Table of Contents

Callable Bond

Callable Bond Definition

A callable bond also goes by the name as redeemable bond. It is a type of bond that the issuer might redeem early before the same reaches its maturity. As per the callable bond features, it allows the issuing party to pay off the respective debt early. A business can consider calling its bond in case the Market rates tend to move lower. This allows the business organizations to re-borrow the same at a highly beneficial rate.

Therefore, callable bond are known to compensate the investors for the given potentiality. This is because they tend to offer a higher coupon rate or rate of interest due to the respective callable nature.

How do Callable Bonds Work?

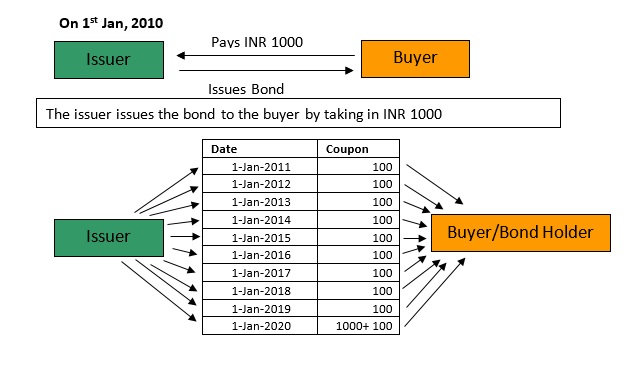

A callable bond can be referred to as the relevant debt instrument in which the issuer has the right to return the principal to the investor while stopping interest payment way before the maturity of the given bond. Corporations are known to issue Bonds for funding expansion or paying off other loans.

Talk to our investment specialist

In case the organization might predict a fall in the overall interest rates in the market, then it might issue the bond as callable. This would allow the organization to ensure early Redemption while securing other finances at a reduced rate. The Offering of the bond will help in specifying the terms of when the organization can recall the note.

Types of Callable Bonds

Callable bonds are known to be available with multiple instruments. For instance, optional redemption is known to allow the issuer to redeem the respective bonds as per the terms when the particular bond was issued. However, it is important to note that not all bonds can be regarded as callable. Treasury notes and treasury bonds are non-callable.

Most of the corporate bonds and municipal bonds are callable. Redemption of a sinking fund ensures that the issuer is expected to adhere to some set schedule while redeeming some portion or all of the debt.

Callable Bonds & Interest Rates

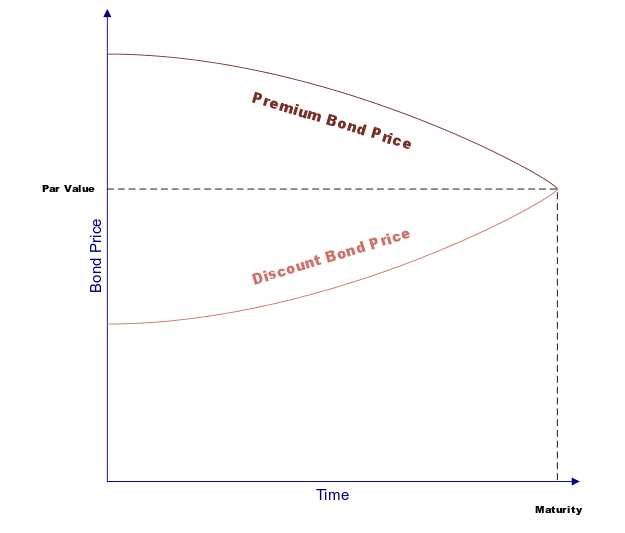

In case the interest rates in the market fall after the floating of a bond by a corporation, then the company can go forward with issuing a new debt. This helps the organization to receive a lower rate of interest in comparison to the original bond. The company can then advance with using the proceeds from the next issue at a lower rate for paying off the previous callable bond through the callable bond feature. In this manner, the company was able to refinance respective debt by paying off the callable bonds that are higher-yielding and available at a lower rate of interest.

Conclusion

Typically, as callable bonds are known to deliver a higher interest or coupon rate to the investors, the companies issuing the same can look forward to benefitting from the same.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.