Dark Cloud Cover

What is the Dark Cloud Cover?

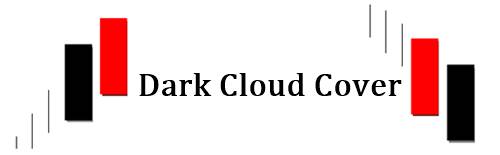

Dark Cloud Cover definition is the pattern revealing the bearish reversal Candlestick in which the down candle (typically red or black) tends to open above the closing before the up candle (typically green or white). Then, the same is known to close below the given midpoint of the respective up candle.

The given pattern tends to be crucial as it is known to reveal the shift in the given momentum – from being upside to reach downside. The pattern is usually created with the help of the up candle, which is then followed by the subsequent down candle. The traders out there are constantly looking for the price to continue going lower on the third or next candle. The given process is referred to as confirmation.

What is the Meaning of Dark Cloud Cover?

The pattern indicating the dark cloud cover is known to involve a large-sized black candle that forms the “black cloud” – usually that hovers over the preceding candle. As in the case of a typical bearish engulfing trading pattern, the buyers are known to push the over price higher during the open phase. However, the sellers are known to take over during a later time in the given session while pushing the price lower steeply. The given shift that occurs from buying to selling is known to indicate that a price reversal mechanism could occur corresponding to the downside.

Most traders out there are known to consider the given pattern as useful only when the same is occurring after some uptrend or a rise in the overall price. As prices continue to rise, the pattern is known to become more crucial for identifying the potential downward move. If the given price action appears to be choppy, then the given pattern turns out to be less significant as the overall price might remain choppy even after the pattern.

Some of the important criteria for the dark cloud cover graph pattern are:

- The gap going up on the following day

- The ongoing bullish uptrend

- An upward or bullish candle within the given uptrend

- The bearish candle closing below the previous bullish candle’s midpoint

- The gap upwards turning into the bearish (downward) candle

Talk to our investment specialist

The dark cloud cover graph pattern can be further recognized by black & white candlesticks having real bodies and relatively non-existent or shorter shadows. The presence of such attributes offers the suggestion that the move that happened lower was highly significant as well as inclusive with respect to the given price movement.

The traders out there might also be looking for the confirmation – represented through a bearish candle that follows the pattern. There are expectations that the price might decline after the Dark Cloud Cover pattern. Therefore, if it does not happen, then this indicates that the given pattern might Fail.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.