Table of Contents

- What is a Cancelled Cheque?

- Understanding the Types of Cancelled Cheques

- Importance and Relevance of Cancelled Cheques in Financial Transactions

- How to Obtain a Cancelled Cheque?

- Final Thoughts

- Frequently Asked Questions (FAQs)

- 1. Can I use a cancelled cheque for proof of address?

- 2. Are cancelled cheques required for international wire transfers?

- 3. Can I cancel a cheque online without visiting the bank?

- 4. Is a cancelled cheque necessary for loan applications?

- 5. Can I use a cancelled cheque for income tax purposes?

- 6. Are cancelled cheques valid indefinitely?

- 7. Can I use an electronic image of a cancelled cheque?

- 8. Are cancelled cheques necessary for online banking transactions?

- 9. Can I obtain a cancelled cheque from a joint bank account?

- 10. Can I use a cancelled cheque from a closed bank account?

Cancelled Cheque

In the dynamic world of finance, understanding the concept of a cancelled cheque holds significant relevance, particularly in India. As we venture into 2023, where the digital transformation is reshaping financial landscapes, the role of cancelled cheques remains pivotal, serving as an essential instrument in various transactions.

Recent statistics unveil an intriguing reality - despite the rapid growth of digital payment methods, a substantial portion of India's population, encompassing over 60% of households, still relies on cheques for their financial dealings. This statistic emphasises the enduring importance of cancelled cheques and underscores their unique place within the Indian banking system.

In this article, you'll understand the diverse applications and legal implications of cancelled cheque in the Indian context.

What is a Cancelled Cheque?

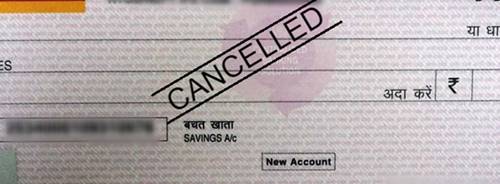

A cancelled cheque is one that has been signed by the account holder, indicating it cannot be used for financial activities or has been cancelled. Typically, the word "CANCELLED" or "VOID" is written or stamped across the front of the cheque, making it invalid for payment. The cancellation process involves drawing a diagonal line across the cheque, perforating it, or using any other method to indicate its non-usability.

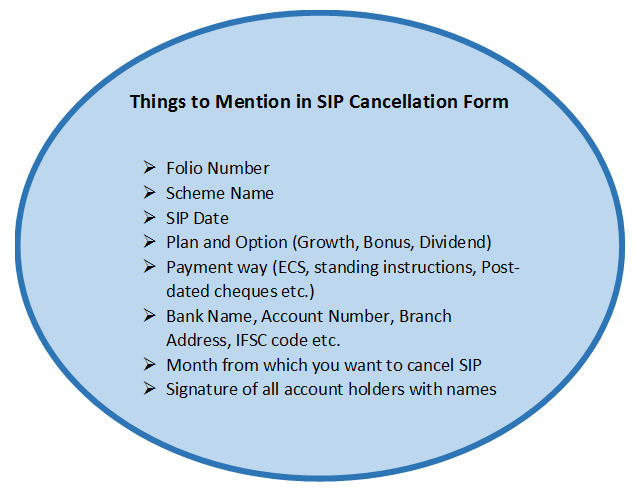

While cancelled cheques cannot be used for direct payments, they serve other purposes in financial transactions. They are often required as supporting documents for various purposes, such as:

- Verifying Bank account details

- Authorising automatic bill payments

- Facilitating Bank Reconciliation

- Fulfilling requirements for Demat accounts

- PF withdrawals

- Other financial operations

Cancelled cheques provide evidence of ownership and validation of bank account information, adding security and credibility to financial transactions.

Talk to our investment specialist

Understanding the Types of Cancelled Cheques

Here is a clear understanding of the different types of cancelled cheques:

1. Cancelled Cheque Leaf

A cancelled cheque leaf refers to a single cheque detached from a chequebook. It is often used for providing bank account details, as it contains the account holder's name, account number, and other essential information. Some other common uses of these leaves are setting up automatic bill payments or fulfilling documentation requirements.

2. Pre-Printed Cancelled Cheque

A pre-printed cancelled cheque is a cheque obtained from the bank that is already printed with the account holder's details. It typically includes the account holder's name, account number, and other pertinent information. Pre-printed cancelled cheques are often requested by organisations or service providers for purposes such as validating bank account information, setting up direct deposit or electronic funds transfer, or completing documentation related to loans, investments, or insurance.

3. Personalised Cancelled Cheque

A personalised cancelled cheque is a cancelled cheque that is customised with the account holder's specific details. It may include personalised designs, logos, or additional information based on the account holder's preference or requirements. Personalised cancelled cheques serve the same purposes as regular cancelled cheques, such as verifying bank account information, authorising transactions, or providing proof of ownership.

4. Bank-specific Cancelled Cheques

Certain banks have their own specific format or requirements for cancelled cheques. For example, a Kotak cancelled cheque refers to a cancelled cheque issued by Kotak Mahindra Bank. Similarly, other banks have their own variations in terms of layout, design, or additional security features on their cancelled cheques. These bank-specific cancelled cheques fulfil the same purposes as regular cancelled cheques and are used as per the respective bank's guidelines.

5. Online Cancelled Cheque

With the advent of digital banking, it is now possible to obtain an online cancelled cheque. Instead of physical paper cheques, you can request a digital version of a cancelled cheque from your bank's online banking platform. Online cancelled checks are frequently available in PDF format, which may be downloaded and printed as necessary. They serve the same purposes as physical cancelled cheques, Offering convenience and eliminating the need for physical documentation.

