mutual fund can be obtained from various sources. By regulation, every fund is required to publish its NAV daily after the end of the trading day.

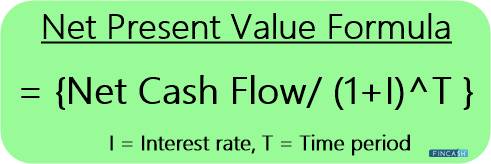

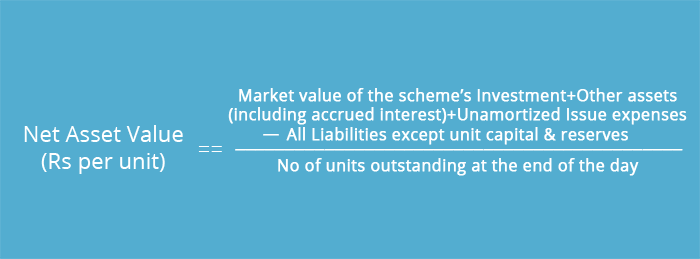

Net Asset Value Formula

The technical nature of the Net Asset Value formula is presented below for reference to those who would like to know mathematically what is looks like.

Essentially it sums up the assets (i.e. market value of the investments+ any other assets (including unamortized expenses) and subtracts the liabilities (except the unit Capital and reserves). While all this seems very technical, Investors need not worry, since the net asset value formula is subject to rules and guidelines as laid out by the regulator, SEBI for mutual funds. There are also clear Accounting guidelines too to calculate the same. Also, the calculations may be subject to audit by the regulator (SEBI) annually.

Calculate MF NAV Using NAV Formula

The formula for NAV is:

NAV = (Market Value of the scheme's investment + Other asses + Unamortized issue expenses - Liabilities) / No of units outstanding at the end of the day

Let's assume at the close of trading yesterday that a particular mutual fund held INR 1,00,00,000 worth of securities, INR 50,00,000 of cash, and INR 10,00,000 of liabilities. If the fund had 10,00,000 shares outstanding, then yesterday's NAV would be:

NAV = (INR 1,00,00,000 + INR 50,00,000 - INR 10,00,000) / 1,00,000 = INR 140

Note that a fund's NAV change daily as the value of a fund's securities, liabilities, cash held and the number of shares outstanding fluctuates.

Frequency

The calculation of Net Asset Value is done daily at the end of the day for each and every fund. Also, this number is calculated up to 4 decimal places and rounded off as per regulations prescribed by Securities and Exchange Board of India (SEBI).

Talk to our investment specialist

Mutual Fund NAV History

The NAV History of Mutual Funds can be obtained from various places. AMFI India has the NAV history of funds, additionally, investors can go to websites of Asset Management Companies ( AMCs) to also get them.

Why NAV Matters?

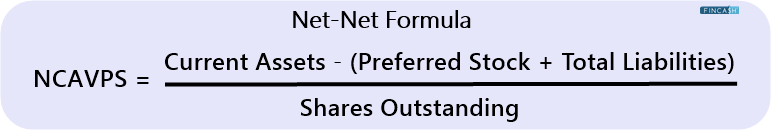

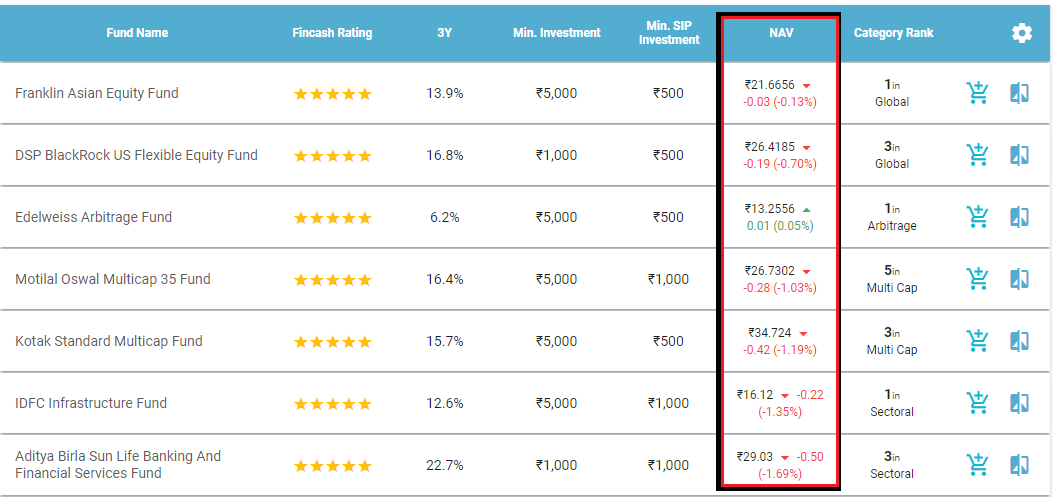

NAV as of 27th Sept'18

NAV as of 27th Sept'18

To understand better, let's look at the funds above. The NAV of these funds is as 27th Sept'18. Each fund above has a different performing net asset value. The NAV of Franklin Asian Equity Fund was INR 21.66, while the NAV of IDFC Infrastructure Fund was INR 16.12. But, the returns of both the funds are comparable.

While the NAV should not be a parameter for your fund selection, it ideally shows how the Underlying assets have performed.

AMFI NAV

The Association of Mutual Funds in India (AMFI) publishes the Net Asset Value of each and every scheme on its website. These data points of Net Asset Value are uploaded and available at amfiindia daily in the evening, so if investors want to know the current NAV of a fund, all they need to do is go to AMFI India.

Impact of Dividend on NAV

When a mutual fund pays out the dividend it sells some of its holdings to provide for it. Since the net asset value reflects the value of the Bonds or stocks held by the mutual fund, its value goes down by the dividend paid by the fund. For instance, if the NAV of a fund is INR 40 and it pays a dividend of INR 1 then the net asset value will go down to INR 39.

NAV of Regular Fund vs Direct Fund

Nowadays a lot of investors are confused whether to opt for regular or direct option in mutual funds. Since direct funds do not attract any commissions, their returns tend slightly on the higher side with 1 percent to 1.5 percent higher than the regular mutual funds, hence their net asset value is also high.

But when investors who are already Investing in a regular scheme and wants to shift to a direct plan often think that the value of their funds is impacted as they may get lesser units due to higher net asset value in the direct plan.

However, this is not the case. In fact, the value remains the same. Even after shifting the returns are higher than the regular fund.

Let's take an example-

You have a current invested value of INR 20,000 in the fund 'A', which is a regular fund and the NAV of A is INR 20. This means you have 1000 units. A (D) is the direct plan variant of A and it has an NAV of INR 21. Now when you switch to A (D), you will get 979 units, but your investment value will remain INR 20,000. Let us presume the next year the NAV of A has increased to 22, then the approximate NAV of A (D) will be 23.31 (considering commission of 1.5%).

So, if you have continued with A, the value of your investment would be = 979 X 22 = INR 21, 538

And, the investment value of A(D) = 23.4 X 979 = INR 22,906

Beyond NAV What?

At the outset, it may seem that monitoring the value of a mutual fund NAV is enough, but that is not so. Monitoring of investments is a very technical task, but with some basic rules, investors can do some of it themselves. They need to look at the investment portfolio, more so for Debt fund, and see the credit quality of instruments in the portfolio. One should also see if there are any changes in the fund manager or any adverse news. Moreover, investments should be in line with the objectives set out at the beginning. Regular balancing of the portfolio and following Asset Allocation is key!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

You Might Also Like