Certainty Equivalent

What is Certainty Equivalent?

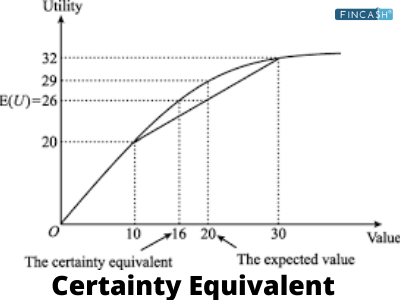

Certainty Equivalent is a return that an investor accepts now, rather than taking the chance of expecting higher returns in the future that is uncertain. In other words, as an investor, you are ready to accept the current return, instead of taking a risk on a an uncertain return in the future.

The concept of certainty equivalent is involved in assessing the risk. It relies on the risk appetite of an individual investor.

Is Certainty Equivalent Useful?

The certainty equivalent is closely related to the concept of risk premium or the amount of additional return an investor wants to opt for a risky investment over a safe investment. For instance, if the government bond pays an interest of 3%, while a private bond pays 7%. It means that the return on the Bonds is more than the 7% to lure the investor towards it.

In order to attract an investor towards the company’s bond, a company can use such behaviour. Now, the company will have an idea of how much return is required to offer to uplift the investors to take the riskier option.

Talk to our investment specialist

Certainty Equivalent Formula

The formula of certainty equivalent is based on the term of cash flow from an investment. A certainty equivalent is a cash flow that is risk-free cash that one sees equal to larger but the riskier expected cash flow.

Formula- Expected Cash Flow/ (1+ Risk Premium)

Certainty Equivalent Calculations

Let’s understand how to calculate a certainty equivalent with the help of an example. An investor has a choice to accept Rs. 15,000 cash flow or choose another option that has the following expectations:

- A 30% probability of getting Rs. 15,000

- A 50% probability of getting Rs. 31,000

- A 20% probability of getting Rs. 8000

Here is the expected outflow in this -

- 30% * 15,000= Rs. 4,500

- 50% * 31,000= Rs. 15,500

- 20% * 8,000= Rs. 1600

Total= Rs. 21,600

Now assume that the risk-adjusted rate to be 10% and the risk-free rate to be 2%. The risk premium will be 8% (10% less than 2).

We got the equation = Rs. 21,600/ (1+10%) = Rs. 19,636

Based on this calculation if the investor chooses to avoid risk, then the investor should accept Rs. 19,636 over Rs. 15,000..

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.