Table of Contents

Bond Yield

What is Bond Yield?

Bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield, which is the interest paid divided by the Face Value of the bond, and current yield, which equals annual Earnings of the bond divided by its current Market price. Additionally, required yield refers to the amount of yield a bond issuer must offer to attract investors.

Details of Bond Yield

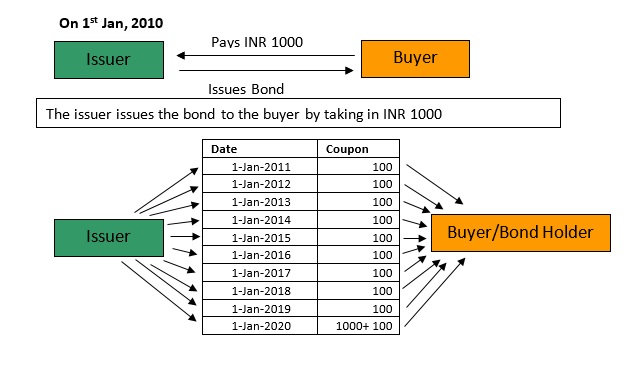

When investors buy Bonds, they essentially lend bond issuers money. In return, bond issuers agree to pay investors interest on bonds throughout their lifetime and to repay the face value of bonds upon maturity. The money that investors earn is called yield. Investors do not have to hold bonds to maturity. Instead, they may sell them for a higher or lower price to other investors, and if an investor makes money on the sale of a bond, that is also part of its yield.

Bond Yield Versus Price

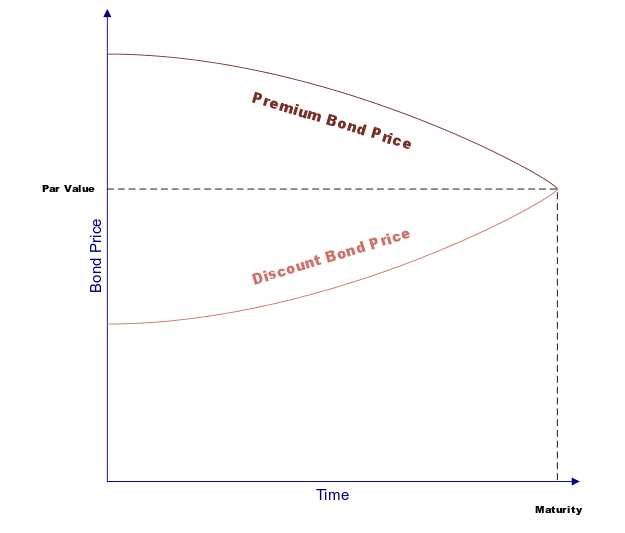

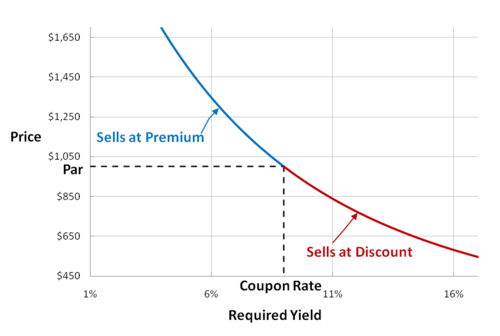

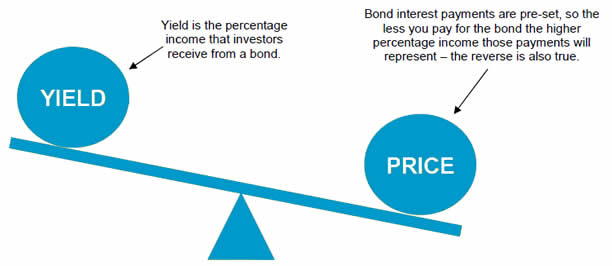

As bond prices increase, bond yields fall. For example, assume an investor purchases a bond with a 10% annual coupon rate and a par value of Rs. 1,000. Each year, the bond pays 10%, or Rs. 100, in interest. Its annual yield is the interest divided by its Par value. As Rs. 100 divided by Rs. 1,000 is 10%, the bond's nominal yield is 10%, the same as its coupon rate.

Eventually, the investor decides to sell the bond for Rs. 900. The new owner of the bond receives interest based on the face value of the bond, so he continues to receive Rs. 100 per year until the bond matures. However, because he only paid Rs. 900 for the bond, his rate of return is Rs. 100/ Rs. 900 or 11.1%. If he sells the bond for a lower price, its yield increases again. If he sells for a higher price, its yield falls.

Talk to our investment specialist

When do Bond Yields Fall?

Generally, investors see bond yields fall when Economic Conditions push markets toward safer investments. Economic conditions that might decrease bond yields include high rates of unemployment and slow Economic Growth or Recession. As interest rates increase, bond prices also tend to fall.

Interest Rates Versus Bond Prices

To examine the relationship between interest rates and bond prices, imagine an investor buys a bond from XYZ Company with a 4% coupon rate and a Rs. 1,000 face value. Another investor waits a few weeks before buying a bond, and during that time, the issuer raises interest rates to 6%. At this point, the second investor can buy a Rs. 1,000 bond from XYZ Company and receive Rs. 60 in interest per year.

Meanwhile, upset that he is only earning Rs. 40 per year, the original investor decides to sell, but to entice others to buy his bond instead of bonds directly from XYZ Company, he lowers his price. For example, he lowers it to Rs. 650, making its effective annual yield Rs. 40/Rs. 650 or 6.15%. If the bond issuer had not increased its rates, the investor might not have had to sell his bond for less than its face value.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.