Table of Contents

Baby Bond

What is a Baby Bond?

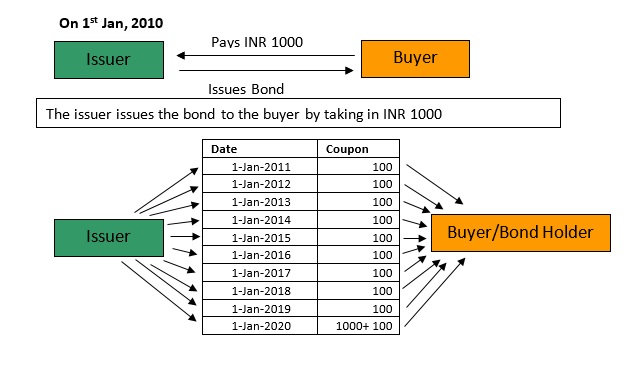

A baby bond is regarded as the fixed Income security that gets issued in small denominations and has a par value of less than Rs. 75,000. These small denominations help attract average retail investors towards these Bonds.

Mainly, these baby bonds are issued by states, counties, and municipalities to fund infrastructure and Capital expenses. They are usually tax-exempted and are structured as zero-coupon bonds with a maturity period of 8 to 15 years.

Comprehending Baby Bonds

Baby bonds also get issued by businesses in the form of corporate bonds. Such baby bond issuers include small and mid-sized business development companies, telecom companies, investment banks, and utility companies.

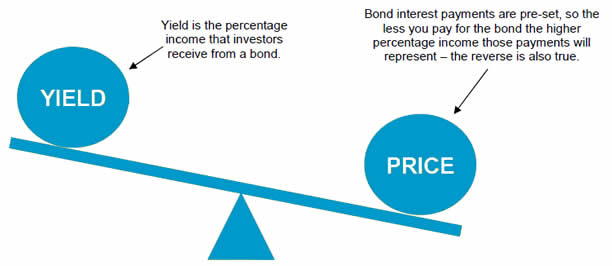

The corporate bond’s price is comprehended by the financial health of the issuer, Market data and credit rating of the company. Thus, if there is a company that doesn’t want to issue a large debt Offering, can issue baby bonds to generate liquidity and demand for them.

For instance, a company that wished to borrow money by issuing bonds worth Rs. 40,000,00 may not get enough interest from institutional investors for small issues. Additionally, with Rs. 75,000 Par value, the issuer can sell 4000 bond certificates on the market.

If the company issues baby bonds, however, retail investors would be able to access such securities affordable, and the company will get enough capacity to issue up to 10,000 bonds in the market.

Talk to our investment specialist

Baby Bonds Pros and Cons

Typically, baby bonds are categorized as unsecured debts. It means that the issuer doesn’t have an Obligation to provide principal repayments and interest payments if the company goes Default. Thus, if the issuer goes default on the payment responsibilities, baby bondholders will get paid only after meeting the secured debt holders’ claims.

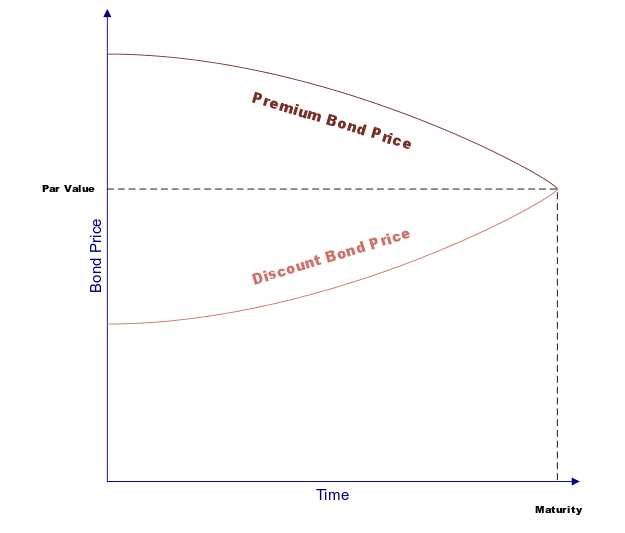

One of the best features of these bonds is that they are callable. Putting it in simple words, a Callable Bond is the one that can get redeemed early by the issuer. Thus, when bonds get called, the issuer stops paying the interest payment.

To compensate the bondholders for the risk of calling a bond before maturity, these bonds get high coupon rates that Range anywhere from 5% to 8%.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.