Importance and Relevance of Cancelled Cheques in Financial Transactions

The importance and relevance of cancelled cheques in financial transactions can be summarised as follows:

Verification of Bank Account: Cancelled cheques play a vital role in verifying the ownership and authenticity of a bank account. When individuals or organisations provide a cancelled cheque, it serves as proof that they hold a legitimate account with the bank mentioned on the cheque. This verification is crucial for various financial transactions, such as opening new accounts, setting up direct deposits, or initiating electronic fund transfers.

Automatic Bill Payments: Cancelled cheques are often required when setting up automatic bill payments or Electronic Clearing Service (ECS) mandates. By submitting a cancelled cheque, individuals authorise the service provider to debit their bank account for recurring payments, such as utility bills, loan instalments, or insurance premiums. It ensures a seamless and automated payment process, eliminating the need for manual interventions.

Bank Reconciliation: Cancelled cheques play a significant role in the bank Reconciliation process for individuals and businesses. By comparing the cancelled cheque images with the bank statements, account holders can verify and reconcile their financial records. This helps identify any discrepancies or errors, ensuring accurate Accounting and financial management.

Documentation for Financial Operations: Cancelled cheques are frequently required as supporting documents for various financial operations. For example, when opening a Demat account for holding securities electronically, providing a cancelled cheque helps verify the linked bank account. Similarly, cancelled cheques are often needed for processing Provident Funds (PF) withdrawals or fulfilling requirements for loans, investments, or insurance policies.

Proof of Ownership and Authorisation: Cancelled cheques provide tangible evidence of ownership and authorisation in financial transactions. The cheque's unique features, including the account holder's name, account number, and bank details, add credibility and transparency to the transaction. It helps ensure that funds are being directed to the intended recipient and prevents fraudulent activities.

Compliance with Regulations: Cancelled cheques are often required to comply with regulatory requirements imposed by financial institutions or government bodies. These requirements aim to enhance transparency, prevent money laundering, and ensure adherence to legal and regulatory frameworks. By providing cancelled cheques when requested, individuals and businesses demonstrate their compliance with these regulations.

How to Obtain a Cancelled Cheque?

To obtain a cancelled cheque, follow these steps:

- First and foremost, make sure you have a chequebook issued in your name. If you don't, you can request the same from your bank

- Once you have the chequebook, begin by writing a cheque from your bank account. Make sure to fill in the necessary details, such as the payee's name, date, amount, and signature. Ensure the cheque is filled out correctly, as any errors may render it unusable

- Once the cheque is written, mark it as cancelled to indicate that it cannot be used for payment. There are a few common methods to cancel a cheque:

- Writing "CANCELLED" or "VOID" across the front of the cheque in large, bold letters

- On the cheque's front, a diagonal line should be drawn from corner to corner

- Perforating the cheque by puncturing it with a hole puncher

After marking the cheque as cancelled, ensure that you retain it for future use. Keep the cancelled cheque in a safe place, as it may be required for various financial transactions.

Many banks now offer the option to obtain an online or digital version of a cancelled cheque. Check if your bank provides this service through their online banking platform or mobile app. You can typically download a PDF copy of the cancelled cheque, which can be printed if a physical copy is needed.

If you require multiple cancelled cheques, you can photocopy or scan the original cancelled cheque to create additional copies. Ensure that the photocopies or scans are clear and legible.

Final Thoughts

Protecting your financial security is paramount, and a cancelled cheque serves as a shield against unauthorised access to your account. Even though cancelled, it remains a valuable source of essential information, including your bank account number, account holder's name, IFSC code, and MICR code.

To maintain utmost caution, it's advisable to refrain from signing cancelled cheques. This precautionary step deters criminals from attempting to forge your signature. However, if you find yourself in a situation where your signature on the cancelled cheque leaf is insisted upon, ensure you obtain a declaration supporting this requirement. By taking these measures, you fortify your financial defences and stay one step ahead in safeguarding your financial well-being.

Frequently Asked Questions (FAQs)

1. Can I use a cancelled cheque for proof of address?

A: No, a cancelled cheque is primarily used for verifying bank account details and is not typically accepted as proof of address. Other documents like utility bills or government-issued address proofs are usually required.

2. Are cancelled cheques required for international wire transfers?

A: While cancelled cheques may be requested in some cases, international wire transfers typically require additional documentation, such as a SWIFT code, beneficiary information, and the purpose of the transfer.

3. Can I cancel a cheque online without visiting the bank?

A: The process for cancelling a cheque varies by bank, but in many cases, you may need to visit the bank in person or contact them directly to initiate the cancellation.

4. Is a cancelled cheque necessary for loan applications?

A: Yes, cancelled cheques are commonly required by lenders to verify bank account details and facilitate loan disbursement and repayment.

5. Can I use a cancelled cheque for income tax purposes?

A: Cancelled cheques are not typically used as standalone proof for income tax purposes. Other documents like bank statements, Form 16, or salary slips are usually required.

6. Are cancelled cheques valid indefinitely?

A: While there is no specific expiration date for cancelled cheques, it is advisable to keep them for a reasonable period as per your personal record-keeping needs.

7. Can I use an electronic image of a cancelled cheque?

A: It depends on the requirements of the specific organisation or financial institution. Some may accept electronic images or scanned copies of cancelled cheques, while others may require physical copies.

8. Are cancelled cheques necessary for online banking transactions?

A: No, cancelled cheques are typically not required for online banking transactions as the necessary account information is already linked to the online banking system.

9. Can I obtain a cancelled cheque from a joint bank account?

A: Yes, a cancelled cheque can be obtained from a joint bank account, provided all account holders sign and mark the cheque as cancelled.

10. Can I use a cancelled cheque from a closed bank account?

A: No, a cancelled cheque from a closed bank account is no longer valid. A current and active bank account should be used to obtain a valid cancelled cheque.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.